This article was co-authored by wikiHow Staff. Our trained team of editors and researchers validate articles for accuracy and comprehensiveness. wikiHow's Content Management Team carefully monitors the work from our editorial staff to ensure that each article is backed by trusted research and meets our high quality standards.

There are 13 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 55,358 times.

Learn more...

It’s easy to form a sole proprietorship in New York. Typically, you can just start working under your legal name and pay business taxes using your Social Security Number. However, some people will need to obtain other licenses or permits, and you’ll have to jump through more hoops if you intend to hire employees.

Steps

Choosing Your Business Name

-

1Decide if you want an assumed business name. You can operate your business under your legal name. However, you might want to use a fictitious business name, also called an assumed name or trade name.[1] An assumed name is a good way to stand out from your competitors.

- For example, which are you more likely to remember: “Jane Doe Landscaping” or “Sweeping Vistas Landscaping”?

-

2Pick a memorable business name. You want your name to be something that will stand out from the crowd. It should also suggest key attributes of your business. For example, if you are operating a floral boutique, you might choose a name like “Family Floral,” since it suggests your shop caters to families and is family run.Advertisement

-

3Check that your name is available. You can’t use an assumed name if someone else is already using it.[2] Check with the county clerk’s office whether a name is currently in use.[3]

- You should also check whether someone has registered the name as a trademark. You can search the federal trademark database, available at https://www.uspto.gov/trademarks-application-process/search-trademark-database.

-

4Confirm that the URL is available. If you want a business website, then ideally the URL will be your business name.[4] Check whether the URL is available at the register.com website.

- Reserve the name if it is available. There’s no need to wait until you are prepared to create a website.

-

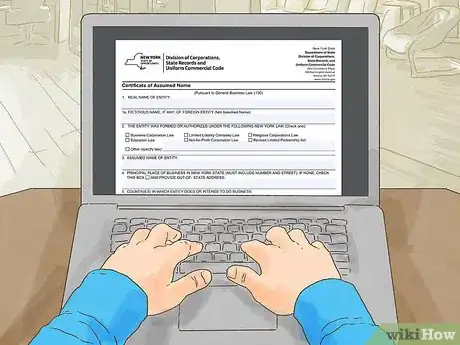

5File a certificate of assumed name. The certificate is here: https://www.dos.ny.gov/forms/corporations/1338-f.pdf. However, each county might have its own form, so check with the court clerk.

- Enter information directly into the form or print the form off and use black ink. You must file the form with the county clerk for every county where you intend to do business.[5]

- The fee is $25. You may need to pay more depending on the counties where you file.

- Remember to get a copy of the form, which you will need when you open a bank account. You might need to pay a small fee.

Satisfying Legal Requirements

-

1Get an Employer Identification Number (EIN). Not all sole proprietors need this number. Instead, you can use your Social Security Number as your tax ID. However, you’ll need the EIN if you hire employees or want to open a business bank account.[6]

- You can get your EIN online at https://www.irs.gov/businesses/small-businesses-self-employed/apply-for-an-employer-identification-number-ein-online.

-

2Obtain required licenses or permits. Your business might need certain permits or licenses before you can open. For example, if you are a cosmetologist or barber, you’ll need a professional license.[7] You can find out which licenses or permits are required by using the Business Express website: https://www.businessexpress.ny.gov/.

- You can also call a business information specialist at 518-453-8130 with questions. Someone is available on weekdays from 8:30 am to 4:30 pm.

-

3Register to pay taxes. If you sell goods or services, you probably must collect sales and/or use taxes. Register with the state to obtain a Certificate of Authority. You can register at the Business Express website. Type Certificate of Authority in the “Find it Here” box.

- If you work in New York City, you should also register for city taxes. Call the city’s Department of Finance at 212-504-4036.[8]

-

4Take appropriate steps when you hire employees. New York requires that you report each employee you hire. You have 20 days from the date you hire the employee to report them to the Tax Department.[9] You can report online at https://www.nynewhire.com/#/login. New users will need to register an account.

- You might need to pay unemployment insurance for your employees. Call the Department of Labor at 1-888-899-8810 to register.

- You probably also need to carry workers’ compensation and state disability insurance (SDI). Call 877-632-4996 for more information.

