wikiHow is a “wiki,” similar to Wikipedia, which means that many of our articles are co-written by multiple authors. To create this article, volunteer authors worked to edit and improve it over time.

This article has been viewed 93,368 times.

Learn more...

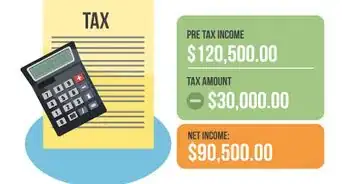

Quickbooks is software designed by Intuit that assists businesses with managing their financial and accounting information. Quickbooks can be used to manage payroll for all the employees within a business, and also stores their taxation information for each fiscal year. Since independent contractors file 1099-Misc forms to pay taxes and do not require you to withhold any taxes on their behalf, you can pay independent contractors in Quickbooks just as if you were paying bills to any other vendor.

Steps

-

1Launch the Quickbooks application on your computer.

-

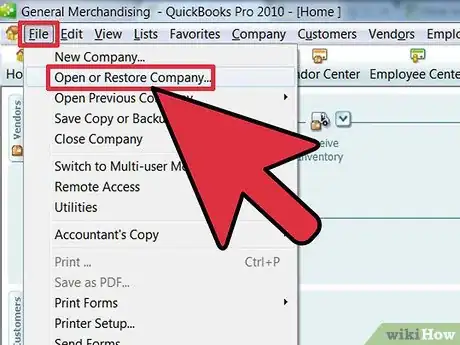

2Open the Quickbooks file for your company or business.

- Point to "File" in the top toolbar and select "Open or Restore Company." Double-click on the file name to open your company's file in Quickbooks.

Advertisement -

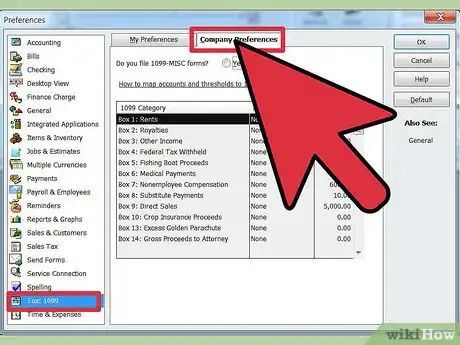

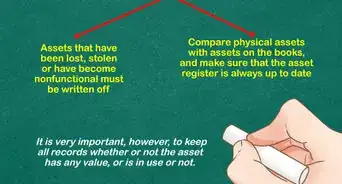

3Enable the 1099 feature so you can add and pay independent contractors.

- Point to "File" and select "Switch To Single-User Mode." You can only enable this feature if nobody else is currently accessing your company's Quickbooks file. You may need to ask your co-workers to exit from Quickbooks or from the company file before you begin this procedure.

- Point to "Edit" in the toolbar and select "Preferences" to edit your company's tax preferences.

- Select "Tax: 1099" on the left side after the Preferences window appears on your screen.

- Click on the tab for "Company Preferences" and answer "Yes" next to "Do you file 1099 MISC forms."

-

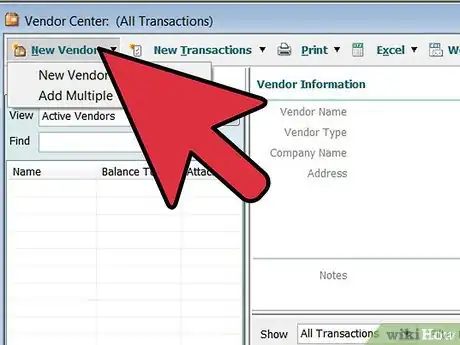

4Add your independent contractor as a new vendor.

- Click "Vendor Center" on the top toolbar, then select "New Vendor."

- Type in the name of the independent contractor as you want it displayed on your Vendors list.

- Enter the amount of money you owe the independent contractor in the "Opening Balance" field, if applicable.

- Click on the "Address Info" tab and provide the independent contractor's address and contact information.

- Click on the "Additional Info" tab to provide Quickbooks with information such as the independent contractor's Tax ID number or Social Security Number, workers compensation insurance information, liability information, and more.

- Place a check mark in the box next to "Vendor eligible for 1099" and click on the "OK" button to save your independent contractor's vendor information.

Pay an Independent Contractor in Quickbooks

-

1Create a bill to represent the work done by the independent contractor for your business.

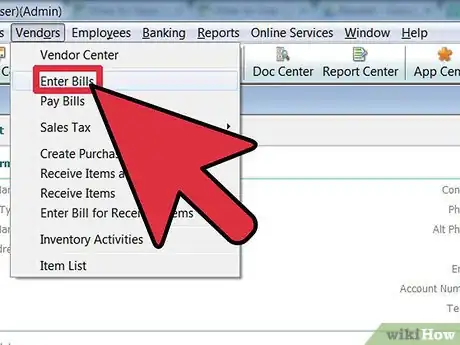

- Point to the "Vendors" menu and select "Enter Bills."

- Select the name of your independent contractor from the drop-down box next to the "Vendor" field.

- Enter the amount of money you owe the independent contractor in the field for "Amount Due."

- Enter the independent contractor's information in the optional fields for reference number, terms, and memo, if applicable.

- Click on the "Expenses" tab and choose your independent contractor's expense account from the drop-down list next to the "Account" field.

- Click on "Save" to finish creating the bill.

-

2Pay the independent contractor's bill.

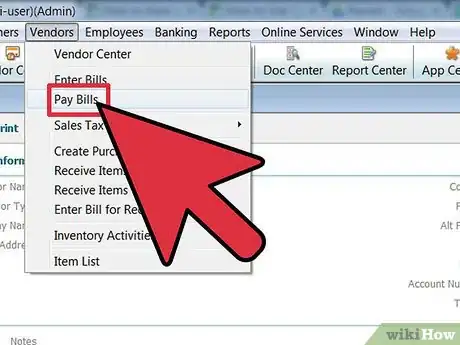

- Click on the "Pay Bills" option from the "Vendors" menu in your session.

- Select the bill that needs to be paid and choose your desired payment method from the drop-down menu next to the "Payment Method" field. A variety of payment methods are available; including check, credit card, cash, debit card, PayPal, and other online payment methods.

- Select the business account from which you want to pay your independent contractor from the "Payment Account" field.

- Click on the button for "Pay Selected Bills" to successfully complete the payment process.

Community Q&A

-

QuestionHow do I get a bill for contract labor charged to a service account on a customer report?

Community AnswerYou will need to have an invoice filled out to be able to submit it.

Community AnswerYou will need to have an invoice filled out to be able to submit it. -

QuestionHow do I pay an independent contractor one amount and bill the customer for a higher amount in order to profit?

Community AnswerI am pretty sure you invoice the customer from your company and then enter a bill from the independent contractor (like they are invoicing you). So you will receive payment for your invoice and then you will pay your contractor from their bill you submitted.

Community AnswerI am pretty sure you invoice the customer from your company and then enter a bill from the independent contractor (like they are invoicing you). So you will receive payment for your invoice and then you will pay your contractor from their bill you submitted.