This article was co-authored by Clinton M. Sandvick, JD, PhD. Clinton M. Sandvick worked as a civil litigator in California for over 7 years. He received his JD from the University of Wisconsin-Madison in 1998 and his PhD in American History from the University of Oregon in 2013.

This article has been viewed 49,440 times.

A partnership is a business where two or more people share ownership and contribute to the business.[1] A partner may wish to leave a partnership for a variety of reasons. For example, one partner may no longer be committed to the business or would like to retire. Sometimes, a partner may wish to start a competing business. Leaving a partnership requires planning and working with the remaining partners.

Steps

Preparing to Leave

-

1Find the partnership agreement. The partnership agreement should have been drafted before the formation of the partnership. It spelled out the different powers and duties of each partner. It should also have explained how a partner could withdraw from the partnership.

- Look for the “buy-sell” agreement. This agreement will stipulate the conditions surrounding a partner’s exit. For example, the buy-sell agreement may state the price the partnership will pay to buy out a partner’s share, who may buy the share, and what situations can trigger the buyout.

- If you no longer have your copy of the partnership agreement, ask the other partners for a copy of theirs, or get a copy from whoever is the custodian of the partnership records.

-

2Meet with a lawyer. You should meet with an attorney if you want to leave a partnership. An experienced business law attorney can help you understand state law and the limits of the partnership agreement. To find an experienced business lawyer, you can visit your state’s bar association website, which should run a referral service.

- Be sure to meet with your own lawyer and not a lawyer for the partnership. An attorney owes a duty of loyalty to its client. If the partnership has retained a lawyer, then that lawyer already owes a duty of loyalty to the partnership, not to you.

- Accordingly, you should seek out your own attorney in case disagreements arise between you and the other partners.

Advertisement -

3Assess the state of the business. Before talking with the other partners about leaving, you should consider the state of the business. For example, you should consider what contracts, liens, mortgages, or other personal agreements you are personally responsible for.

- Also consider how much the business is worth. If the partnership dissolves, the partners will receive their share of the assets and liabilities according to their ownership interest in the partnership.

- You could have the partnership appraised. You can do this by hiring a business valuation service, which can be found on the internet. However, be aware that hiring someone to value the business will tip off the other partners that you intend to leave. You might not want them to suspect that you desire to leave until you have firmly made up your mind.

Leaving the Partnership

-

1Discuss your departure with other partners. If the partnership agreement does not spell out any terms for your departure, then talk with the other partners. For example, you could agree to sell your stake in the business or you could agree that the other partners would buy your share of the business.

- You could also agree to stay with the partnership but to change the weighting of the partnership agreement. Under this situation, you may gain a majority stake in the partnership and the ability to make decisions alone, while the other partner may take a secondary role. Alternately, you may wish to take a secondary role.

-

2Consider mediation. If you are having difficulty reaching an agreement with the other partners on your terms of leaving, then you might want to consider mediation. With mediation, all interested parties meet with a third party neutral (the mediator). The mediator's job is to listen to all sides and help the parties reach a solution that is mutually acceptable.[2] The mediator does not decide the case or give an opinion as to who is right or wrong.

- Your local courthouse may run a mediation program. You should contact them to find out. Mediators often charge between $70 and $400 an hour for their services.[3] Nevertheless, this could be cheaper than a drawn out lawsuit.

-

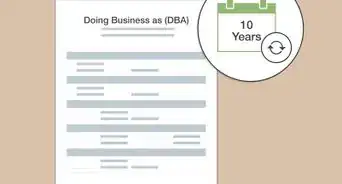

3Remove your name from obligations and other documents. If you have identified contracts or other documents where you guaranteed that you would be personally liable for the partnership, then you will want to get your name removed before you leave the partnership. If your name remains on those contracts, then you will remain personally liable even though you are no longer a partner.

- Getting your name removed can be difficult. The partnership will need to execute new agreements, this time without you as a guarantor.

- Furthermore, the other partners may not want to release you from liability. In this situation, you should hire a lawyer who can help you negotiate solutions with the partnership.

-

4Draft a separation agreement. A separation agreement memorializes everything you and the partnership have agreed to with respect to your leaving. You will want the separation agreement to cover the following:

- How assets will be disposed.

- How your name will be removed from obligations.

- The price and method of payment for your share of the partnership.

- Indemnities for future lawsuits arising out of the partnership.

- A right to audit the partnership’s books. This is especially important if you are being paid money over a period of time.

- A clause on material breach, included in case the partnership cannot meet its obligations.

- A security interest to cover any debts or obligations for which you cannot be removed.

-

5Dissolve the partnership, if necessary. If you cannot reach an agreement with the other partners as to how to leave the partnership, then you may want to consider legally dissolving the partnership. The dissolution process is governed by state law and usually requires that the partners equally split the debt and assets of the partnership.

- Filing for dissolution usually requires filing a statement of dissolution with the relevant secretary of state. It usually takes 90 days to dissolve the partnership.

- In California, partners can file a Statement of Dissolution with the Californian Secretary of State.

- Dissolving a partnership does not necessary mean the business has to end. The other partners may continue operating the business as a partnership. If the partnership consisted of only two people, then the business will need to be restructured, for example as a limited liability company.

-

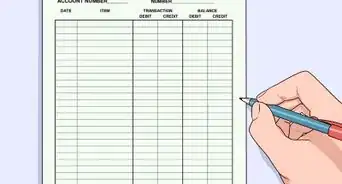

6Meet with an accountant. There are no direct tax consequences associated with dissolving a partnership. Nevertheless, tax liability could have accrued, especially if partnership property increased in value. Accordingly, you should consider consulting with an accountant or tax professional.

- You should also inform all taxing authorities that you are no longer part of the partnership. In addition, if you cash out any investments in the business, it may be considered a taxable event.

-

7Notify others of the dissolution. You will need to let clients, customers, and distributors know that you have left the partnership.[4] Send a letter and keep a copy for your records.

- You may also have to file a notice of withdrawal with your state or county. Contact any agency from which the partnership received a license or permit and ask if you must file a notice of withdrawal.

References

About This Article

Deciding to leave a partnership can be tough, but if you work together with your remaining partner, you can feel secure in your decision. Meet with a business attorney before you leave your partnership since the legal procedure can be a bit tricky. Once you’ve met with your attorney, talk to your business partner about your plans to leave and decide what you want to do next. For example, you could agree to sell your stake in the business and have the other partners buy you out. If you have trouble reaching an agreement, try talking the issue out with a mediator. Once you come to a compromise, you’ll need to remove your name from any relevant contracts and draft a separation agreement to make it official. Alternatively, if you can’t reach an agreement, you can dissolve the partnership. This means all the remaining assets and debts will be equally split between you and your partner. For more advice on drafting a separation agreement, read more from our Legal co-author.