This article was co-authored by Clinton M. Sandvick, JD, PhD. Clinton M. Sandvick worked as a civil litigator in California for over 7 years. He received his JD from the University of Wisconsin-Madison in 1998 and his PhD in American History from the University of Oregon in 2013.

There are 13 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 222,941 times.

No one likes paying taxes, but most law-abiding taxpayers expect everyone and every business to pay their fair share. Therefore, you may feel compelled to report tax fraud of which you have personal knowledge. Reporting a tax law violation by an individual or company is strictly voluntary, but you may be eligible for reward money.

Steps

Reporting Noncompliance With Tax Laws

-

1Determine when tax fraud should be reported. The IRS is a relatively small governmental body compared to the size of the US population. Because it only audits about 1% of the population, it needs to choose its targets carefully.[1] Help the IRS out by blowing the whistle on truly significant instances of tax fraud.

- A multi-national company serially underreporting its income in order to pay fewer taxes is significant, but a babysitter failing to declare the $40 of income is not.[2]

- The IRS is seeking solid and comprehensive information, not speculation or educated guesses. Tax fraud reporting is meant as a way to tackle serious fraud not to resolve personal disputes.

- The IRS offers rewards for information, but often the amount in dispute must exceed $2 million, or the individual have an income of over $200,000 to qualify for a significant reward.

- These guidelines reflect the IRS’s desire to catch major tax offenders.[3]

-

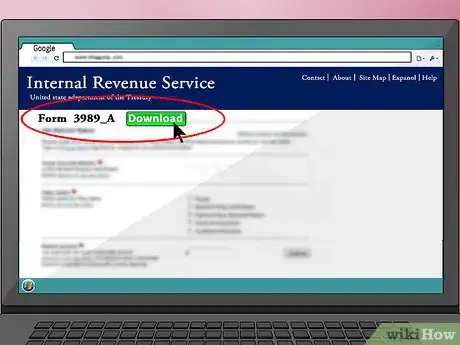

2Download Form 3949-A. The main way to report suspected tax fraud to the IRS is by downloading and completing the relevant form from the IRS website. You can download a PDF of Form 3949-A directly: https://www.irs.gov/pub/irs-pdf/f3949a.pdf. This is the form you should use if you know or suspect a person or business is not compliance with tax law on issues such as:

- Failure to pay tax, or unreported income.

- False tax exemptions or deductions.

- False or altered documents.

- Kickbacks.

- Organised crime.

- Failure to withhold.[4]

Advertisement -

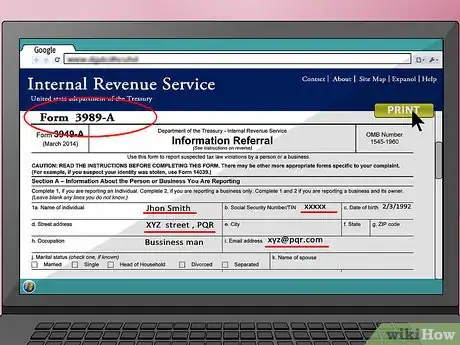

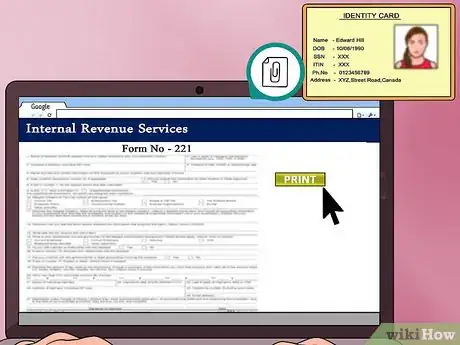

3Provide information about who you are reporting. In order to fill out the form you will need to provide information about the person or business you are reporting. If you are reporting a person, you are asked to provide their name, address, Social Security number, date of birth, occupation and email address. You can fill in the form on your computer and print it out.

- If you are reporting a business, you should provide the name, address and Employer Identification Number as well as a description of the type of business.

