This article was co-authored by wikiHow Staff. Our trained team of editors and researchers validate articles for accuracy and comprehensiveness. wikiHow's Content Management Team carefully monitors the work from our editorial staff to ensure that each article is backed by trusted research and meets our high quality standards.

There are 7 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 276,230 times.

Learn more...

Sending money from India to any other country, known as an outward remittance, involves a high amount of government restrictions, and tight control of foreign exchange.[1] However, it can be accomplished once you know what the Indian government deems acceptable. You will need to choose a method of remittance, and make sure that your transaction meets any regulations it is subject to.

Steps

Choosing a Method of Remittance

-

1Visit a bank.[2] [3] Many banks will allow you to visit a branch and fill out an application to remit money abroad. You may be limited in the methods of remittance you can use with this method. For instance, you may only be able to apply for a wire transfer or Foreign Currency Demand Draft (FCDD). You may also be required to be an account holder at the particular bank. Whether or not you are an account holder, be prepared to:

- Show identification, such as a passport

- Give information on the recipient of your funds, including an account number to transfer the money to

- Show proof of the purpose of your remittance, such as an invoice

- Choose an account (checking, savings, etc.) to transfer your funds from

-

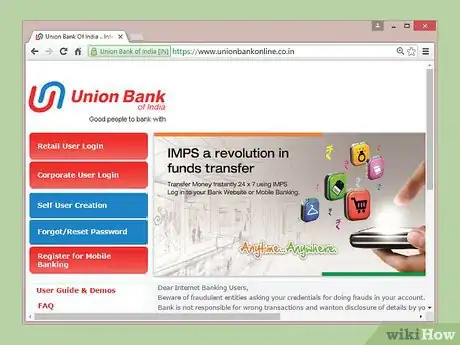

2Use an online banking service.[4] [5] If your bank offers online banking services, you may be able to remit money online. Log in to your bank’s online service, and look for a “transfer” or “remittance” option. You will need to give information on the recipient of your funds (including an account number to transfer the money to), and you may need to show prof of the purpose of your remittance, such as an invoice.Advertisement

-

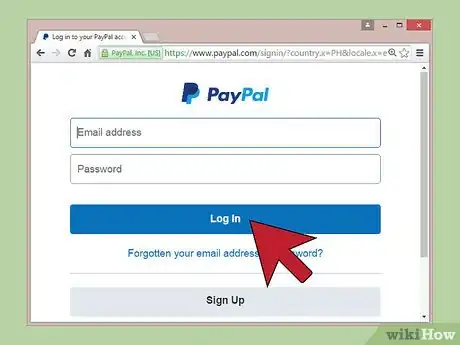

3Use a third-party transfer service. These include Money2World, PayPal, or Book My Forex, and services offered by some banks to non-account holders.[6] [7] [8] These are subject to a limit of $25,000 USD per month per transaction.

- If you are not an accountholder at the institution making your outward remittance, you will need to provide proof of identification and residence (such as a passport).

- You will most likely have to complete a one-time registration process, which will record your account number and other personal information. This information will be used to verify the remittance, and any that you would like to make in the future.

- You may also be required to register and verify the recipient of your remittance. This is to protect the security of your fund, to prevent fraud, and to make future remittances more streamlined.

- After you register with a funds transfer service, you will most likely have to wait a short period of time (such as 24 hours) before you can use the service for an outward remittance.

-

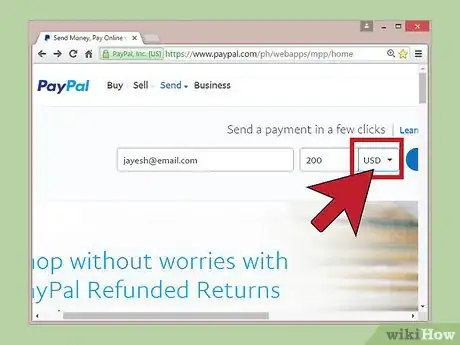

4Send a remittance in an international currency such as US dollars (USD) or Euro. Outward remittances sent in rupees are subject to more restrictions than those sent in foreign currencies. You can arrange to have money sent from India in a foreign currency, such as USD or Euro, as long as you have access to this money via a checking or other account. These foreign funds can then be sent in a variety of ways, including wire transfers and checks.

- Be prepared to provide proof of the purpose of your remittance, such as an invoice.

- You can purchase foreign currency from many banks as well as private currency exchanges.

- You can also remit money in a foreign currency using an FCDD (available through many banks and financial institutions), although this will be converted from rupees, and therefore subject to the restrictions imposed by the Indian government.

- You must know each remittance transfer provider is offering an own exchange rate. It means the exchange rate of Western Union is different from the real mid-market rate. You could use a price comparison portal to find out about the hidden fees.

