This article was co-authored by Ylva Bosemark. Ylva Bosemark is a high school entrepreneur and the founder of White Dune Studio, a small company that specializes in laser cut jewelry. As a young adult herself, she is passionate about inspiring other young adults to turn their passions into business ventures.

wikiHow marks an article as reader-approved once it receives enough positive feedback. In this case, 93% of readers who voted found the article helpful, earning it our reader-approved status.

This article has been viewed 94,529 times.

Running a business is complicated, but you can easily track your expenses by opening a separate business bank account. Shop around to see if banks offer any perks for small business owners. When it's time to sign up, gather the required information and sign up in person or online.

Steps

Obtaining Necessary Information

-

1Get your tax ID. Banks usually require that you use a business ID to open a bank account. In the U.S., you should get an Employer Identification Number (EIN) from the IRS. Although sole proprietors can use their Social Security Number as a tax ID, most banks want an EIN.[1]

-

2Obtain your business license. A bank might also want to see your business license.[2] Contact your local or state government to check how to get it. You will probably need to pay a fee.

- Your business license should show both the owner's name and the business name.

Advertisement -

3Make copies of your legal documents. If you formed a corporation or limited liability company (LLC), you should have filed forms with your state. Corporations file articles of incorporation and LLCs file articles of organization. A bank might want to see these, so find your copies.[3]

- After your state approves your business, you should get back copies. If not, contact your Secretary of State.

-

4Show who can use the business account. The bank will need to know who has been authorized to withdraw money from the account. Gather the following legal documents:

- A partnership should have a partnership agreement, which should contain your business name and the names of all partners.

- A limited liability company should have a corporate resolution with a list of authorized signers.

- A corporation should also have a corporate resolution identify the authorized signers.

-

5Gather personal identification for all signers. Banks will probably want personal identification for every person who can sign on the account. Generally, you'll need copies of each person's driver's license or other state-issued ID.[4]

-

6Collect proof of your business name. You might do business under an assumed name, also called a trade name or a DBA (“doing business as”). The bank will probably want to see this document. You should have received a name certificate when you filed for your assumed business name.[5]

-

7Get proof of your business address. A bank might also want to see your address. Generally, a copy of a utility bill will suffice. However, you might need something else, such as a communication from the state.[6]

Reviewing Your Options

-

1Create a checklist of your needs.[7] Consider what you need from your bank account. For example, you might want a free business checking account, or a savings account to help you save for taxes.

- If you don't know what you need, then talk to a new small business owner. Ask where they have their business bank account and what features they like. Ask if they wish the account had anything.

-

2Contact multiple banks. Start with the bank you have your personal banking accounts with, but don't stop there. You should also check with other local banks. You might also check with local credit unions, although not all offer business bank accounts.[8]

-

3Ask about special benefits for business owners. Some banks are competing for the business of small business owners. Stop in or call and ask what perks they offer. Consider some of the following benefits:

- Reduced fees. Some banks will waive banking fees if you keep a minimum in the account every month.

- Business credit card or line of credit. Small businesses rarely qualify for lines of credit, so you might want to sign up with a bank that is willing to offer one.

- Coin and currency service. If you have a high volume of cash, you want a bank equipped to handle it. Some banks offer overnight deposit, coin verification, and other services.

- Courier service. You can arrange daily pickups at your business.

Opening Your Account

-

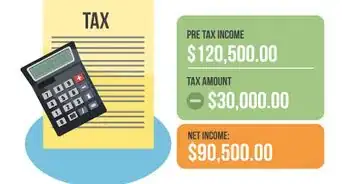

1Consider opening more than one account. If your business is small, you might be able to get away with having only one business account. However, you might benefit from having multiple accounts—one for taxes, payroll, and income.[9]

- If you aren't sure what you need, you should consult with your accountant.

EXPERT TIPYlva Bosemark is a high school entrepreneur and the founder of White Dune Studio, a small company that specializes in laser cut jewelry. As a young adult herself, she is passionate about inspiring other young adults to turn their passions into business ventures.Teenage Entrepreneur

Ylva Bosemark

Ylva Bosemark

Teenage EntrepreneurWhat Our Expert Does: "I have a separate business bank account from my personal bank account because I have a surprising number of business expenses. Everything I spend on the business comes from that account, and all of the revenue goes into the account. It really helps me keep my business finances organized."

-

2Check if you can open an account online. Most business can open accounts online. However, a few industries are prohibited from opening an account this way and will need to go in person:

- Telemarketing

- Gambling

- Precious metal dealers

-

3Sign up for your account. Most banks should offer many options for opening a bank account. Choose the option that works best for you:

- In person. Gather your required documents and visit the nearest branch.

- Over the phone. Call and provide required information. They will tell you how to submit copies of required documents.

- Online. Like applying over the phone, you can provide basic information and then send copies of your business documents.

Community Q&A

-

QuestionShould I use my EIN or SSN when opening my business checking account as a sole proprietor?

Community AnswerUsually, the bank would require your EIN for a business account, but if you are the sole proprietor they may also ask for your SSN.

Community AnswerUsually, the bank would require your EIN for a business account, but if you are the sole proprietor they may also ask for your SSN.

References

- ↑ https://www.inc.com/aj-agrawal/how-to-open-a-business-bank-account-for-your-startup.html

- ↑ https://www.inc.com/aj-agrawal/how-to-open-a-business-bank-account-for-your-startup.html

- ↑ https://www.inc.com/aj-agrawal/how-to-open-a-business-bank-account-for-your-startup.html

- ↑ http://www.businessnewsdaily.com/6477-business-bank-account-documentation.html

- ↑ https://www.inc.com/aj-agrawal/how-to-open-a-business-bank-account-for-your-startup.html

- ↑ http://www.businessnewsdaily.com/87-how-to-open-a-business-bank-account.html

- ↑ https://www.inc.com/aj-agrawal/how-to-open-a-business-bank-account-for-your-startup.html

- ↑ https://www.inc.com/aj-agrawal/how-to-open-a-business-bank-account-for-your-startup.html

- ↑ https://www.inc.com/aj-agrawal/how-to-open-a-business-bank-account-for-your-startup.html

-Step-04.webp)