This article was written by Jennifer Mueller, JD. Jennifer Mueller is an in-house legal expert at wikiHow. Jennifer reviews, fact-checks, and evaluates wikiHow's legal content to ensure thoroughness and accuracy. She received her JD from Indiana University Maurer School of Law in 2006.

This article has been viewed 7,894 times.

When you start a new job, your employer will give you a Form W4 to fill out. This form provides your employer with information they will use to determine how much money to deduct from your paycheck for federal taxes. If you're exempt from federal taxes, you can indicate this on the form. Provided you qualify as exempt, your employer will not withhold any federal taxes from your paychecks throughout the year. If you are a nonresident alien and your home country has a tax treaty with the US, you would use Form 8233 to claim an exemption from withholding. You normally wouldn't fill out a form W4.[1]

Steps

Qualifying as Exempt on a W4

-

1Review last year's tax returns. If you had no tax liability last year and don't expect to have any this year, you are considered exempt from federal tax withholding. If you filed a tax return last year, use that form to determine whether you had any tax liability last year.[2]

- Generally, if you had taxes withheld last year and all of those taxes were refunded to you, that means you have no tax liability. You can also look at the line that would indicate the taxes you owe. If there is a "0" on that line, that means you weren't liable for paying any taxes.

- Keep in mind that if there have been significant changes to your household or income, you may have tax liability this year even if you didn't have any last year.

-

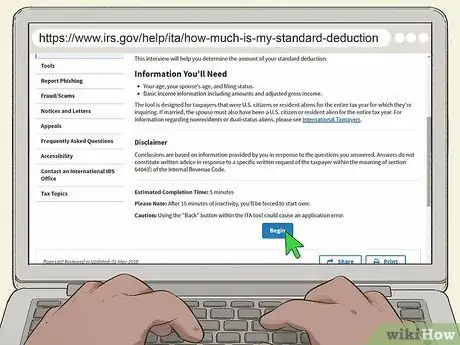

2Check the standard deduction for the current tax year. There are two prongs to the exemption test. The second prong requires you to consider whether you anticipate having any tax liability for the current year. Generally, if you earn income higher than the standard deduction that is applicable to you, you would have to pay taxes.[3]

- To determine the amount of the standard deduction that applies to you, go to https://www.irs.gov/help/ita/how-much-is-my-standard-deduction. You'll need basic income information, your age, your spouse's age (if you're married), and your filing status to determine your standard deduction using this calculator.

Advertisement -

3Evaluate whether you're eligible for any refundable tax credits. Refundable tax credits, such as the child tax credit or the earned income tax credit, directly reduce your tax liability. These tax credits operate as tax payments, similar to withholding, which means if your tax liability is less than the amount of the credit, you'll get a refund.[4]

- The easiest way to determine your eligibility for these tax credits is to look at last year's tax return. If you qualified for refundable tax credits last year and haven't experienced significant changes to your household or income since then, you likely qualify for the tax credits again.

- If you know that you're eligible for refundable tax credits, you can claim exempt from withholding, even if you have some tax liability before the credit is applied. Just make sure your tax liability is less than the amount of the credit.

Tip: Keep in mind that to get a refundable tax credit, you have to file a tax return and claim the credit. Otherwise, you may end up owing taxes.

Completing Your W4

-

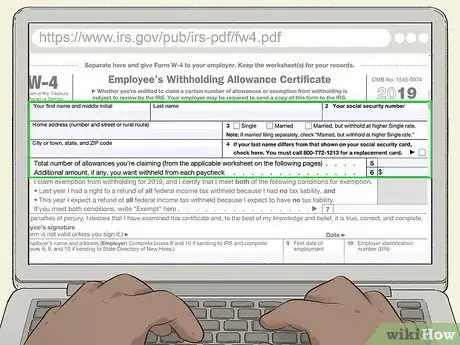

1Read the instructions for completing Form W4. Especially if you've never filled out a Form W4 before, the instructions can help you figure out what information you're supposed to provide on the form. The instructions are provided with the form itself. However, if your employer has developed their own W4, it may not have the instructions.[5]

- If you didn't get a full copy of the instructions with your Form W4, you can download them at https://www.irs.gov/pub/irs-pdf/fw4.pdf.

