This article was written by Jennifer Mueller, JD. Jennifer Mueller is an in-house legal expert at wikiHow. Jennifer reviews, fact-checks, and evaluates wikiHow's legal content to ensure thoroughness and accuracy. She received her JD from Indiana University Maurer School of Law in 2006.

There are 11 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 16,134 times.

The process of starting a business can be just as nerve-wracking as it is exciting. If you live in the state of New York and have decided to start a business, you'll first need to choose a business structure. If you decide to incorporate your business or form an LLC, you'll have to register it with the NYS Department of State. However, even if you don't need to do that, you'll still need to register for taxes, as well as any other licenses or permits you need to operate your business legally. Once you've registered and gotten all the licenses and permits you need, maintain your records according to state guidelines to avoid any legal trouble with your business.[1]

Steps

Forming a Business Entity

-

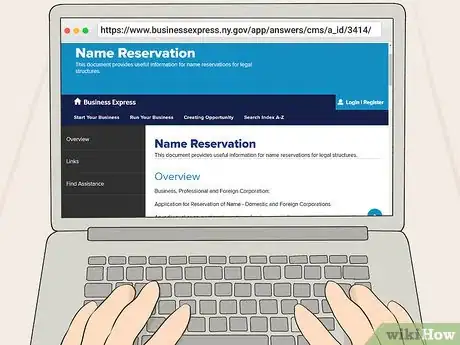

1Register your business name. Generally, you need a name for your business that isn't already being used by another business in New York. Choose a name that's catchy and indicates the products or services your business will offer.[2]

- Since you don't know if the name you choose will be available, come up with a list of 3 to 5 names that appeal to you and your partners (if you have any). Then go to https://www.dos.ny.gov/corps/bus_entity_search.html and search the name to see if it's already in use in the state.

- Check similar names as well. For example, if you want to go with "Caroline's Crazy Cupcakes," you might also see if there are any other "Crazy Cupcakes" businesses that might be confused with yours.

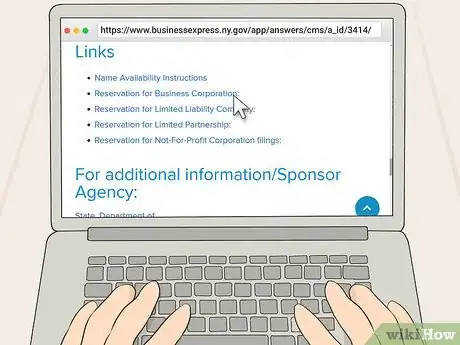

- Once you've chosen your name, you can reserve it for up to 60 days with a fee of $20. Go to https://www.businessexpress.ny.gov/app/answers/cms/a_id/3414/ to reserve your name. The 60 days will give you time to finish forming your business before you register your name.

Tip: Before you commit to a business name, make sure the domain name is available. You might also want to make sure you can get social media accounts in the business's name.

-

2Choose a legal structure for your business. In New York State, you can organize your business as a sole proprietorship, partnership, limited liability company (LLC), or corporation. Each of these legal structures has different tax implications and may impact your ability to expand your business in the future.[3]

- A sole proprietorship is treated as indistinct from you for tax purposes. You report the business income on your personal tax return and pay self-employment taxes. If your business goes bankrupt, you may be personally liable for your business's debts.

- A partnership is treated similarly to a sole proprietorship, except there are 2 or more people involved in the business.

- With a corporation, you are not legally responsible for the debts of your business. The corporation is considered an entirely separate legal entity and pays its own taxes. Corporations are more highly regulated than the other structures and can be more expensive and complicated to form.

- An LLC is, in some ways, the best of both worlds. You get the limited liability of a corporation but can also enjoy pass-through taxation by electing to be treated as a partnership. That way, your business doesn't have to pay corporate taxes. A limited liability partnership (LLP or Limited Partnership) is another form of LLC, typically among professionals, such as doctors or lawyers.

Advertisement -

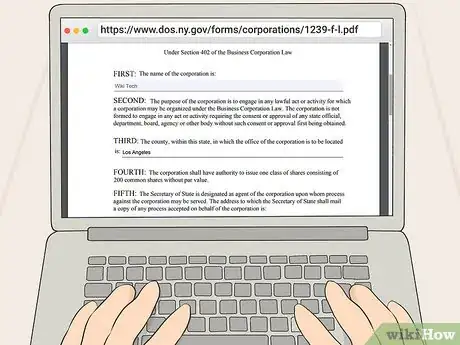

3Complete the appropriate forms to organize your business. Corporations tend to have more extensive document requirements than other business structures. However, even if you have a partnership, creating your own organizational documents gives you the power to make your own rules for your company. New York has some blank forms that you can use as a starting point for your organizational documents if you don't want to create your own from scratch.[4]