- You are asked to provide as much information as you can, and leave blank any sections you cannot complete.[5]

-

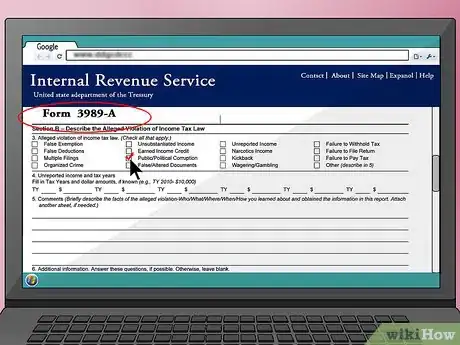

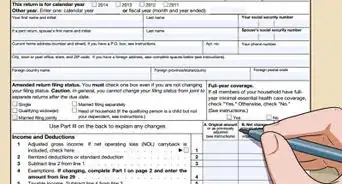

4Indicate the type of tax law violation. The form includes a section where you should outline the alleged tax violation you are reporting. Use the check boxes on the form or the space provided for a description. Specifying which laws the person or employer violated will give the IRS a starting point with which to launch the investigation. Here are some common tax law violations:[6]

-

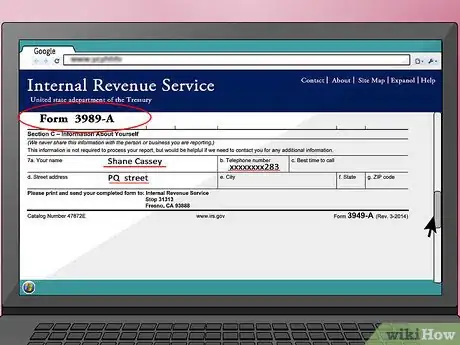

5Decide whether to provide your contact details. The form invites you to provide your name, address and phone number. The informant's information isn't required for the IRS to process a report of tax fraud, but it can be helpful if the IRS need to contact you for any follow-up or further information.

- If you do choose to provide your identity, know that the IRS will keep your identity confidential.[9]

- An anonymous fraud reporter may not be able to collect a reward, if the IRS chooses to issue one.

-

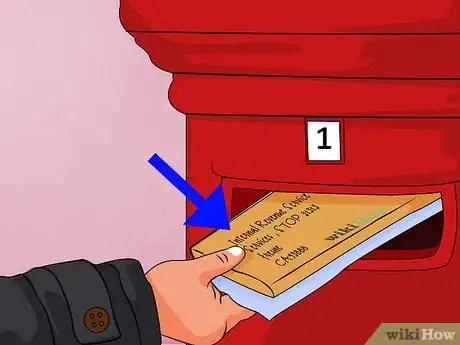

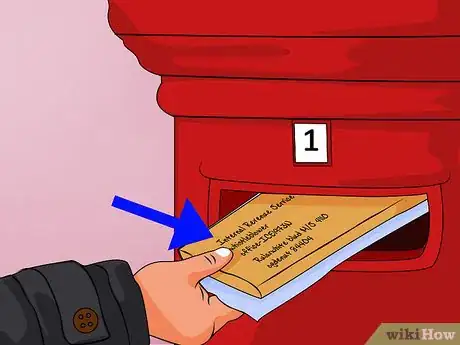

6Send in the form. Once you have completed the form, mail it to the IRS to be processed. Mail the completed form to the Internal Revenue Service. Send it to: Internal Revenue Service, Stop 31313, Fresno, CA 93888.[10]

Reporting Other Kinds of Tax Fraud

-

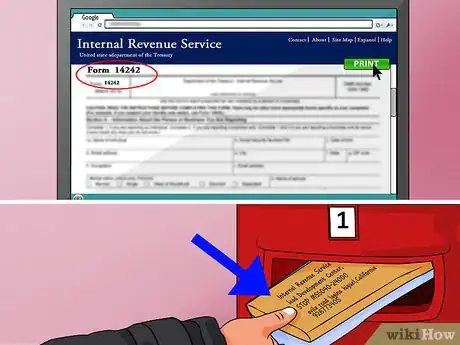

1Report promoters of abusive tax schemes. You can report those you suspect of promoting abusive tax schemes. Some of the most common abusive schemes include anti-tax law, home-based businesses, and off shore tax schemes. The report these kinds of abuses you need to complete a referral form, and mail it to the IRS.[11]

- You can download Form 14242 from the IRS website here: https://www.irs.gov/pub/irs-pdf/f14242.pdf

- Mail the completed form to: Internal Revenue Service Lead Development Center, Stop MS5040, 24000 Avila Road, Laguna Niguel, California 92677-3405.

- Include any promotional material you have about the scheme you are reporting with the form.

