This article was co-authored by wikiHow Staff. Our trained team of editors and researchers validate articles for accuracy and comprehensiveness. wikiHow's Content Management Team carefully monitors the work from our editorial staff to ensure that each article is backed by trusted research and meets our high quality standards.

This article has been viewed 43,176 times.

Learn more...

A sole proprietorship is the simplest business form to register in Tennessee. If you want, you can just start working under your legal name and use your Social Security Number as your tax ID. However, you might want to use a business trade name or hire employees. In these situations, you’ll need to set up a sole proprietorship. If you’re in Tennessee and looking to get ahead in your career, you’re in the right place.

Steps

Choosing Your Business Name

-

1Decide if you want a trade name. Tennessee generally expects sole proprietors to operate under their legal name. For example, Mary Smith will advertise her services as “Mary Smith, Hairdresser.” However, you might be able to use a trade name, also called a fictitious name. You’ll need to talk to your county clerk about this option.

- A trade name can help you stand out in the market, but weigh the benefits of a trade name against the hassle of getting one.

-

2Pick a memorable trade name. If you want a trade name, pick something consumers will remember. The name should reflect your brand—the values and experiences you create for your consumers.

- For example, “Smith Hairdressing” is boring. It doesn’t convey anything about your service.

- However, “Better Braids” tells consumers that you specialize in braiding hair, and that you’re good at it!

Advertisement -

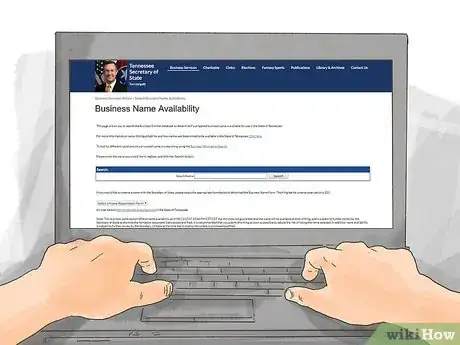

3Check that your trade name is available. You shouldn’t use a trade name if another business is using it in Tennessee. You should search the business name database at the Secretary of State’s website: https://tnbear.tn.gov/Ecommerce/NameAvailability.aspx.

- Also check whether someone has registered the name as a trademark. Search the federal trademark database at https://www.uspto.gov/trademarks-application-process/search-trademark-database.

-

4Talk to your county clerk. Stop in and talk about whether you can get a fictitious business name for your sole proprietorship. The county clerk can tell you what your options are.

Completing Legal Requirements

-

1Obtain a county business license. Contact the county clerk for the county where your principal place of business is located. The license should cost around $15.

-

2Get other required licenses or permits. Depending on your business, you might need licenses or permits before you can start operating. Many professions do—barbers, plumbers, funeral directors, accountants, surveyors, etc. Ask your county clerk about what licenses or permits are required. Also check with the Department of Commerce and Insurance.

- If you need help identifying licensing requirements, you should consult with an attorney.

-

3Obtain an Employer Identification Number (EIN). You can use your Social Security Number as your business tax ID. However, if you want to hire employees, then you’ll need an EIN. Many banks also require an EIN, so you should get one even if you don’t hire anyone.

- You can get your EIN online at https://www.irs.gov/businesses/small-businesses-self-employed/apply-for-an-employer-identification-number-ein-online.

-

4Register to pay taxes. If you sell goods or services to the public, you’ll need to collect sales tax. Register with the Tennessee Department of Revenue to pay taxes. You’ll need to create an account.

-

5Hire employees legally. You must contact multiple state agencies soon after hiring your first employee. Begin by reporting new hires to the New Hire Reporting Program. You must report a new employee within 20 days of their hiring date. Register for the program at https://newhire-reporting.com/TN-Newhire/default.aspx.

- If you have five or more employees, you’ll need worker’s compensation insurance. Contact your insurance agent about getting acceptable coverage.

- Complete Form LB-0441 to check whether you must pay unemployment insurance.[1]

- You should register and use E-Verify to confirm your employees are legally eligible to work in the U.S.

Taking Next Steps

-

1Open a bank account. Shop around first to find a bank that offers the best deals for small businesses. Some offer discounted fees, lines of credit, or business credit cards.

- Keep your business and personal banking separate so that it’s easier to track your business expenses.[2]

-

2Buy insurance. Sole proprietors are personally responsible for all business debts and obligations. For example, if your business injures a customer, they can sue you. If they win, they can come after your personal assets, such as your car or your home. For these reasons, you’ll want general liability insurance.[3]

- Don’t expect your homeowners insurance to cover business accidents. It typically doesn’t.

- You can buy insurance by contacting an insurance agent and discussing your needs.

-

3Find office space. If you want to run a business from your home, check that your neighborhood zoning allows it. Stop into your zoning office and ask.

- You can find commercial real estate at websites such Loopnet.com or by contacting a realtor who specializes in commercial properties. Most commercial rents are calculated by square footage or as a percentage of your gross sales.[4]

-

4Write a business plan. A business plan identifies where your business is headed over the next three years and how you intend to get there. You should draft a business plan if you want financing, since lenders will want to see it. However, it’s also a good exercise even if you don’t need funding. A solid business plan should have the following:[5]

- Business description. Explain the purpose of your business. For example, you might want to provide hair braiding services to people in Memphis.

- Market analysis. You should identify your typical consumer in terms of age, gender, income, location, education, etc. Also discuss your industry. Is it well-established? Is it growing?

- Competitive assessment. Point out your major competitors and analyze their strengths and weaknesses.

- Marketing plan. Discuss your products or services in greater detail. Identify what promotional efforts you will use, such as social media, paid advertising, etc. Also discuss your pricing strategy and how your prices will be attractive to your targeted consumer.

- Operations and management. Provide background information on anyone who will help you run the business: education, business experience, etc. If you sell products, identify who will manufacture them.

- Financial plan. Create financial projections for the next few years, and estimate your income, cash flow, and balance sheet. If you need funding, identify the amount and explain what you will spend it on.

-

5Hire professional help, if necessary. As your business grows, you might need help keeping everything straight. Consider hiring the following professionals:

- Business attorney. A business attorney can help you sue someone or defend you in a lawsuit. They can also help you negotiate favorable contracts. Get a referral to a business attorney by visiting the Tennessee Bar Association at https://www.tba.org/index.cfm?pg=find-an-attorney.

- Bookkeeper. You might use software at first to record your daily business transactions. However, as your business grows, you might want to outsource this task.

- Accountant. An accountant can file your tax returns, but they can do a lot more. An accountant might also help draft your business plan, identify sources of funding, or think strategically about how to grow your business.

Community Q&A

-

QuestionI am an author who hopes to sell books through Amazon. Do I still have to file quarterly sales tax reports in Tennessee?

Community AnswerYou don't. Amazon is collecting the sales tax and sending it to the government. All you are getting from Amazon is royalties.

Community AnswerYou don't. Amazon is collecting the sales tax and sending it to the government. All you are getting from Amazon is royalties.

References

- ↑ https://www.tn.gov/workforce/employers/tax-and-insurance-redirect/unemployment-insurance-tax.html

- ↑ http://www.nolo.com/legal-encyclopedia/how-establish-sole-proprietorship-tennessee.html

- ↑ http://www.nolo.com/legal-encyclopedia/how-establish-sole-proprietorship-tennessee.html

- ↑ http://smallbusiness.findlaw.com/business-operations/negotiating-a-lease-for-commercial-real-estate.html

- ↑ https://www.extension.purdue.edu/extmedia/ec/ec-735.pdf