- Certificate of Incorporation

- Certificate of Limited Partnership

- Articles of Organization

-

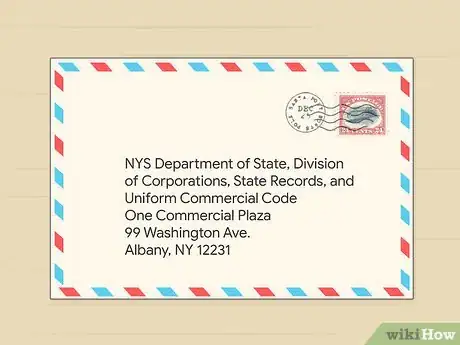

4File your formation documents with the NYS Department of State. If you're forming an LLC or corporation, file your formation documents and pay the required fees to legally create your company.[5]

- Submit your forms online at http://www.nys-opal.com/ or mail them to NYS Department of State, Division of Corporations, State Records, and Uniform Commercial Code, One Commercial Plaza, 99 Washington Ave., Albany, NY 12231.

- As of 2019, the filing fees are $125 plus $10 a share for corporations, $250 for LLPs or LLCs. The NYS Department of State accepts major debit or credit cards, personal or business checks, and money orders. Make your check or money order out to "Department of State."

Tip: If you're forming an LLP or an LLC, you also must publish your Certificate of Limited Partnership or Articles of Organization within 120 days of formation. Publish the notice once a week for 6 consecutive weeks in 2 newspapers of your choice in the county where your business will be located.

-

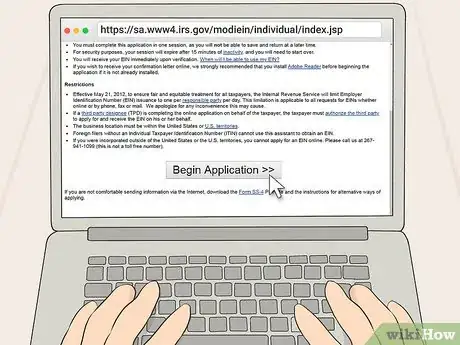

5Get an employer identification number (EIN) from the IRS. Even if you don't plan on having any employees, you'll still need an EIN to distinguish your business from yourself. Otherwise, you'll have to use your Social Security number to identify your business, which could leave you vulnerable to identity theft.[6]

- Applying for an EIN from the IRS is quick, easy, and free. Simply go to https://sa.www4.irs.gov/modiein/individual/index.jsp to apply online. The application asks a few basic questions about your business and takes about 5 minutes to fill out. Your EIN will be issued immediately.

- The IRS website is secure. However, if you don't feel comfortable sending information over the internet, you can fill out Form SS-4, available at https://www.irs.gov/pub/irs-pdf/fss4.pdf, and submit it to the IRS. Read the instructions, available at https://www.irs.gov/pub/irs-pdf/iss4.pdf, to learn about the different ways to submit the form.

Registering for Taxes

-

1Set up a NY.gov business account. If you want to register your business and manage all of your licenses or permits online, you'll need a NY.gov account for your business. Even if you already have an individual account, you still need to set up a business account. This is true even if your business is structured as a sole proprietorship. Only business accounts can access the business services.[7]

- To set up your account, go to https://my.ny.gov/ and answer "BUSINESS" as the account type. Fill out the application to finish setting up your account.

-

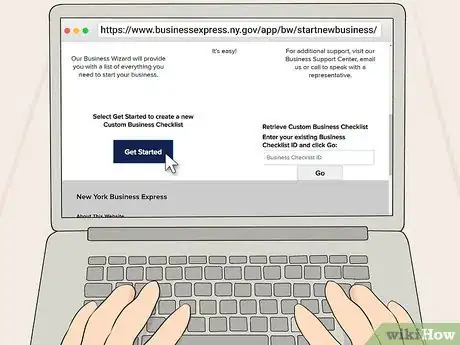

2Register through the New York Business Express. Once you have a NY.gov business account, you have access to the New York Business Express, which you can use to register your business for taxes and apply for any permits or licenses you may need.[8]

- Go to the Business Express web page at https://www.businessexpress.ny.gov/app/bw/startnewbusiness/ and click "Get Started" to access the Business Wizard. After you answer a few questions about your business, it will tell you exactly what you need to register for and what licenses or permits you need. The process takes about 10 minutes.

Tip: New York Business Express only tells you about state business registration, licenses, and permits. You likely also need local licenses and permits, especially if your business is located in New York City.

-

3Get a certificate of authority to collect sales taxes. If your business sells taxable goods or services, you'll have to collect state and local sales taxes from your customers and remit them to the state. Apply at least 20 days before you sell taxable goods or services. You must display the certificate in plain view at your place of business.[9]

- Go to https://www.businessexpress.ny.gov/app/answers/cms/a_id/2058/kw/certificate%20of%20authority/ to apply for your certificate. The approval process takes about 5 days. There is no fee for a certificate of authority.

- The application requires you to provide the day you plan to start business. Your first sales tax return is due at the end of the sales tax quarter that includes that date. Even if you end up opening your business later, you still have to file this first tax return.

