This article was co-authored by wikiHow staff writer, Jennifer Mueller, JD. Jennifer Mueller is a wikiHow Content Creator. She specializes in reviewing, fact-checking, and evaluating wikiHow's content to ensure thoroughness and accuracy. Jennifer holds a JD from Indiana University Maurer School of Law in 2006.

This article has been viewed 17,310 times.

Learn more...

If you are self-employed or own your own business, many governments, including the U.S. federal government, allow you to deduct business-related transportation costs as a business expense on your taxes. To take this deduction, calculate mileage correctly and keep accurate logs. These records will protect you in the event of an audit. Rather than take a standard mileage deduction, you may be able to deduct your actual expenses. While this requires additional record keeping, it may enable you to take a larger deduction.[1]

Steps

Calculating Mileage

-

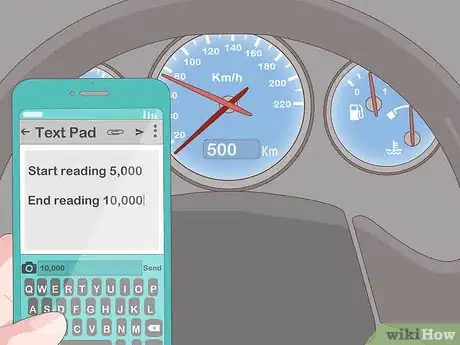

1Record your odometer readings. The most straightforward way to record business miles, and the one preferred by the IRS, is to write down your car's odometer readings when you begin and end the trip. The difference is your mileage.[2]

- This will get you the most exact mileage for your trip. While writing down your odometer reading at the beginning and end of every trip takes effort, eventually it will become a habit.

- If you travel a lot, you may find you get more benefit by using actual odometer readings. This way, you get credit for that time you had to drive around the block 3 times waiting for a client to arrive, or for driving through a packed parking garage looking for a space.

-

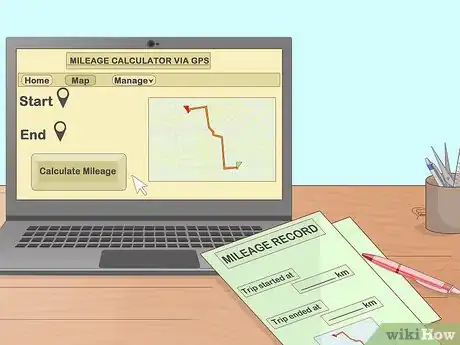

2Use GPS to find mileage after the fact. If you don't record your car's odometer readings at the beginning and end of the trip, plug your beginning and ending address into a GPS or mapping application and use the mileage provided.[3]

- Double-check the route selected by the app you use and make sure it was the same route you took. When using this method, you may want to print off a paper copy of the route and mileage to keep with your mileage logs for your records.

- With this calculation method, you don't get to add a mile or two for the distance you traveled looking for a parking space or stopping to get food. You can only deduct the mileage that you can substantiate.

Advertisement -

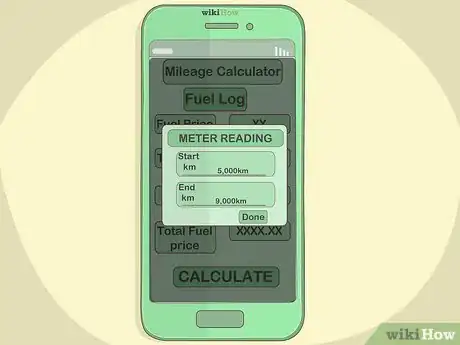

3Keep track of your mileage with a smart phone app. There are a number of apps for smart phones, such as MileIQ and Hurdlr, that can help you record your business miles more easily. And since account records are typically kept in the cloud, you can access them anywhere.[4]

- If you use a smart phone app to record your business miles, keep a separate record of them elsewhere, such as in a spreadsheet on your computer. Have at least one copy of your mileage logs under your control in case one day you can no longer access your account on the app.

