This article was written by Derick Vogel and by wikiHow staff writer, Cory Stillman. Derick Vogel is a Credit Expert and CEO of Credit Absolute, a credit counseling and educational company based in Scottsdale, Arizona. Derick has over 10 years of financial experience and specializes in consulting mortgages, loans, specializes in business credit, debt collections, financial budgeting, and student loan debt relief. He is a member of the National Association of Credit Services Organizations (NASCO) and is an Arizona Association of Mortgage Professional. He holds credit certificates from Dispute Suite in credit repair best practices and in Credit Repair Organizations Act (CROA) competency.

This article has been viewed 18,460 times.

Mobile payment services like Apple Pay certainly make our lives easier, but they also offer limited buyer protection, making them prime targets for scammers. In some cases, it is impossible to get money back from Apple after you were scammed. In other cases, you may be able to receive a refund. It all depends upon whether you were scammed via Apple Pay, Apple Cash, or your Apple Card. This wikiHow will walk you through everything you need to know about scammers on Apple Pay and how to get your money back.

Things You Should Know

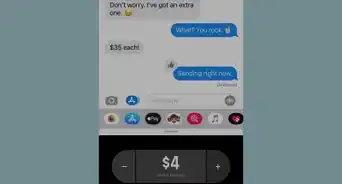

- Scammers are most active on Apple Cash, where they can request money from you via the Messages app.

- It can be very difficult to get your money back if you were scammed through Apple Cash or Apple Pay.

- Contact your bank or credit card provider if you recognize an unauthorized charge via Apple Pay.

- Apple will assist you in getting your money back if there is an unrecognized charge regarding Apple Services on your Apple Card.

Steps

Scams on Apple Cash

-

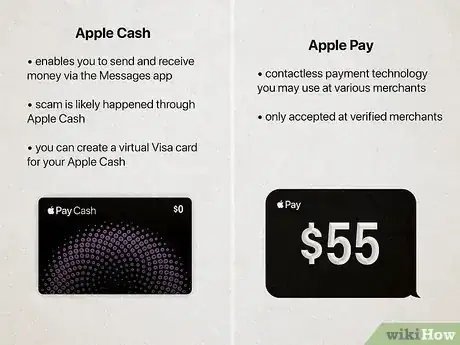

1Understand the difference between Apple Cash and Apple Pay. Before trying to get your money back after being scammed, it is important to understand the differences between Apple Pay and Apple Cash:

- Apple Pay is the contactless payment technology you may use at various merchants, while Apple Cash enables you to send and receive money via the Messages app.

- If you believe you were scammed, this likely happened through Apple Cash, as Apple Pay is only accepted at verified merchants.

- Unfortunately, Apple Cash does not include any buyer protection. Apple is not responsible for any fraudulent payments sent through Apple Cash.

- You can create a virtual Visa card for your Apple Cash to use at online and in-person merchants. This card works via Apple Pay, so you may be eligible for a refund if you see an unauthorized charge there.

-

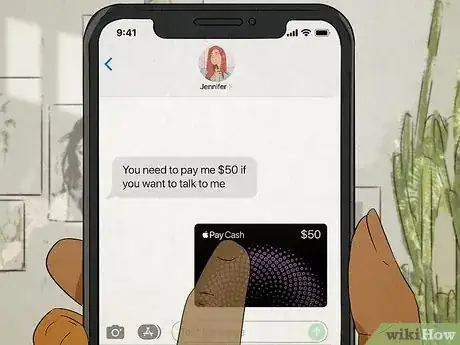

2Open the relevant conversation in your Messages app. Find the conversation in which you sent the money to the scammer.Advertisement

-

3Tap the payment. This will open your Apple Cash "card" in your Wallet app.

-

4Tap the payment again. Find the contested payment under Latest Transactions and tap it. Then, tap it again.

-

5Select "Cancel Payment." If the payment has not yet been accepted, you will see the option to cancel it. If there is no option to cancel, the payment has already been accepted and cannot be returned.[1]

- Most payments are accepted automatically, unless the recipient has "Manually Accept Payment" activated in their settings.[2]

-

6Contact the recipient. If you sent money through Apple Cash to someone you believe to be a scammer, try reaching out to them and asking for your money back. Of course, it is unlikely for a scammer to return the funds, but this is your only recourse if scammed via Apple Cash.

- Because Apple Cash works through Messages, you may consider reporting the scammer's phone number to local authorities, although the number may not actually belong to them.

-

7Contact Apple. Although Apple is not responsible for any scams carried out through Apple Cash, you should still notify them of the suspicious activity.

Scams on Apple Pay

-

1Ensure the scam came via Apple Pay. Apple Pay is highly encrypted, so being scammed through it is rather unlikely. Of course, it is possible, but it is more likely to be scammed via Apple Cash.