-

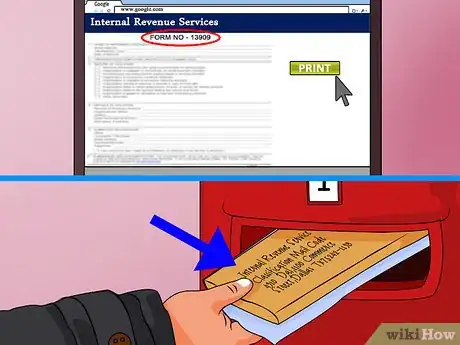

2Refer an exempt organisation. If you suspect or know that an exempt organisation is committing a tax fraud offence, you can report it to the IRS by completing Form 13909 and mailing it in. Exempt organisation are sometimes used by for-profit entities in tax avoidance schemes.[12] The form asks you to provide details on the organization you are referring and the kind of tax fraud you suspect has been committed.[13]

- Common violations include people using the organisation’s income or assets for personal gain, the organisation participating in for-profit business activities, or involvement in a political campaign.

- Complete Form 13909, which is available here: https://www.irs.gov/pub/irs-pdf/f13909.pdf.

- Mail it in, along with any supporting information, to: IRS EO Classification, Mail Code 4910DAL, 1100 Commerce Street Dallas, TX 75242-1198.

- You can also fax it to 214-413-5415, or email it to eoclass@irs.gov.[14]

-

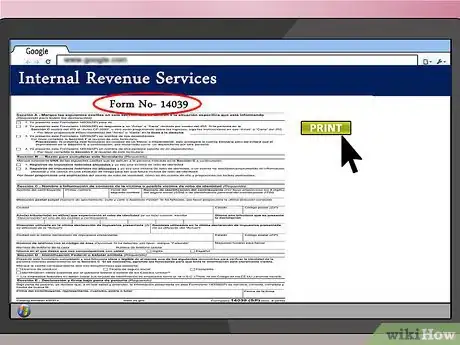

3Inform the IRS if you think someone is using your SSN. If you suspect someone is using your Social Security Number and may have filed a tax return with it, or could do so in the future, report this to the IRS immediately. To do this you will need to complete Form 14039, and submit it to the IRS. You can complete the form online and then print it out.[15] Access the form directly here: https://www.irs.gov/pub/irs-pdf/f14157.pdf.

- You can complete a Spanish version of the form here: https://www.irs.gov/pub/irs-pdf/f14039sp.pdf.

- Depending on the specific nature of your report, you will be asked either to pass the form to the office where you normally file your returns, submit it electronically, or mail it to a different IRS office.

- Full information about where to send your form is provided on page two of the document.

- You will need to include a photocopy of a document that proves your identity. The acceptable documents are listed on the form and include a passport, driving licence, and social security card.[16]

-

4Report a tax return preparer. If you suspect that a tax return preparer has altered or filed a return without your consent, you can report this to the IRS. To report this, and request to change your account, you will need to complete and submit two forms, Form 14157, and Form 1457 – A. These forms ask you provide information about yourself and the return preparer, as well as details on the specific complaint you have.[17]

- Form 14157 can be accessed here: https://www.irs.gov/pub/irs-pdf/f14157.pdf.

- Form 14157 – A can be accessed here: https://www.irs.gov/pub/irs-pdf/f14157a.pdf.

- Once you have completed the forms according to the instructions, mail them to: Internal Revenue Service AM – Preparer Complaints, Mail Stop 58, 5333 Getwell Road, Memphis, TN 38118.[18]

- You can use Form 14157 to report any suspected fraud by a return preparer.

Claiming a Reward for Reporting Tax Fraud

-

1Determine whether you are eligible for a reward. Individuals who report instances of tax fraud may be eligible to receive compensation from the Whistleblower Office of the IRS. There are significant financial rewards if you are reporting an individual whose annual gross income exceeds $200,000 for the relevant tax year. Or if you are reporting a business which costs the IRS at least $2 million, including taxes, penalties and interest.[19]

- The IRS may pay between 15%-30% of the amount collected in a reward to the whistleblower.