Creating Mileage Logs

-

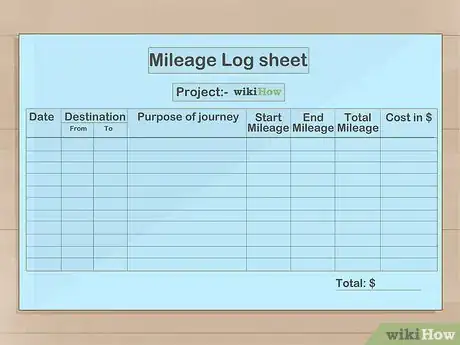

1Record trips for business travel. You can buy pre-printed mileage logs at many discount or office supply stores. You can also make your own using any basic spreadsheet program. Use this log to enter the mileage for every business trip you make throughout the year.[5]

- The mileage for trips you make for a business purpose, such as traveling to another city for a meeting or visiting clients or customers, is potentially tax deductible. Commuting expenses, such as driving from your home to your workplace, generally are not.

- Nondeductible expenses include extra trips made after hours, if you're going to your regular workplace.

- You can, however, deduct commutes to temporary work locations. This would come into play if, for example, you are a contractor who works at various customers' homes.

-

2Include the date and destination for each trip. Have one column on your mileage log spreadsheet for the date of the trip and another for where you went. Be as specific as possible so that the trip is identifiable later.[6]

- You may also want a column to record where you traveled from. If you always travel from the same place (such as your home or office), this column wouldn't be necessary. However, if you frequently travel between client locations or temporary work sites, your starting location may be important information.

-

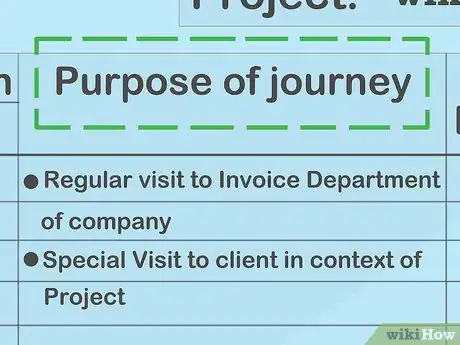

3State the purpose of the trip clearly. You may not be able to identify the trip solely from the destination long after the fact. Providing space for a description of the purpose of the trip may help you recall it later.[7]

- This can also help distinguish similar trips. For example, if you routinely make trips to your state's capital for business, you would want to know the purpose for each trip.

- Include notes of any additional documentation you have, such as sales invoices, that would substantiate the purpose of the trip.

-

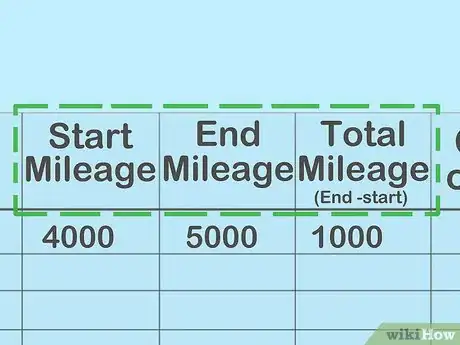

4Write in odometer readings or total mileage. If you're calculating your business miles using your odometer readings, you'll want 3 columns: two for your beginning and ending mileage, and then another for the difference between the two.[8]

- If you used a GPS app or other method to calculate the mileage, you may simply want one column for the mileage.

- Total the mileage column at the bottom of your spreadsheet so you have that number for your tax returns without having to add up the whole column yourself.

-

5Update your logs in a timely fashion. The IRS doesn't necessarily require that you make mileage entries every day. However, you should update your mileage logs at least once a week, even if you don't make frequent business trips.[9]

- If you have several trips for one day, each of those trips should be a separate entry. Many of the details would be different. A generic entry with miles for an entire day likely wouldn't pass muster if your return was audited.