- Neither Apple Pay nor Apple Cash offer buyer protection, so Apple is not responsible for any scams pulled off through such services.

- You may still see an unauthorized transaction, and want to be reimbursed. While this is not technically a scam, it can still be a frustrating experience, and may entitle you to compensation.

-

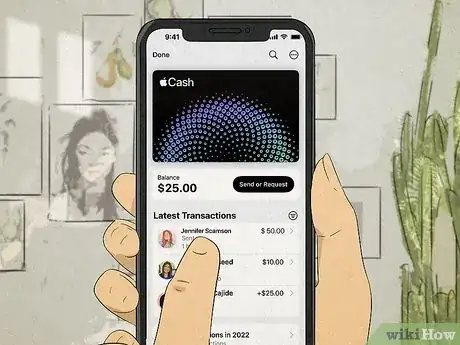

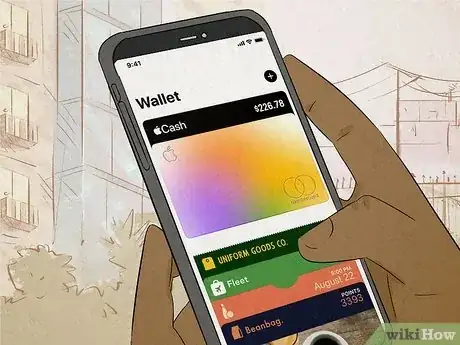

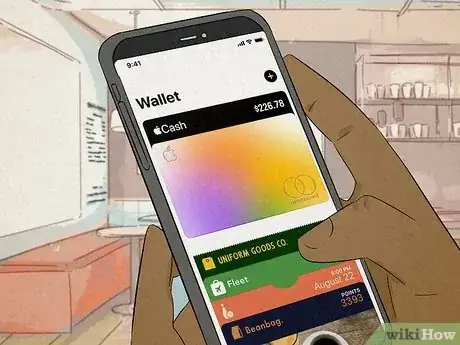

2Find the transaction in question. Open your Wallet app and tap the relevant card. This will open a list of all recent transactions. Tap the contested transaction to pull up more info.

- Because cards in Apple Pay are simply virtual copies of cards from your bank or credit card provider, you may search for the transaction through those channels as well.

-

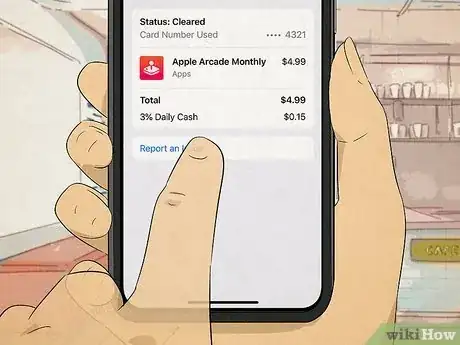

3Report the transaction. Although you may not be able to get your money back, you should still report the fraudulent transaction to Apple. Click Report an Issue to do so.

- When prompted, select "Incorrect Merchant Info." Then, select "Merchant Name, Merchant Category, or Other Issue."

-

4Contact your bank or credit card provider. Apple is not responsible for any fraudulent charges on a card linked to Apple Pay (unless it is an Apple Card). To dispute a charge, contact your bank or credit card provider.[3]

- You may also consider contacting whomever issued the charge if it is a company you recognize.

- A bank or credit card provider is not responsible for any money you freely sent to another person, even if that person is a scammer.

- A bank or credit card provider may compensate you for any unauthorized charges on your account, however.

Scams on Apple Card

-

1Find the transaction in question. Open your Wallet app and tap your Apple Card. This will open a list of all recent transactions. Tap the contested transaction, then tap it again, to pull up more info.

- Is the transaction from Apple Services or another merchant? If it is not from Apple Services, simply call Mastercard, who issues the card, to discuss your transaction.

-

2Tap "Report an Issue." It is located below all the listed information for the transaction.

-

3Select "Unknown Transaction." There are two kinds of issues you may report. In the case of getting scammed, we do recognize the transaction. We just regret making it. Therefore, select "Dispute Charge" and then choose a reason to dispute.

- Apple Cards can be registered under a "Family Sharing Group." Before proceeding, check with everyone in your group and ensure the transaction did not come from them.

- To dispute a transaction that you do not recognize, select "Unknown Transaction."[4]

-

4Tap "Done." You will then enter a live chat with an Apple Card support specialist. Communicate your concerns to them and request a refund.

- Keep in mind Apple does not guarantee a refund for any unrecognized charges.

