This article was co-authored by Hovanes Margarian. Hovanes Margarian is the Founder and the Lead Attorney at The Margarian Law Firm, a boutique automotive litigation law firm in Los Angeles, California. Hovanes specializes in automobile dealer fraud, automobile defects (aka Lemon Law), and consumer class action cases. He holds a BS in Biology from the University of Southern California (USC). Hovanes obtained his Juris Doctor degree from the USC Gould School of Law, where he concentrated his studies in business and corporate law, real estate law, property law, and California civil procedure. Concurrently with attending law school, Hovanes founded a nationwide automobile sales and leasing brokerage which gave him insights into the automotive industry. Hovanes Margarian legal achievements include successful recoveries against almost all automobile manufacturers, major dealerships, and other corporate giants.

There are 10 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 19,302 times.

Selling a financed car can seem a little tricky. After all, the lender who finances your car is technically the owner until you pay it off. That can make buyers a bit nervous when you're trying to sell your car, as they'd rather not have a delay in getting the title. However, you can take steps to put the buyer at ease. Start by figuring out the equity in your car, which can help you determine the amount you'll make by selling your car. Then you can find a buyer and use the lender to pass the title to them.

Steps

Determining Your Equity

-

1Call your loan company for the payoff amount.[1] The first thing you need to do is figure out how much it would cost to pay off the car loan. The easiest way to do that is to call the car company to ask for the payoff amount. That's how much you have left to pay on the loan, plus any fees for paying it off early.[2]

-

2Determine the value of your car. It's also essential to know what your car is worth on the market. Look up the fair market value of your car. You can find this information through places like Edmunds.com or Kelly Blue Book, both of which are available online.[3]

- You'll need information like your car's make and model, year, and condition to figure out the value.

Advertisement -

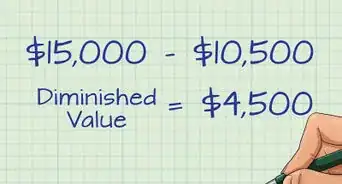

3Figure out if you have negative equity. Another term for this situation is being "upside-down" on your loan. Basically, it means you owe more on the car than it's worth. To figure out if you're in this situation, subtract what you owe from what the car is worth. If it's a negative number, you have negative equity.[4]

- For instance, if you owe $10,000 and the car is only worth $9,000, you'd subtract $10,000 from $9,000 ($9,000-$10,000), meaning your "equity" is -$1,000. That's negative equity.

- On the other hand, if you owe $8,000 and the car is worth $12,000, you'd subtract $8,000 from $12,000 ($12,000-$8,000), meaning you have $4,000 worth of equity in the car.

- Ideally, you want to sell your car for enough to cover the whole loan. However, if it's not valued for that much, you likely won't be able to get that much. Try to set it at or near the fair market value.

Finding a Buyer

-

1List the car for sale in several places. You can use sites specific to cars, such as www.autotrader.com, www.cars.com, or www.instamotor.com. However, you can also use local sale sites like Facebook Market and Craigslist, as well as place an advertisement in your local newspaper.

-

2Create the ad. Make sure to list all the relevant details in your ad, including the make, model, year, and condition of your car. With online sites, take clear pictures that show the complete exterior and interior of the vehicle. It's also a good idea to take a picture of the mileage.[5]

- Add a note about why you're selling the car.

- List your asking price. You can also add "OBO," which stands for "or best offer," if you're willing to haggle.

- It's also a good idea to note in the ad that the car is financed, so the buyer knows what they are getting into.

-

3Wait for potential buyers. After placing the ad, take time to field calls and messages from potential buyers. Who you choose is up to you, but it's a good idea to vet buyers. Try asking a few engaging questions to get a feel for the buyer. Ask them what they are looking for and why they are interested in the car. That can help you gauge whether they are serious or not.[6]

- Keep in mind that potential buyers will want to see and drive the car. Meet in a public place, and take someone with you. Also, make sure to carry your cellphone with you.