Sending Funds

-

1Make sure that the funds will be used for an acceptable purpose. Outward remittances are typically restricted to certain purposes. You must also provide proof of the purpose, such as an invoice, bill, or debit note. The invoice or other document must be in the same name as the account requesting the remittance. You may send money from India when it will be used abroad for one of the following[9]

- Education expenses

- Emigration fees

- Employment

- Care for a close relative

- Medical treatments

- Visa fees

- Police verification

- Visits abroad for private purposes

-

2Keep your outward remittances within acceptable limits. Most funds transfer services have limits on the amount on money that can be sent from India. For most purposes (called “Small Value Remittances”) the limit is $25,000 USD per financial year.[10]

- One exception is the Liberalized Remittance Scheme, which allows Indian residents to send up to $125,000 USD per financial year for purchasing shares or debt investments in a company abroad.

- You can remit up to $100,000 for medical expenses, and more if a doctor estimates a cost above this.

- You may send $100,000 per financial year for medical, educational, employment, familial, or emigration expenses if you are an Indian resident. Corporations are not eligible for this program.

- Accounts held by non-residents are not subjected to these limits.

-

3Choose how the funds will be distributed. Typically, there is more than one way to send funds to a beneficiary via an outward remittance. Fees for the remittance will vary based on the type of service you use, and the amount of money you remit. Common ones include:[11] [12]

- Wire transfer. This method sends funds from one account to another quickly and electronically, in the amount you specify in your currency. The fees for this service may be relatively higher, but it is the best choice when you want to send a specific amount in your currency.

- A Foreign Currency Demand Draft (FCDD) sends a specific amount in a foreign currency, and withdraws the equivalent amount from your account in your currency. Funds may be delivered as soon as the next business day. Common foreign currencies used are US Dollars and Euro; however, your bank may offer FCDD's in numerous others.[13] FCDD's typically have lower fees than wire transfers, and are the best choice when you need to send a specific amount in a foreign currency.

-

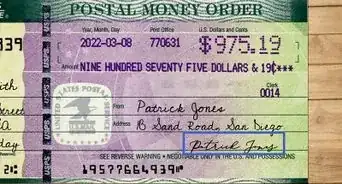

4Have the funds debited from your account. If you are an accountholder at the bank or service making your outward remittance, then the funds will be withdrawn from the account you have specified. If you are a non-accountholder, you will need to make a payment by check, draft, or cash deposit for the funds that you want to remit.[14]

Community Q&A

-

QuestionHow do I send a large amount of money from India to China?

Community AnswerThe best way to send large amount of money is through Telegraphic Transfer (T.T). The process may take up to two weeks but can be initiated through any bank.

Community AnswerThe best way to send large amount of money is through Telegraphic Transfer (T.T). The process may take up to two weeks but can be initiated through any bank. -

QuestionHow do I send money from India to Albania?

Avinash KCommunity AnswerIts very tough to get the best exchange rate for all currency so it's always best option to send money in the form of USD to Albania. To transfer money you can contact Local banks, Online money exchange agents like Fxkart or BMF or local dealers.

Avinash KCommunity AnswerIts very tough to get the best exchange rate for all currency so it's always best option to send money in the form of USD to Albania. To transfer money you can contact Local banks, Online money exchange agents like Fxkart or BMF or local dealers. -

QuestionDo I have to have a bank account in order to receive money from India?

Community AnswerIf you want to receive money from India, then yes, you need a bank account for remittance.

Community AnswerIf you want to receive money from India, then yes, you need a bank account for remittance.

References

- ↑ https://rbi.org.in/scripts/FS_Overview.aspx?fn=5

- ↑ http://www.icicibank.com/Personal-Banking/faq/detail.page?identifier=prod-outward-remittance-20131212173002343

- ↑ http://www.hsbc.co.in/1/2/personal/nri-services/outward-money-transfers

- ↑ http://www.icicibank.com/Personal-Banking/faq/detail.page?identifier=prod-outward-remittance-20131212173002343

- ↑ http://www.hsbc.co.in/1/2/personal/nri-services/outward-money-transfers

- ↑ http://www.icicibank.com/Personal-Banking/onlineservice/online-services/FundsTransfer/outward-remittance/online-transfer/index.page?

- ↑ https://www.paypal.com/in/home

- ↑ http://www.icicibank.com/Personal-Banking/faq/detail.page?identifier=prod-outward-remittance-20131212173002343

- ↑ http://www.icicibank.com/Personal-Banking/faq/detail.page?identifier=prod-outward-remittance-20131212173002343

- ↑ http://www.icicibank.com/Personal-Banking/faq/detail.page?identifier=prod-outward-remittance-20131212173002343

- ↑ http://www.icicibank.com/Personal-Banking/faq/detail.page?identifier=prod-outward-remittance-20131212173002343

- ↑ http://www.thomascook.in/tcportal/Foreign-Exchange/Remittance

- ↑ http://www.dbs.com/in/personal/deposits/pay-with-ease/remittance

- ↑ http://www.icicibank.com/Personal-Banking/faq/detail.page?identifier=prod-outward-remittance-20131212173002343

About This Article

To send money from India, try using a third-party transfer service, like Money2World, PayPal, or Book My Forex, which allow you to send up to $25,000 USD per month per transaction. You can also visit your bank and fill out an application to send money abroad, or you can use your bank's online transfer service if it offers one. Keep in mind that you may want to send your money in a foreign currency instead of in rupees since rupees are subject to more restrictions. To learn how to provide proof of the purpose for your money transfer, scroll down!