-

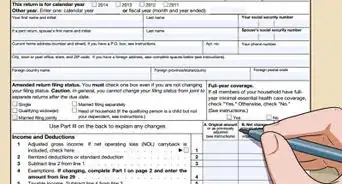

2Enter your personal information and filing status. At the top of Form W4, write your full name, Social Security number, and home address. Then select a filing status and check the box in front of it.[6]

- Generally, if you're going to claim exempt, you would only use "married" or "single." The third filing status, "married, but withhold at higher single rate," is irrelevant since you aren't having taxes withheld.

-

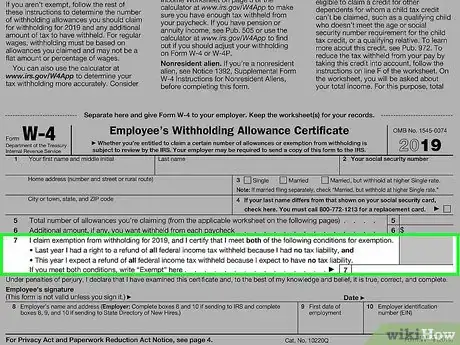

3Write "Exempt" on Line 7 of the form. If you qualify as exempt, you don't have to enter any information on Lines 5 or 6 of your Form W4. These lines relate to withholding allowances and any additional amount you want withheld from each paycheck. Since your employer won't be withholding anything from your paychecks, skip down to Line 7 and write the word "exempt."[7]

-

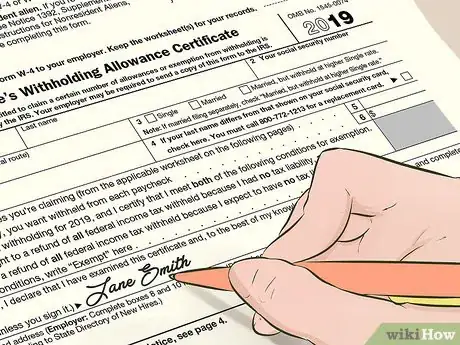

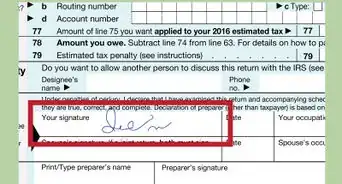

4Sign and date your form before giving it to your employer. Your form is not valid until you've signed it. When you sign the form, you are certifying under penalty of perjury that all the information you provided on the form is true, correct, and complete to the best of your knowledge.[8]

- This statement means that if you have reason to believe that you are not exempt from withholding, but you fill out a W4 claiming exemption anyway, you could be subject to fines or even jail time.

-

5Fill out a new W4 each year to keep your exemption. A W4 claiming exemption from withholding is only valid for the calendar year in which you file it. If you want to continue to claim exemption, you have to fill out a new form each year.[9]

- If you fail to complete a new form claiming exemption, the IRS requires your employer to withhold federal taxes from each of your paychecks as though you were single with no withholding allowances – the highest rate at which taxes can be withheld from your paycheck.

Tip: Submit your new W4 as soon as possible after January 1. The deadline is February 15 if you want to continue to claim exemption.

Using Form 8233

-

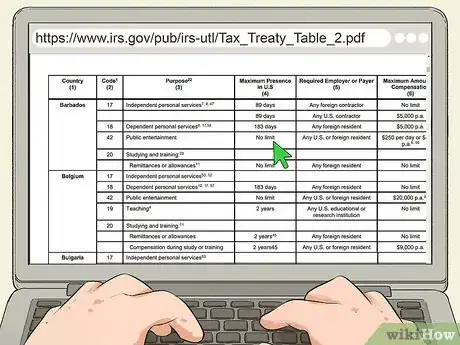

1Determine whether you're considered a resident of a treaty country. If your home country has a tax treaty with the US, you may be exempt from US tax withholding. You must be considered a resident of your home country, either under that country's laws or under the definition established in the tax treaty.[10]

- If you're claiming exemption as a foreign student for scholarship or fellowship income, you only need to have been a resident of the treaty country before you moved to the US for school.