-

4Agree on a price. If you're willing to haggle, you may find a buyer more quickly. However, you'll still need to agree on a price. Keep your equity in mind as you haggle, as you don't want to put yourself in a bad situation financially. You'll need to pay off whatever the buyer doesn't cover on your loan.[7]

- Make it clear that you'll only accept cash or a cashier's check if the payment is coming to you instead of the bank.[8]

Getting the Title to the Buyer

-

1Ask about the lender's procedures for selling a car. When you sell a car that you still owe on, you don't actually own the title. Essentially, the lender will be selling the car. Talk to your lender about the procedures they have in place for getting the title to the buyer quickly.[9]

-

2Have the buyer make the payment to the bank. Because your car is financed, some buyers may get a bit nervous. If they give you the money, you can pay off the car and keep the title, or keep the money and not pay off the car at all, which would mean it would still be under financing. Neither of these options would make the buyer happy, not to mention they're illegal. However, to put them at ease, you can have them make the payment directly to the bank through cash or a check.[10]

-

3Pay any extra still owed on the loan. If you owe more to the lender than the buyer is willing to pay, it's your responsibility to pay off the rest of the loan. You'll need to do this when you're selling the car so the title can be transferred.[11]

-

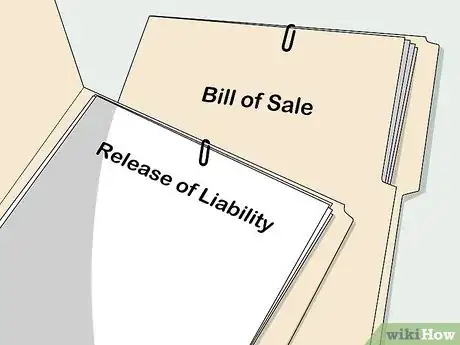

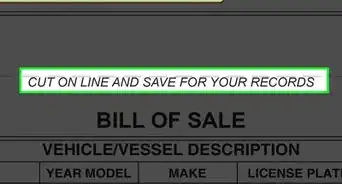

4Have the documents ready. You'll need a bill of sale and a release of liability, which you can usually print off from the website for the department of motor vehicles (DMV). You can also pick them up in person.[12]

- For the bill of sale, you'll need things like the vehicle identification number and the mileage on the odometer.

-

5Meet at one of the lender's locations to make the sale. In most cases, it's best to just make the sale at the bank with the buyer. That way, if you have any questions, the lender is right there to answer them, as well as to provide paperwork and notarize it as needed. Plus, it lends a formality to the sale, and the lender can hand the title over to the buyer.[13]

- Take your license plates off before finishing the sale.

-

6Obtain a temporary operating permit for out-of-state buyers. Obviously, you won't always be able to meet the buyer to sell your car. In that case, you'll need to take the bill of sale to your local DMV. They can issue the buyer a temporary operating permit until the title comes in.[14]

- Once you complete the sale and get the title, you can then transfer it to the buyer by signing it and mailing it.

Finishing the Sale

-

1File the release of liability. After the sale has gone through, you'll need to file the release of liability with the department of motor vehicles. Generally, you can mail or walk the form in.[15]

- This form releases you from future liability, meaning that if the buyer commits a crime in the car, you're not responsible.

-

2Pay the transfer fees to the DMV. Once you've made the sale, pay any necessary fees to the DMV. You'll need to check with your local DMV to figure out what those fees are.[16]

-

3Cancel your insurance. Once you're done with the sale, call your insurance company to stop your insurance. That way, you won't be paying for coverage that you don't need.[17]

Expert Q&A

-

QuestionCan the dealer sell my financed car for me?

