This article was co-authored by wikiHow Staff. Our trained team of editors and researchers validate articles for accuracy and comprehensiveness. wikiHow's Content Management Team carefully monitors the work from our editorial staff to ensure that each article is backed by trusted research and meets our high quality standards.

There are 7 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 29,263 times.

Learn more...

Sending money to Mexico is easier than ever before. There are several money transfer companies active in the Mexican market, with thousands of locations blanketing the county. However, even with all of the choices in companies available, there are still only a few ways for the recipient to safely receive the money. Unless you want to send an envelope full of cash through the postal mail (and you don’t), you’re going to be paying the money transfer company to allow the recipient to either pick cash up locally, or have the money deposited in their bank accounts.

Steps

Sending Money Person to Person

-

1Ask the recipient how soon they’ll need it. Some types of transfers will take longer than other types of transfers. Make sure the person you’re sending the money to doesn’t need it sooner than your chosen method of transfer will allow.[1]

- All of the money transfer services offer quick transfers if your payment is made with a debit or credit card. If you use a bank account, the transfer will take between three and four business days.

-

2Drop off cash in person. If you send cash, you’ll have to find a physical Western Union or Moneygram location. If you’re in a town of even modest size, this shouldn’t be a problem. There are literally thousands of locations for each across the US and in Mexico. However, Western Union’s fees are two dollars lower than Moneygram’s ($8.00 compared to $10.00).[2]Advertisement

-

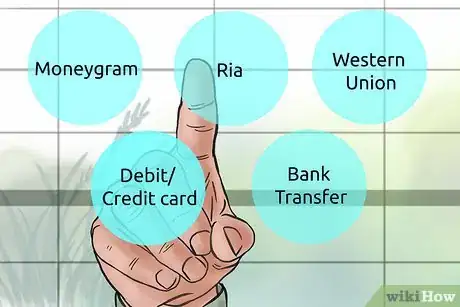

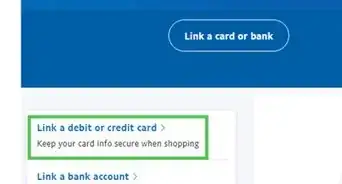

3Make a transfer using a credit or debit card. You can send money using credit or debit cards through numerous services. Even many online money transfer companies have cash pickup locations in Mexico. Western Union, Moneygram, Ria, Remitly, and Sharemoney all have cash pickup locations in Mexico, so price is the deciding factor. Remitly, Ria, and Sharemoney all have fees of about $4.00 to send $1000 with a debit card. The fees to send the money with a credit card are substantially higher--$33.00 with Sharemoney and $35.00 with Ria. Remitly doesn’t take credit cards. Western Union and Moneygram, on the other hand charge a $15.00 fee for both credit and debit.

-

4Complete a bank to bank transfer. Sending money via a bank withdrawal is always the cheapest way to send money—companies rarely charge more than $4.00, and most charge a little less.[3]

- Take note, however: although bank to bank transfers are the cheapest way to transfer money, they also take longer than others.

-

5Choose a service. Choose a service based on the fees and its convenience and proximity to yourself and the recipient.

- If you’re unfamiliar with the location where the money will be sent, make sure to ask the recipient if the surrounding area is safe. Just because it’s close by doesn’t mean it’s the best.

- Moneygram, Western Union, and Ria all offer a home delivery service. Naturally, it takes longer to have the cash delivered than it does to pick up, but a credit, cash, or debit transfer will still usually arrive the same day.[4] [5] [6]

-

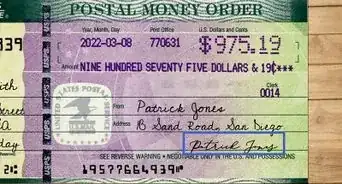

6Complete the transaction. In order to complete the transaction, you’ll need to have the recipient’s first and last name as it appears on their driver’s license or ID, their email or telephone number, and their address. Be sure to take down the transaction number. You’ll need to give it to the recipient so they can complete the pickup.[7]

- In order to pick the money up, the recipient must show their ID and know the transaction number for the transfer.