Taking Next Steps

-

1Open a business bank account. Research business bank accounts. Some offer special deals for businesses, such as discounted fees or lines of credit. To open the account, go to the bank with your EIN and your business name certificate.[10]

- It’s better to keep your business banking separate from your personal banking. That way, you can more easily track your business expenses. One good idea is to open your business account at a different bank.

-

2Obtain insurance. As a sole proprietor, you are fully responsible for all business debts and any other liabilities. There is no legal distinction between you and your business. To protect yourself, you should get general business liability insurance.[11] Contact your insurance agent for help finding an appropriate policy.

- Don’t rely on your homeowners’ insurance policy. If clients are injured when visiting your home, they might need be covered.[12]

- There may be other insurance available unique to your industry. Talk to your agent.

-

3Find a work space. You can certainly work from home, but check whether or not your neighborhood has been zoned for your business use. Also make sure your lease or deed doesn’t restrict you from working at home.[13]

- If you want to rent commercial space, consider working with a real estate agent. Otherwise, you can find commercial space on websites such as Loopnet.com. Generally, commercial rents are based on the square footage or on a percentage of your gross profits.

-

4Create a business plan. A business plan is a must if you are seeking financing. It’s also a good exercise to write one because it forces you to think about your business goals and how you will achieve them. A solid business plan should contain the following:[14]

- Business description. Capture the essence of what you’re trying to do with your business. For example, you might want to start a cosmetology service in New York City for women with sensitive skin.

- Market analysis. Describe the industry—its health, size, new trends, etc. Place your business in this larger framework. For example, specialty cosmetology might be an emerging field. Also describe your typical consumer. What is their age, income, gender, educational level, etc.?

- Competitive assessment. Identify any key competitors and analyze what they do well. Explain how you will distinguish yourself.

- Marketing plan. You should identify how you will promote your products or services. Paid advertising? Social media? Discuss how your pricing strategy plays into your marketing.

- Operating plan. Identify anyone else who will help you manage the business. If you sell products, identify who actually manufactures them.

- Financial needs. Discuss how much money you need and what you will spend it on. Lenders and other investors need some clue as to your financial stability, so create financial projections for three years.

-

5Hire professional help. As your business grows, you might need help keeping your finances and legal obligations straight. Consider hiring the following professionals:

- Business attorney. A good attorney can help you negotiate favorable contracts and represent you in case you are sued. They also are helpful advisers. For example, an attorney can guide you through the process of firing or disciplining an employee without getting sued. Obtain a referral from your nearest bar association.[15]

- Accountant. A good accountant does more than just prepare your taxes. They can also help you generate financial documents to include in your business plan, and they can help you make smart financial decisions.[16]

- Bookkeeper. You can use bookkeeping software to start. However, as your business grows, you might need to hire someone to record your daily business transactions.

References

- ↑ http://www.nolo.com/legal-encyclopedia/how-establish-sole-proprietorship-new-york.html

- ↑ http://www.nolo.com/legal-encyclopedia/how-establish-sole-proprietorship-new-york.html

- ↑ http://www.nyc.gov/html/sbs/nycbiz/downloads/pdf/educational/legal/registering.pdf

- ↑ https://www.inc.com/guides/2010/10/how-to-start-a-sole-proprietorship.html

- ↑ https://www.dos.ny.gov/corps/assdnmins.html

- ↑ http://www.nolo.com/legal-encyclopedia/when-does-sole-proprietor-need-ein.html

- ↑ http://www.ny.gov/services/apply-professional-license

- ↑ https://www.tax.ny.gov/bus/doingbus/nyc.htm

- ↑ https://www.tax.ny.gov/bus/doingbus/hire.htm#hire

- ↑ http://www.nolo.com/legal-encyclopedia/how-establish-sole-proprietorship-new-york.html

- ↑ http://www.nolo.com/legal-encyclopedia/how-establish-sole-proprietorship-new-york.html

- ↑ http://www.nolo.com/legal-encyclopedia/locating-your-sole-proprietorship-home.html

- ↑ http://www.nolo.com/legal-encyclopedia/locating-your-sole-proprietorship-home.html

- ↑ https://www.extension.purdue.edu/extmedia/ec/ec-735.pdf

- ↑ https://archive.nysba.org/lawyerreferral/

- ↑ https://www.accountingtoday.com/news/5-reasons-your-small-business-needs-an-accountant