This article was co-authored by Clinton M. Sandvick, JD, PhD. Clinton M. Sandvick worked as a civil litigator in California for over 7 years. He received his JD from the University of Wisconsin-Madison in 1998 and his PhD in American History from the University of Oregon in 2013.

There are 14 references cited in this article, which can be found at the bottom of the page.

wikiHow marks an article as reader-approved once it receives enough positive feedback. In this case, 97% of readers who voted found the article helpful, earning it our reader-approved status.

This article has been viewed 93,331 times.

Normally, when you sell property held for investment or business purposes for a greater value than that which you originally paid for it, any gain you realize from the sale will be subject to capital-gains tax. However, a Section 1031 exchange—also called a tax-deferred exchange— allows you to sell property and acquire replacement property through an exchange method, allowing you to defer having to pay capital-gains taxes resulting from the initial sale.[1] This allows you to, in effect, reinvest the sale proceeds without having to pay additional taxes and can therefore be a powerful money-saving tool if used correctly. So, for example, if you own a rental property (say, an apartment) that you wish to sell because you'd like to purchase similar property in a different location (say, because you are moving or because you'd like to take advantage of a favorable housing market), a 1031 exchange can help you do that while deferring capital-gains tax.

Steps

Conducting a 1031 Exchange

-

1Consider hiring professionals to assist you. In order to conduct a 1031 exchange—and safely navigate the complexities of the relevant provisions of the Internal Revenue Code—you should either (1) have a sophisticated understanding of the portions of the United States Code governing 1031 tax-deferred exchanges[2] or (2) find a qualified professional to assist you. Because tax laws change and new tax regulations are issued periodically, your best bet for a successful 1031 exchange is to enlist the help of a professional.

- An attorney, tax specialist, or accountant will not only help you understand exactly what you need to do in order to conduct a valid 1031 exchange but can also ensure that you don't make any mistakes during the process.

- A real estate agent will also be helpful—especially if they have been a part of a 1031 exchange before—and should know what language to insert in the relevant contracts to make the exchange go as smooth as possible.

- As soon as you decide to conduct a 1031 exchange, be sure to tell any professionals you will be working with during the exchange (i.e., your attorney, your real estate agent, etc.) of your intent so they can properly assist you in conducting the transaction.

-

2Find a buyer for the property you wish to sell. This property—commonly referred to as the "relinquished property," because this is the property you will be giving up in exchange for another—is the property you will be exchanging for another in this transaction in order to defer capital-gains taxes. Your next step, then, is to find someone who is willing to purchase your property at the amount at which you wish to sell it.

- Once you have found someone willing to purchase your relinquished property, you will enter into a Purchase & Sale Agreement with the buyer.

Advertisement -

3Insert a special clause in the Purchase & Sale Agreement. To facilitate the 1031 exchange, you will want to insert special language referencing the 1031 exchange in the Purchase & Sale Agreement for your relinquished property. You can do this yourself, if you decide to draft the agreement on your own. If you have hired the services of an attorney to complete the transaction and draft the agreement, instruct him or her to include 1031 language.

- This clause in the agreement should read something like: "Buyer understands it is Seller's intention to use this transaction as part of a 1031 Exchange, and hereby agrees to cooperate with Seller to accomplish same."

- This is important because the Buyer will have to sign certain exchange documents in order for you to successfully complete your 1031 exchange.

-

4Select a Qualified Intermediary. A key aspect of a 1031 exchange is that you are not simply selling one property and then using the proceeds from that sale to buy another. Rather, the selling of the relinquished property and buying of the replacement property is conducted as one transaction. To achieve this, you will generally use what is known as a "Qualified Intermediary"—a third party that will handle the funds throughout the exchange—to conduct the transaction.[3]

-

5Enter into an Exchange Agreement with the Qualified Intermediary. Once you have identified a Qualified Intermediary you wish to use, you will enter into an Exchange Agreement with the Qualified Intermediary. This agreement will allow the intermediary to receive the funds from the sale of your relinquished property, hold those funds, and then eventually use them to purchase your replacement property.

- The reason for this is that, to receive the tax-deferment benefits of a 1031 exchange, you must not have direct control over the funds from the sale of your relinquished property, otherwise the IRS will treat this as a sale and subsequent purchase—not a 1031 exchange.