-

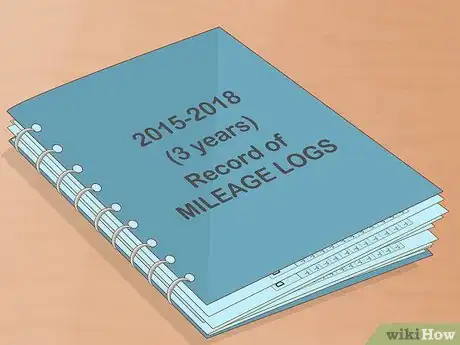

6Keep your logs for 3 years after you file your return. When you file your tax return, keep your mileage logs along with all your other business files related to your taxes for that year. If the IRS audits your tax return, you'll need to produce these records.[10]

- The IRS does not allow you to estimate business expenses, including mileage expenses, for the purposes of a deduction. This applies whether you're using the standard mileage rate or actual expenses. If you can't produce proof that the expense was incurred and that it was for a business purpose, the deduction will be disallowed and you could end up owing the IRS money.

Comparing Actual Expenses

-

1Confirm that you can use actual expenses. Deducting actual expenses requires a lot more work than simply using the standard mileage rate. Before you go to all that effort, check the IRS rules to make sure this method is available to you.[11]

- If you own the car you're using for business, use the standard mileage rate the first year that car is available for you to use for business. This preserves the choice. After that first year, you can use actual expenses or the standard mileage rate, whichever is better for you. However, if you didn't use the standard mileage rate that first year, you're stuck using actual expenses as long as you own that car.

- If you're leasing the car, you cannot deduct actual expenses. You must use the standard mileage rate for the duration of the lease.

-

2Record your car's total mileage at the beginning and end of the year. If you use your car for both business and personal expenses, you need to determine what portion of your use is for business. The easiest way to do this is as a percentage of mileage.[12]

- Subtract your mileage at the beginning of the year from your mileage at the end of the year. This gives you your mileage for the year.

-

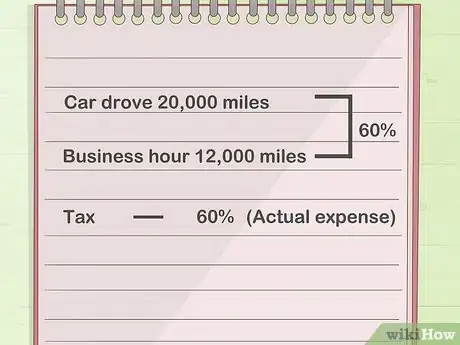

3Determine the portion of overall use that was for business. Total your business mileage from your business mileage logs. Divide that number by your total mileage for the year to get the percentage of your car's overall use that was business use.[13]

- For example, suppose you're a contractor who drove your car 20,000 miles over the course of the year. Of that total mileage, 12,000 miles were business miles. You can deduct 60 percent of your actual expenses on your taxes.

-

4Gather receipts and other records for car expenses. Allowable expenses include gas, oil, tires, repairs and maintenance, insurance, tag and registration fees, and depreciation of your vehicle. To calculate your depreciation, you'll use the appropriate IRS depreciation table.[14]

- Receipts aren't required for some expenses, but you still have to have proof of the expense. For example, if your car insurance is the same amount every month, you can simply multiply your monthly payment by 12 and use that figure. However, in the event of an audit you would have to provide proof of the expense, such as by getting your payment records from your insurance company.

- If you don't have a receipt for an expense, don't deduct it. In the event of an audit, you are only allowed the deductions that you can support with a receipt or other evidence.

-

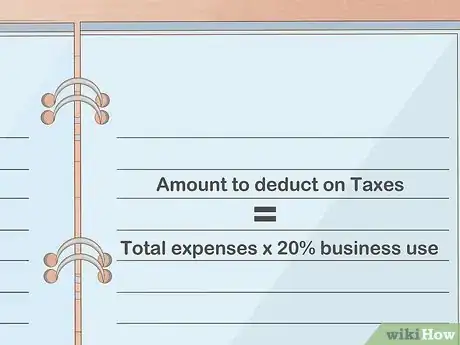

5Calculate the business portion of your total expenses. Once you have a figure for your total expenses, multiply it by the percentage allocated to business use to determine the amount you can deduct on your taxes.[15]

- All of your actual expenses are deductible only if you never use the car in question for personal reasons.