Hovanes MargarianHovanes Margarian is the Founder and the Lead Attorney at The Margarian Law Firm, a boutique automotive litigation law firm in Los Angeles, California. Hovanes specializes in automobile dealer fraud, automobile defects (aka Lemon Law), and consumer class action cases. He holds a BS in Biology from the University of Southern California (USC). Hovanes obtained his Juris Doctor degree from the USC Gould School of Law, where he concentrated his studies in business and corporate law, real estate law, property law, and California civil procedure. Concurrently with attending law school, Hovanes founded a nationwide automobile sales and leasing brokerage which gave him insights into the automotive industry. Hovanes Margarian legal achievements include successful recoveries against almost all automobile manufacturers, major dealerships, and other corporate giants.

Hovanes MargarianHovanes Margarian is the Founder and the Lead Attorney at The Margarian Law Firm, a boutique automotive litigation law firm in Los Angeles, California. Hovanes specializes in automobile dealer fraud, automobile defects (aka Lemon Law), and consumer class action cases. He holds a BS in Biology from the University of Southern California (USC). Hovanes obtained his Juris Doctor degree from the USC Gould School of Law, where he concentrated his studies in business and corporate law, real estate law, property law, and California civil procedure. Concurrently with attending law school, Hovanes founded a nationwide automobile sales and leasing brokerage which gave him insights into the automotive industry. Hovanes Margarian legal achievements include successful recoveries against almost all automobile manufacturers, major dealerships, and other corporate giants.

Attorney Unfortunately, dealers may end up tacking on services and fees that will cost you more money. I suggest you call your loan company directly to figure out your payoff amount.

Unfortunately, dealers may end up tacking on services and fees that will cost you more money. I suggest you call your loan company directly to figure out your payoff amount.

Warnings

- You may end up paying more if you ask the dealer to do your paperwork. It's best to talk to your loan company directly and sell the car yourself.[19]⧼thumbs_response⧽

References

- ↑ Hovanes Margarian. Attorney. Expert Interview. 15 September 2020.

- ↑ https://www.autotrader.com/car-tips/how-to-sell-a-car-if-the-bank-has-the-title-215870

- ↑ https://www.moneyunder30.com/sell-your-car-with-payments-left

- ↑ https://www.edmunds.com/car-buying/being-upside-down.html

- ↑ https://www.kbb.com/sell-your-car/tips-on-how-to-create-a-good-classifieds-car-ad/

- ↑ https://www.edmunds.com/sell-car/sell-your-car-safely.html

- ↑ https://www.autotrader.com/car-tips/how-to-sell-a-car-if-the-bank-has-the-title-215870

- ↑ https://www.moneyunder30.com/sell-your-car-with-payments-left

- ↑ https://www.autotrader.com/car-tips/how-to-sell-a-car-if-the-bank-has-the-title-215870

- ↑ https://www.autotrader.com/car-tips/how-to-sell-a-car-if-the-bank-has-the-title-215870

- ↑ https://www.carsguide.com.au/car-advice/selling-a-car-under-finance-33714

- ↑ https://www.moneyunder30.com/sell-your-car-with-payments-left

- ↑ https://www.autotrader.com/car-tips/how-to-sell-a-car-if-the-bank-has-the-title-215870

- ↑ https://www.moneyunder30.com/sell-your-car-with-payments-left

- ↑ https://www.edmunds.com/sell-car/sell-your-car-safely.html

- ↑ https://www.moneyunder30.com/sell-your-car-with-payments-left

- ↑ https://www.moneyunder30.com/sell-your-car-with-payments-left

- ↑ https://www.autotrader.com/car-shopping/how-do-you-trade-in-a-car-you-havent-paid-off-248831

- ↑ Hovanes Margarian. Attorney. Expert Interview. 15 September 2020.

About This Article

To sell a financed car, start by calling the car company to figure out how much you still owe. Next, use Kelley Blue Book to figure out the market value of your car, and use that price to figure out if you have “negative equity,” meaning that you owe more on the car than it’s worth. If so, you’ll have to pay off the remainder somehow. If possible, try to sell the car for enough to pay off the rest of the loan. Then, in the listing, include high-quality photos, along with all the information you have about the car. To learn how to vet potential buyers, keep reading!