- This agreement should provide that you will be assigning seller's rights for the relinquished property and buyer's rights for the replacement property to your intermediary, so it can act on your behalf without you ever directly controlling the funds involved in the exchange.[6]

- You must enter into this agreement with a Qualified Intermediary before the closing date for the sale of the relinquished property.[7]

-

6Identify a property or properties you wish to buy. This property—commonly referred to as the "replacement property," because this is the property that will be replacing your relinquished property—is the property you will be acquiring with the proceeds from the sale of your relinquished property in order to defer capital-gains taxes. You must identify the replacement property/properties in writing, sign the document, and deliver it to your Qualified Intermediary within the 45-day timeframe.[8]

- You may identify up to three potential replacement properties regardless of their value. If you wish to acquire more than three replacement properties, you may identify more than three potential replacement properties so long as the total fair market value of your identified properties does not exceed 200% of the sale price of your relinquished property.[9]

- This replacement property/properties should have a fair market value greater than or equal to your relinquished property in order for the exchange to be completely tax-deferred.[10]

- If the replacement property is real property, you must provide the street address and name of the property in your written identification.

- You have 45 days from the sale of your relinquished property in which to select and identify replacement property.

-

7Direct your Qualified Intermediary to enter into a Purchase & Sale Agreement with the seller of your replacement property. The next step is to have your intermediary enter into a sale agreement with the seller of your replacement property. Your intermediary will, according to your Exchange Agreement, use the funds it received from the sale of your relinquished property to buy the replacement property. The seller will deed the property to you, receive payment from the intermediary, and then you will receive your replacement property.[11]

- This Purchase & Sale Agreement should include specific 1031 language, similar to the Purchase & Sale Agreement for your relinquished property.

- You must complete the exchange and receive title to your replacement property within 180 days of the sale of your relinquished property or the due date of the income-tax return for the year in which such property was sold—whichever date is earlier.[12]

-

8

-

9Comply with applicable state-reporting requirements. A Section 1031 exchange is a product of federal law, which is why you must report such an exchange to the IRS. Certain states, such as California, also have state-reporting requirements for 1031 exchanges conducted in their territory.[15] You will have to complete and submit an additional form in order for your 1031 exchange to comply with the laws of your state.

- Tax law is quite complex, and the best way to find out if your state has a 1031 reporting requirement is to consult with an experienced tax attorney.

- You can also try searching for this information online using the phrase "<<your state>> 1031 reporting" and looking over the results to see if any state websites provide forms for state-reporting purposes.[16]

Avoiding Problems with Your 1031 Exchange

-

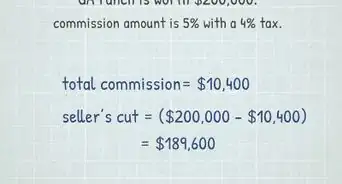

1Ensure the exchange is between "like-kind" properties. In order for your 1031 exchange to be valid, the exchange must be between properties of the same type, or kind. Quality or level of improvement of the property is not a factor. Generally, all real property (i.e., land and/or buildings) is considered like-kind with all other real property.[17] Some examples that satisfy this type of "like-kind" exchange requirement include:[18]

- Unused land in exchange for rental property.

- A single-family rental property in exchange for a multi-family rental property.

- Retail space in exchange for a hotel.

- A farm/ranch in exchange for a golf course.

- Take note that real property located within the United States is never like-kind to real property located outside of the United States.[19]

- If you are unsure as to whether the properties being exchanged are like-kind—or, for that matter, if you have questions about this or any of the following requirements, consider the benefits of paying a (relatively) small amount of money for the advice of a professional instead of finding out later that your exchange was invalid and that any associated gains are fully taxable.

-

2Exercise caution when exchanging personal property. While the "like-kind" requirement is relatively loose when it comes to real property, the requirements for the exchange of personal property are much stricter.[20] For example, cars and trucks—while both vehicles—are not considered like-kind as far as the IRS is concerned.

- If you are contemplating a 1031 exchange that involves personal property, be sure to seek the advice of a qualified tax attorney or accountant regarding whether the property you are planning to exchange satisfies the like-kind requirement.

-

3Ensure the properties involved in the exchange satisfy 1031's usage requirement. For property to be exchanged via Section 1031, all properties involved in the exchange must be held either for (1) use in a trade or business or (2) investment.[21] If the property is mainly used for personal reasons, like a primary residence or a vacation home, you cannot use it to complete a 1031 exchange.

-

4Ensure the properties involved in the exchange are not excluded. There are certain types of property that are specifically excluded from 1031 exchanges, and you should make sure that your intended exchange does not involve any of these types of properties. They are:[22] [23]

- Inventory or stock in trade (i.e., property held primarily for sale).

- Stocks, bonds, or notes.