- If you neglected to record your odometer readings at the beginning and end of the year, you would have to split your expenses according to what you actually used for business. Without the odometer readings, you would typically be unable to capture expenses such as insurance and registration, unless your car is only used for business.

-

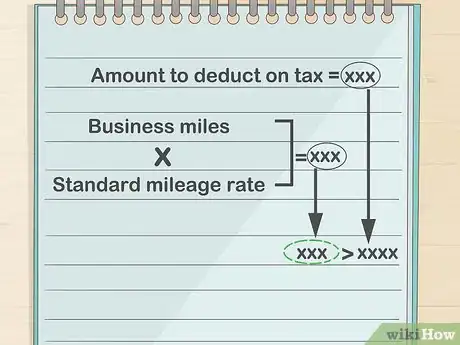

6Check actual expenses against the mileage rate. Once you've determined how much you can deduct in actual expenses, multiply your business miles by the standard mileage rate and see which deduction is larger.[16]

- Provided you can choose between the two methods, you're free to choose the higher deduction.

Warnings

- This article primarily covers IRS rules for recording business miles for U.S. federal tax purposes. If you live in another country, follow up with an attorney or certified tax professional near you.⧼thumbs_response⧽

- If your trip was primarily for personal reasons, the travel itself is not considered a deductible business expense. However, you can deduct any business expenses you incurred while on the trip.[19]⧼thumbs_response⧽

- Be extra careful if you claim your vehicle 100 percent for business use, especially if you're working with a ride-share company such as Uber or Lyft. This is an audit red flag, and you will be expected to produce records that include the date, mileage, and purpose for every trip ever made in the car.[20]⧼thumbs_response⧽

- You can't deduct both mileage and actual expenses for use of your vehicle. While you're free to choose the larger deduction, you have to choose one. Whichever you choose, make sure you have the records to back up the deduction you claimed in the event of an audit.[21]⧼thumbs_response⧽

References

- ↑ https://www.irs.gov/pub/irs-pdf/p463.pdf

- ↑ https://www.irs.gov/pub/irs-pdf/p463.pdf

- ↑ https://www.thebalancesmb.com/keeping-track-of-business-mileage-the-easy-way-3969271

- ↑ https://www.thebalancesmb.com/keeping-track-of-business-mileage-the-easy-way-3969271

- ↑ https://www.irs.gov/pub/irs-pdf/p463.pdf

- ↑ https://www.irs.gov/pub/irs-pdf/p463.pdf

- ↑ https://www.irs.gov/pub/irs-pdf/p463.pdf

- ↑ https://www.irs.gov/pub/irs-pdf/p463.pdf

- ↑ https://www.irs.gov/pub/irs-pdf/p463.pdf

- ↑ https://www.irs.gov/pub/irs-pdf/p463.pdf

- ↑ https://www.irs.gov/pub/irs-pdf/p463.pdf

- ↑ https://www.irs.gov/taxtopics/tc510

- ↑ https://www.irs.gov/taxtopics/tc510

- ↑ https://www.irs.gov/taxtopics/tc510

- ↑ https://www.irs.gov/taxtopics/tc510

- ↑ https://www.irs.gov/pub/irs-pdf/p463.pdf

- ↑ https://www.irs.gov/pub/irs-pdf/p463.pdf

- ↑ https://www.irs.gov/taxtopics/tc510

- ↑ https://www.irs.gov/pub/irs-pdf/p463.pdf

- ↑ https://quickbooks.intuit.com/r/taxes/8-common-tax-audit-triggers/

- ↑ https://quickbooks.intuit.com/r/taxes/8-common-tax-audit-triggers/