-

4Check with local authorities for local permits and licenses. After you have all your state permits and licenses lined up, find out if you need any additional business licenses or other permits to do business in your exact location. If your business is located in New York City, you'll also have to register for city taxes.[10]

- Your city or county government office will have information on the licenses or permits you need. Typically, you'll be able to file your applications online.

Maintaining Your Licenses and Registrations

-

1Keep business financial records and supporting documents. Keep both paper and digital business financial records that support information you provided on your state tax returns for at least 3 years in case of an audit. Records you should keep include:[11]

- Canceled checks

- Cash register tapes

- Purchase orders

- Receipts

- Invoices

- Sales records

Tip: Based on these records, you may be eligible for state tax credits and other incentives that you can use to help grow your business. Information about these credits and incentives is available on the New York Business Express website.

-

2File sales tax returns quarterly. Set up a dedicated bank account to hold sales tax you collect from your customers and pay that money directly to the state form that account each quarter. Your return lists the total sales you had during that quarter and the amount of sales tax you collected.[12]

- If you get business from customers who are exempt from sales tax, such as nonprofit organizations, keep records of those transactions for at least 3 years in case of an audit.

-

3Report newly hired employees within 20 days of their hire date. Your employee's hire date is the first day they start working for you in a paid capacity. Submit identifying information about the employee, including their name, date of birth, address, and citizenship status. This information is necessary for the unemployment insurance records.[13]

- You can submit this information through the New York Business Express website or at https://www.nynewhire.com/#/login.

-

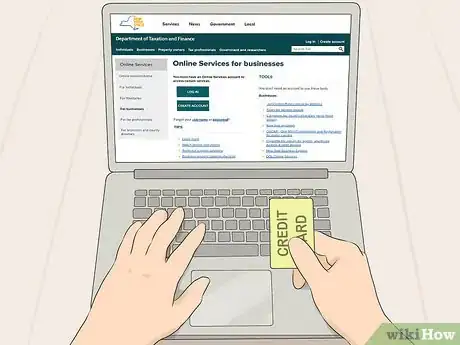

4Withhold state income taxes from your employees' pay. The Tax Department will provide you with information on the state income tax rates and how much is to be withheld from your employees' pay. Open a separate bank account to collect these taxes so you can remit them directly to the state.[14]

- If you use payroll software or a payroll service, they will calculate your state income taxes for you. However, you are ultimately responsible for checking the amount withheld and making sure it's correct.

-

5Pay your state unemployment insurance contributions. Generally, if you pay more than $300 in wages in a calendar quarter, you're responsible for state unemployment insurance contributions. You can register and pay your contributions through the New York Business Exchange website.[15]

- If you're required to pay state unemployment insurance contributions, you must also submit a quarterly wage report to the Tax Department. The Department of Labor uses the data in this report to determine your employees' benefits. Submit your wage report through your online account at https://www.tax.ny.gov/online/bus.htm.[16]

-

6File income tax returns at least once a year. Regardless of how you've structured your business, you're responsible for reporting and paying taxes on the income your business earned throughout the year. If your business is a corporation, you'll file a separate corporate return. Otherwise, you'll report your business's income and expenses on your personal tax return.[17]

- You are only taxed on the net profits of your business — the money your business made after all expenses are taken into account. Keep records of your business expenses for at least 3 years in the event of an audit.

- If your business is structured as a sole proprietorship, you'll have to pay self-employment taxes and may be required to pay quarterly estimated taxes rather than simply filing once a year.

References

- ↑ https://www.businessexpress.ny.gov/app/portal/content/start_a_business

- ↑ https://www.businessexpress.ny.gov/app/portal/content/start_a_business

- ↑ https://www.tax.ny.gov/pdf/publications/multi/pub20.pdf?_ga=1.6423602.1869875226.1462212111

- ↑ http://www.nyc.gov/html/sbs/nycbiz/downloads/pdf/educational/legal/registering.pdf

- ↑ http://www.nyc.gov/html/sbs/nycbiz/downloads/pdf/educational/legal/registering.pdf

- ↑ https://www.businessexpress.ny.gov/app/portal/content/start_a_business

- ↑ https://www.tax.ny.gov/bus/st/register.htm

- ↑ https://www.tax.ny.gov/bus/multi/register_license.htm

- ↑ https://www.tax.ny.gov/e-services/elcoa/default.htm

- ↑ https://www.tax.ny.gov/bus/doingbus/permits.htm

- ↑ https://www.tax.ny.gov/bus/doingbus/recordkeeping.htm

- ↑ https://www.tax.ny.gov/e-services/elcoa/default.htm

- ↑ https://www.tax.ny.gov/bus/doingbus/hire.htm

- ↑ https://www.tax.ny.gov/bus/doingbus/hire.htm

- ↑ https://www.labor.ny.gov/ui/employerinfo/registering-for-unemployment-insurance.shtm

- ↑ https://www.tax.ny.gov/pdf/publications/multi/pub20.pdf?_ga=1.6423602.1869875226.1462212111

- ↑ https://tax.ny.gov/bus/ct/article9a.htm