Avoiding Scams on Apple Pay

-

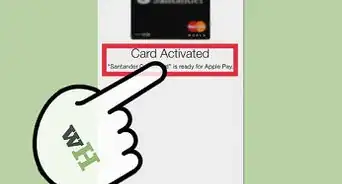

1Do not add cards to your Apple Pay while on public Wi-Fi. Apple Pay is quite secure, but you still remain vulnerable to hackers when on a public Wi-Fi. Never add a card to your Apple Pay while connected to a public Wi-Fi network, or hackers might be able to discover your card info.

- Likewise, if you ever lose your phone in public, you can use the Find my iPhone app to place your phone into Lost Mode, preventing anyone from using Apple Pay if they were to find it.

-

2Consider linking to a credit card rather than a debit card. Although Apple Pay allows you to link any of your cards, credit cards tend to offer greater protection.

-

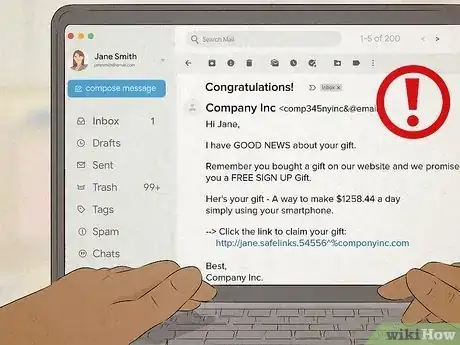

3Be wary of phishing. Phishing refers to fake emails that claim you have made some form of payment. Never click a link in such an email.

- If you receive a phishing email related to Apple Pay, forward it to reportphishing@apple.com.

- If you are unsure whether or not an email is a phishing scam, check the email address. It will quickly become obvious whether or not the email is actually from an official party.

-

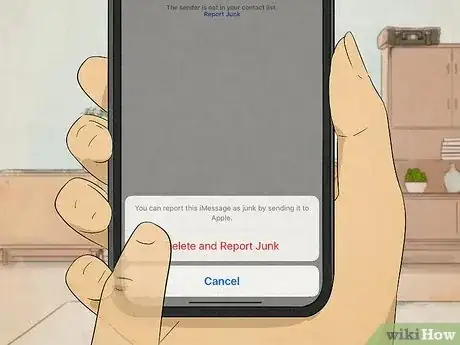

4Report unrecognized payment requests as junk. If you receive a request for payment via Apple Cash and do not recognize the number, simply tap Report Junk and block the number from contacting you again.

- If you believe the person contacting you is a scammer impersonating someone in your life, try asking a personal or specific question that only the two of you would know the answer to.

- Although you may need to send money to strangers for various reasons, try to limit your Apple Cash transactions to only those you know and trust.

-

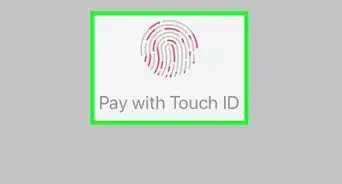

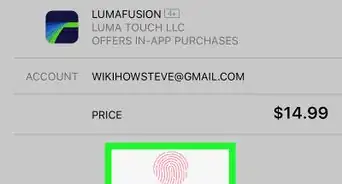

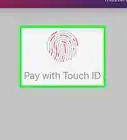

5Set up 2FA or Face ID. Apple offers several added layers of protection, including 2FA, Face ID, and Touch ID. Use these to protect yourself against any erroneous payments.

- Never give out information like your 2FA codes or passwords to strangers. No legitimate customer support agent would ever ask for this information.

-

6Check your Apple Pay transactions regularly. You can view all recent transactions in the Wallet app. If you see something suspicious, report it to Apple.

-

7Navigate online marketplaces with care. Scammers are particularly active on online marketplaces such as Craigslist, where they can easily pose as ticket sellers or the like. While many sellers on these sites are legitimate, be careful when making purchases in this way.

- Selling on these marketplaces can also be dangerous. Be on the lookout for overpayment scams, in which a buyer will use a stolen check to "accidentally" overpay for an item you have for sale, then request the surplus money back. In the end, you will lose both the original amount and the amount you returned.

-

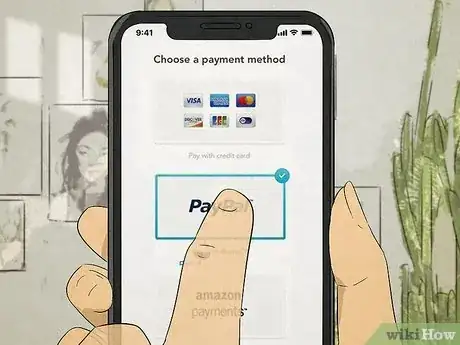

8Consider an alternative form of mobile payment. PayPal users report having the most success with getting their money back after being scammed, whereas most other mobile payment services offer little to no buyer protection.

-

9Contact your bank after being scammed. Whenever you are scammed, you should let your bank know immediately that this happened to you. Banks have fraud departments that can assist you in avoiding this experience moving forward.