- Other securities or debt.

- Partnership interests.

- Certificates of trust.

-

5Pay attention to the relevant deadlines. There are two important time limits placed on a 1031 exchange that you must follow. If you do not strictly adhere to these deadlines, your 1031 exchange will be invalid. It is unlikely you will be able to receive an extension on either of these deadlines.[24]

- Remember, you have 45 days from the date you close on the sale of your relinquished property to identify potential replacement property/properties and generally must complete the exchange within 180 days of that date.

- These timeframes include business days, holidays, and weekends.[25]

Warnings

- If the your 1031 exchange involves cash or other proceeds that are not like-kind property in addition to the like-kind property, you will be taxed on those gains.[26] As a result, you should always aim to acquire property equal or greater in value than the property you are relinquishing so that no proceeds from the sale of the relinquished property are left over.[27]⧼thumbs_response⧽

- Remember to have your Qualified Intermediary handle all funds during the exchange. If you directly receive the proceeds from the sale, you will disqualify yourself from the 1031 exchange tax deferment.⧼thumbs_response⧽

- If the replacement property you receive in the exchange was owned by someone related to you, you cannot sell this property for two years if you wish to keep the tax benefits of the 1031 exchange.[28]⧼thumbs_response⧽

- Tax-deferred exchanges under Section 1031 are complex legal and tax structures. Always consult your legal, tax, and/or financial advisers before completing a tax-deferred 1031 exchange transaction.⧼thumbs_response⧽

References

- ↑ https://jflawfirm.com/1031-exchange/

- ↑ https://www.law.cornell.edu/uscode/text/26/1031

- ↑ https://www.irs.gov/uac/Like-Kind-Exchanges-Under-IRC-Code-Section-1031

- ↑ https://www.wellsfargo.com/com/corporate-trust/1031-exchange-services/

- ↑ https://jflawfirm.com/1031-exchange/

- ↑ http://apiexchange.com/index_main.php?id=8&idz=37

- ↑ https://www.northcarolina.ctt.com/docs/1031%20TRAPS%20&%20TRIPWIRES.pdf

- ↑ https://www.irs.gov/uac/Like-Kind-Exchanges-Under-IRC-Code-Section-1031

- ↑ http://www.exeter1031.com/article_identification_rules_like_kind_replacement_property.aspx

- ↑ http://realtormag.realtor.org/law-and-ethics/feature/article/2005/03/eight-1031-exchange-rules-you-cant-ignore

- ↑ http://www.ipx1031.com/the-role-of-the-qualified-intermediary/

- ↑ https://www.irs.gov/uac/Like-Kind-Exchanges-Under-IRC-Code-Section-1031

- ↑ https://www.irs.gov/uac/Like-Kind-Exchanges-Under-IRC-Code-Section-1031

- ↑ https://www.irs.gov/pub/irs-access/f8824_accessible.pdf

- ↑ https://www.ftb.ca.gov/individuals/1031_reporting_requirements.shtml

- ↑ http://forms.marylandtaxes.com/14_forms/MW506AE.pdf

- ↑ https://www.irs.gov/uac/Like-Kind-Exchanges-Under-IRC-Code-Section-1031

- ↑ https://www08.wellsfargomedia.com/assets/pdf/commercial/corporate-trust/Exchanges_of_Real_Property.pdf

- ↑ https://www.irs.gov/uac/Like-Kind-Exchanges-Under-IRC-Code-Section-1031

- ↑ https://www.irs.gov/uac/Like-Kind-Exchanges-Under-IRC-Code-Section-1031

- ↑ https://www.irs.gov/uac/Like-Kind-Exchanges-Under-IRC-Code-Section-1031

- ↑ https://www.irs.gov/uac/Like-Kind-Exchanges-Under-IRC-Code-Section-1031

- ↑ https://www.northcarolina.ctt.com/docs/1031%20TRAPS%20&%20TRIPWIRES.pdf

- ↑ https://www.irs.gov/uac/Like-Kind-Exchanges-Under-IRC-Code-Section-1031

- ↑ http://www.breckenridgeassociates.com/1031-tax-deferred.php

- ↑ https://www.irs.gov/uac/Like-Kind-Exchanges-Under-IRC-Code-Section-1031

- ↑ http://www.breckenridgeassociates.com/1031-tax-deferred.php

- ↑ http://realtormag.realtor.org/law-and-ethics/feature/article/2005/03/eight-1031-exchange-rules-you-cant-ignore

-Step-10.webp)

-Step-17.webp)