- If you're not sure whether you're a resident of a treaty country, look for the name of your country on the table at https://www.irs.gov/pub/irs-utl/Tax_Treaty_Table_2.pdf.

Tip: Make sure you check the maximum amount of time you're allowed to be present in the US, as this differs from country to country and may also depend on the type of work you do. If you exceed the maximum presence in the US, you are not exempt from withholding.

-

2Make sure the type of work you do qualifies for exemption from withholding. Different treaties provide that specific types of work are exempt from withholding. Check the definitions of the categories of income, then check the table at https://www.irs.gov/pub/irs-utl/Tax_Treaty_Table_2.pdf to determine if the treaty between your home country and the US covers your type of work.[11]

- For example, if you're a resident of Australia and a lawyer who provides independent personal services in the US, your income is exempt from US withholding as long as you're in the US no more than 183 days over the course of the year.

-

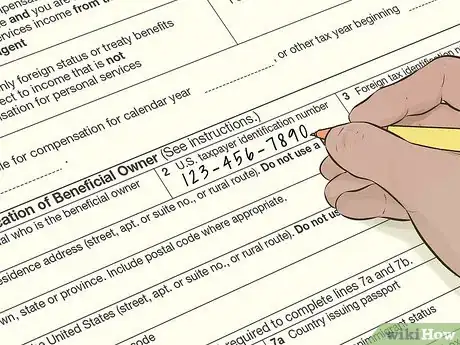

3Apply for a US taxpayer identification number if you don't already have one. When you fill out Form 8233 to claim exemption from US federal tax withholding, you must provide an individual taxpayer identification number (ITIN). If you don't already have one, fill out Form W7 and submit it to the IRS.[12]

- You can download a copy of Form W7 and instructions for filling it out at https://www.irs.gov/forms-pubs/about-form-w-7</ref>

- Allow at least 7 weeks for the IRS to send you notification of your ITIN. If you're applying from another country, it may take 9 to 11 weeks.

-

4Fill out Form 8233. For the purposes of Form 8233, you are considered the "Beneficial Owner." Provide your name, permanent residence address, and address in the US. You also must provide your US ITIN and your foreign taxpayer identification number, if your country uses them.[13]

- On the second of the form, describe the type of work you do and the income you expect to be paid for that work.

Tip: Your employer may provide you with a copy of the form. Otherwise, you can download it at https://www.irs.gov/pub/irs-pdf/f8233.pdf.

-

5Submit your form to your US "withholding agent." For the purposes of Form 8233, your "withholding agent" is generally the person or entity that would be responsible for paying your income and withholding any US taxes. If you're an independent contractor, this would be your client. However, if you're an employee, this would typically be your employer.[14]

- You'll need a separate Form 8233 for each separate withholding agent. For example, if you're an independent contractor and work for 3 different clients, you would need 3 forms, one for each of them. When you describe your work and income on each form, it should be specific to that withholding agent.

Tip: You must submit a new Form 8233 each year you work in the US and want to claim an exemption from withholding.

Warnings

- If you have any doubts about whether you qualify as exempt from withholding, go ahead and fill out Form W4 and list your withholding allowances. If you have tax liability and claimed you were exempt, you may have to pay fees and penalties for inadequate withholding.[15]⧼thumbs_response⧽

References

- ↑ https://www.irs.gov/taxtopics/tc753

- ↑ https://www.irs.gov/taxtopics/tc753

- ↑ https://blog.turbotax.intuit.com/tax-refunds/can-i-file-exempt-still-get-a-tax-refund-6695/

- ↑ https://turbotax.intuit.com/tax-tips/tax-deductions-and-credits/5-things-you-should-know-about-refundable-tax-credits/L9gpESSU2

- ↑ https://www.irs.gov/pub/irs-pdf/fw4.pdf

- ↑ https://www.irs.gov/pub/irs-pdf/fw4.pdf

- ↑ https://www.irs.gov/pub/irs-pdf/fw4.pdf

- ↑ https://www.irs.gov/pub/irs-pdf/fw4.pdf

- ↑ https://www.irs.gov/taxtopics/tc753