- There are separate rewards for reporting tax fraud of those on less income. These rewards are lower, but still require you to complete the same paperwork.[20]

-

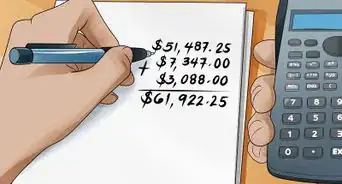

2Complete Form 211. This form is the Application for Award for Original Information.[21] You can access the form directly here: https://www.irs.gov/pub/irs-pdf/f211.pdf. Attach any supporting documents in your possession, as well as providing your name, date of birth, Social Security number or Individual Taxpayer Identification Number (ITIN), and address. You may also choose to include your phone number.

- If you reported the tax fraud to an IRS employee, provide that date and the employee's name and title.

- Provide details about the tax fraud that you think will lead to the collection of unpaid taxes.

- List all supporting documents you have as well as a description and location of documents you don't have.

- Explain your relationship to the taxpayer and describe how and when you became aware of the fraud.

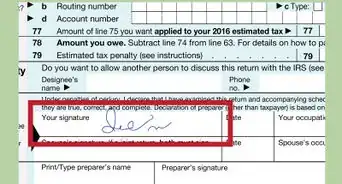

- Substantiate the amount of unpaid taxes, and sign the Declaration under Penalty of Perjury at the bottom of the form.[22]

-

3Mail the Form. Once you have completed Form 211, you should mail it to the Whistleblower Office of the IRS. The address for this office is: Internal Revenue Service, Whistleblower Office – ICE, 1973 N. Rulon White Blvd., M/S 4110, Ogden, UT 84404. Be sure to check this address with the details provided on the form itself to make sure it is up-to-date.

References

- ↑ http://www.kiplinger.com/article/taxes/T054-C000-S001-irs-audit-red-flags-the-dirty-dozen.html

- ↑ http://www.investopedia.com/articles/taxes/09/reporting-tax-cheats.asp

- ↑ https://www.irs.gov/uac/Whistleblower-Informant-Award

- ↑ https://www.irs.gov/Individuals/How-Do-You-Report-Suspected-Tax-Fraud-Activity

- ↑ https://www.irs.gov/pub/irs-pdf/f3949a.pdf

- ↑ https://www.irs.gov/pub/irs-pdf/f3949a.pdf

- ↑ http://www.post-gazette.com/businessnews/2007/03/25/Tax-cheats-cost-U-S-hundreds-of-billions/stories/200703250264

- ↑ http://www.post-gazette.com/businessnews/2007/03/25/Tax-cheats-cost-U-S-hundreds-of-billions/stories/200703250264

- ↑ http://www.irs.gov/Individuals/How-Do-You-Report-Suspected-Tax-Fraud-Activity

- ↑ https://www.irs.gov/pub/irs-pdf/f3949a.pdf

- ↑ https://www.irs.gov/Businesses/Small-Businesses-&-Self-Employed/Tax-Scams-How-to-Report-Them

- ↑ https://www.irs.gov/Businesses/Small-Businesses-&-Self-Employed/Tax-Scams-How-to-Report-Them

- ↑ https://www.irs.gov/Individuals/How-Do-You-Report-Suspected-Tax-Fraud-Activity

- ↑ https://www.irs.gov/pub/irs-pdf/f13909.pdf

- ↑ https://www.irs.gov/Individuals/How-Do-You-Report-Suspected-Tax-Fraud-Activity

- ↑ https://www.irs.gov/pub/irs-pdf/f14039.pdf

- ↑ https://www.irs.gov/Individuals/How-Do-You-Report-Suspected-Tax-Fraud-Activity

- ↑ https://www.irs.gov/pub/irs-pdf/f14157a.pdf

- ↑ http://www.irs.gov/uac/Whistleblower-Informant-Award

- ↑ https://www.irs.gov/uac/Whistleblower-Informant-Award

- ↑ https://www.irs.gov/Individuals/How-Do-You-Report-Suspected-Tax-Fraud-Activity

- ↑ https://www.irs.gov/pub/irs-pdf/f211.pdf

About This Article

To report tax fraud, first make sure you have a valid, significant case to report since the IRS is mostly interested in catching major tax offenders. If you’re ready to report the suspected fraud, download and complete Form 3949-A. In order to fill out the form, you’ll need to provide information about the person or business you are reporting, such as their name, address, and the type of tax law they’re violating. You can also provide your contact details, which will be kept confidential and is helpful if the IRS has any questions. To learn how to claim a reward for reporting tax fraud, keep reading!