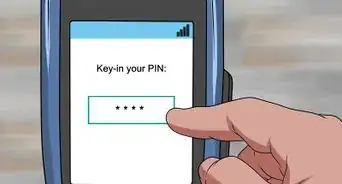

- You will also be required to set up an account with the transfer company if you send money online. If you plan on sending money with your bank account, you will have to enter your account information and verify the account.

Sending Money to a Bank Account

-

1Gather your account or card information. If you choose to have money deposited directly into the recipient’s bank account, you may send the remittance online or in person. In order to do so, you’ll need your credit card, debit card, or the name and address of your bank, along with your bank account number and routing number.[8]

- If you wish, you can also go to a physical Western Union or Moneygram location, pay cash, and have it deposited into the recipient’s account.

-

2Gather the recipient’s account information. Any international monetary transfer requires certain information from the recipient. In order to send money via a bank to bank transfer, you’ll need the recipient’s account information, including their full name, account number, routing number, and the name and address of their bank.[9]

-

3Choose a service. Pick a service to use based on location, speed, and price. Deposits into a bank account always take longer than cash pickups, but making the deposit using a debit or credit card is quicker than doing a bank-to-bank transfer (one business day vs. five business days).[10]

- If you’re sending more than $500, Western Union’s transfers into bank accounts are free. If you are sending less than that, the charge is anywhere from $1.00-$7.00, depending on the amount and form of payment. Remitly never charges for a transfer from your bank account into the recipient’s bank account (no matter the amount), but charges a flat fee of $3.99 for using a debit card. All of the other services charge anywhere from $3.00-$104 depending on the amount sent and the method of payment, with Ria’s fees for credit card payments being the highest.

-

4Complete the transfer. Once you’ve picked a service, register for an online account. If you are doing a bank-to-bank transfer, you’ll need to verify your account. The verification process usually involves the company making a small deposit into your account and you confirming the amounts of the deposits. Once you've verified your account, all you need to do is give final approval to the transfer.

Community Q&A

-

QuestionIf I send personal check from U.S. to Mexico, how long before recipient gets the cash?

EricTop AnswererSending a check from the United States in US currency will need to be processed by a Mexican bank and sent for collection and currency conversion through a US bank or correspondent. This process may take several weeks or longer before the recipient receives the funds. If you need to send funds more quickly, consider sending the funds electronically, such as via a wire transfer.

EricTop AnswererSending a check from the United States in US currency will need to be processed by a Mexican bank and sent for collection and currency conversion through a US bank or correspondent. This process may take several weeks or longer before the recipient receives the funds. If you need to send funds more quickly, consider sending the funds electronically, such as via a wire transfer. -

QuestionHow to use PayPal to send money to person in Mexico with an e-mail address?

Community AnswerYou need to enter the PayPal website, create an account for yourself (or log in to an existing account) and connect your account with a payment method. Then, you can enter the e-mail address of the recipient and select the amount of money you want to send.

Community AnswerYou need to enter the PayPal website, create an account for yourself (or log in to an existing account) and connect your account with a payment method. Then, you can enter the e-mail address of the recipient and select the amount of money you want to send.

References

- ↑ http://www.moneygram.com/us/en/faq

- ↑ https://www.westernunion.com/us/en/send-money/start.html

- ↑ https://www.westernunion.com/us/en/send-money/start.html

- ↑ http://www.moneygram.com/us/en/faq

- ↑ https://www.riamoneytransfer.com/help/faq

- ↑ https://www.westernunion.com/us/en/send-money-online.html

- ↑ https://www.westernunion.com/us/en/send-money-online.html

- ↑ https://www.westernunion.com/us/en/send-money-online.html

- ↑ https://www.westernunion.com/us/en/send-money-online.html

About This Article

The fastest way to send money to someone in Mexico is by using a money transfer service and making your payment with a debit or credit card. The recipient will usually be able to pick up the cash on the very same day. The company will charge a fee for the service, which you'll pay on top of the amount you're sending to the recipient. The fees vary from company to company, so be sure to shop around! To learn more about what recipient information you need to provide, read on!