This article was co-authored by Gina D'Amore. Gina D'Amore is a Financial Accountant and the Founder of Love's Accounting. With 12 years of experience, Gina specializes in working with smaller companies in every area of accounting, including economics and human resources. She holds a Bachelor's Degree in Economics from Manhattanville College and a Bookkeeping Certificate from MiraCosta College.

There are 8 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 19,076 times.

An invoice is a bill for the goods or services you provide clients. You should send invoices promptly, but sometimes you need to send them again. For example, you might have made an error on the original invoice, or your client might have lost their copy. To reissue an invoice, make any necessary corrections to the original and change the invoice number. If your client doesn't pay promptly, follow up with a payment reminder. If you are outside the U.S., consult with an accountant if your invoice was included in a VAT Return.[1]

Steps

Creating Another Invoice

-

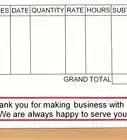

1Identify what information has changed. For example, someone might have increased their order, or you made a mistake on the original invoice. Go down through each piece of information on the invoice and look for changes to any of the following:[2]

- client information

- amount due

- payment deadline

- description of goods or services provided

-

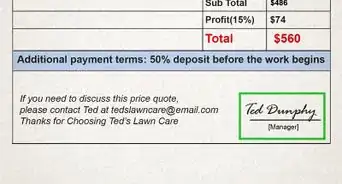

2Correct the invoice. Go into your invoicing software and update whatever information needs to be changed. You should change the invoice number so that it reflects that it has been revised. For example, invoice number 12567 would be 12567-R. Put the words “Revised Invoice” at the top of the document.

- You should also change the date of the invoice.

- If your client simply lost the invoice, you don't need to update the information or include the words “Revised Invoice” at the top. Instead, you are simply providing a new copy of an invoice that hasn't changed.

Advertisement -

3Extend the due date, if necessary. If you had to revise the invoice to reflect additional services provided, then you should probably extend the due date. However, if your client merely lost their copy you don't need to do this.

-

4Print your invoice. You'll need to send your client a copy of the revised invoice, so print it out and prepare for mailing it. Many invoice software programs allow you to send invoices by email, so send it that way if it is more convenient.[3]

- Print off a copy for your records and staple it to the original invoice.

Sending a Cover Letter with the Invoice

-

1Format a standard business letter. You need to include a short note with the new invoice and explain any changes. Open a blank word processing document and set the font to something readable, e.g., Times New Roman 12 point.[4]

- If your business has letterhead, then leave space at the top of the page for the letterhead.

- If you are sending a PDF of your invoice, then you can type up this cover letter in an email.

-

2Explain changes to the invoice. It should be clear from your letter why you sent the invoice again. For example, you might have made an error when calculating how much you were owed. You can write something like, “The enclosed invoice reflects the corrected amount due. I apologize for the error on the original invoice.”

- If there were no revisions, then write something like the following: “I have provided an additional copy of the invoice dated May 30, 2017, per your request.”

-

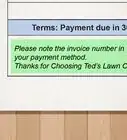

3Remind the client when payment is due. Your invoice might already state the payment due date, but it's a good idea to repeat the due date in the letter. For example, you can write, “As a reminder, payment is due on July 1, 2017.”

-

4Conclude the letter. Remind the client to contact you if they have questions, which is particularly important if you've changed how much the client owes. Thank them for their business and include “Sincerely” and your signature.[5]

Drafting a Payment Reminder

-

1Set up a standard business letter. If you don't receive payment by the due date, prepare a letter to send to the client. Some clients forget when bills are due, so a friendly reminder might help. Format a business letter.

- You can also send a late payment reminder by email, if you think it is easier.[6]

-

2Explain why you are writing. In the first paragraph, tell the client that their account is past due and you are sending this letter as a payment reminder. For example, you can write, “This letter is a reminder that your account with us is now past due.”[7]

- Avoid showing anger or attacking the client. Mistakes do happen, so try to be understanding.

-

3Identify which invoices are unpaid. Write something like, “We have not received payment for the following invoices….” Include the invoice number, the due date for the invoice, and the amount owed. If the client is past-due on multiple invoices, list them in columns.[8]

-

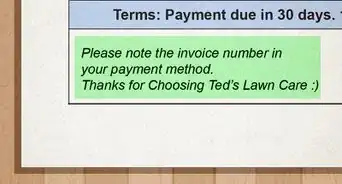

4List the client's payment options. Make getting paid as easy as possible. Remind the client which payment methods you accept, e.g., cash, major credit cards, personal check, etc. If you accept online payment, include a link to the website.[9]

-

5Remind the client about your late fees. You might charge a late penalty for payments that are more than 30 days past due. Now is the time to remind the client of those terms, which should prompt them to pay you quickly.

- For example, you can write, “As you probably know, your payment terms are 30 days from the invoice issuance date. A 5% late fee will be assessed if we don't receive payment by then.”[10]

- Don't threaten to sue in this letter. Instead, hold that threat for a subsequent letter if the client still refuses to pay.

-

6Conclude the letter. Thank the client for their prompt attention to this matter and remind them that they are a valued customer. Type “Sincerely” and then include your name underneath.[11]

-

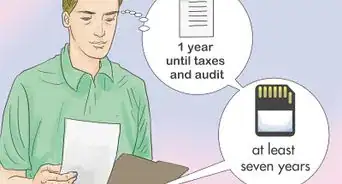

7Send the letter. Include the letter with a copy of the unpaid invoice. Send the letter certified mail, return receipt requested so you know when it has been received. Remember to keep a copy of the letter for your records.

-

8Write additional letters, if necessary. Hopefully, one letter is enough. If not, you should draft additional payment reminders. Your ability to collect on the debt will decrease once your invoice is more than 60 days past due.[12]

References

- ↑ https://help.sageone.com/en_ie/accounts/sales-invoice-edit.html

- ↑ https://www.score.org/resource/what-information-should-my-invoices-include

- ↑ https://www.bill.com/faq/accounts-receivable-questions/send-invoices-online/

- ↑ https://owl.english.purdue.edu/owl/resource/653/01/

- ↑ https://writing.wisc.edu/Handbook/BusinessLetter.html

- ↑ https://www.runviably.com/blog/6-tips-to-write-a-friendly-overdue-invoice-letter/

- ↑ https://www.runviably.com/blog/6-tips-to-write-a-friendly-overdue-invoice-letter/

- ↑ https://www.runviably.com/blog/6-tips-to-write-a-friendly-overdue-invoice-letter/

- ↑ https://www.runviably.com/blog/6-tips-to-write-a-friendly-overdue-invoice-letter/

- ↑ https://www.runviably.com/blog/6-tips-to-write-a-friendly-overdue-invoice-letter/

- ↑ https://www.runviably.com/blog/6-tips-to-write-a-friendly-overdue-invoice-letter/

- ↑ https://www.runviably.com/blog/6-tips-to-write-a-friendly-overdue-invoice-letter/

- ↑ https://www.freeagent.com/glossary/invoice/

- ↑ https://help.sageone.com/en_ie/accounts/sales-invoice-edit.html