This article was co-authored by Carla Toebe and by wikiHow staff writer, Jennifer Mueller, JD. Carla Toebe is a licensed Real Estate Broker in Richland, Washington. She has been an active real estate broker since 2005, and founded the real estate agency CT Realty LLC in 2013. She graduated from Washington State University with a BA in Business Administration and Management Information Systems.

There are 8 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 9,551 times.

If you're a homeowner, you can build equity in your home by making mortgage payments over time. There are three basic methods that allow you to use the equity in your home to cover bills or other expenses. Taking out a second mortgage is the most restrictive, while a home equity line of credit is generally the most flexible. You also have the option of refinancing your home for more money than you owe on the original mortgage and taking the difference in cash.[1]

Steps

Assessing Your Equity and Finances

-

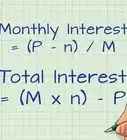

1Evaluate your budget. When you take out a second mortgage, you'll be making an additional monthly payment for the term of that loan. Total your income and other bills to figure out how much of a payment you can handle.[2]

- You can take out a second mortgage with a term as long as 20 years or as short as one year. Generally, the shorter the term, the higher your monthly payment will be. Choosing a shorter term can free up your home equity faster.

- Take future earnings into account, especially if you're contemplating a longer-term loan. For example, you may be able to afford an additional $500 monthly payment now, but you might have problems if you retire before the end of the loan's term.

-

2Check your credit score. Your credit score is a major determining factor in the rate lenders will offer for a second mortgage. Typically you won't be able to get a second mortgage unless you have a credit score over 700. With an excellent credit score of 760 or higher, you'll qualify for the best rates.[3]

- You can get one free credit report a year from annualcreditreport.com. This is the only site approved by the federal government for you to get the free credit report you are entitled to under law.

- You also may want to sign up with a free service such as Credit Karma or Credit Sesame, so you can continually check your credit score during the application process for your home equity loan. Some credit card companies also offer free credit monitoring services.

Advertisement -

3Check your debt-to-income ratio. Before approving you for a home equity loan, lenders evaluate how much of your monthly income is absorbed by other debt. If your debts are a low percentage of your income, you'll typically be able to get better rates.

- Most lenders have a cut-off debt-to-income ratio of 45 percent. If your debts constitute more than 45 percent of your income, you will have a much harder time finding a lender to approve you for a home equity loan.

-

4Get your home appraised. An appraisal tells you how much your home is worth on the open market. The difference between the appraisal amount and the amount you owe on your first mortgage is your home equity. If you haven't had your home appraised within the last year or so, get a fresh appraisal so you have up-to-date information.[4]

- You typically won't be able to get a home equity loan for all of the equity you have in your home. Most lenders will lend up to 80 or 90 percent of your equity.

- Other factors may affect the value of your home and the equity you have in it, such as general real estate market conditions or demand for homes in your neighborhood.

-

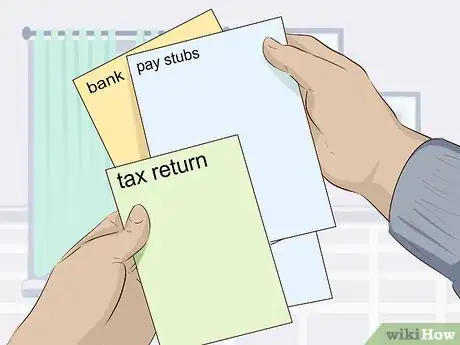

5Gather documents for the application process. The process of applying for a second mortgage is roughly the same as the process you went through when you got your first mortgage. You'll need similar documents and information, including pay stubs, tax returns, and bank or financial statements.[5]

- Check with several lenders to find out what documents are typically needed. There may be a list on lenders' websites.

- Some documents, such as copies of tax returns or tax transcripts, may take a little longer to get. Request those as soon as possible to prevent any delays.

Choosing a Loan Type

-

1Get a second mortgage if you need a lump sum at once. When you take out a second mortgage (also referred to as a home equity loan), the money you borrow is secured by the equity in your home. Your original mortgage remains intact, and you'll have an additional monthly payment for the second mortgage.[6]

- The lender of your first mortgage has priority over the lender of your second mortgage. If you sell your house, the first mortgage will be paid first, and anything left over will go towards your second mortgage.

- Be wary of taking out a second mortgage for loan consolidation. You aren't really paying off those debts. Rather, you're borrowing more money. If your financial situation doesn't change or you get into more debt, you could lose your home.

-

2Choose a home equity line of credit (HELOC) if you need continual access to funds. A HELOC operates similar to a credit card. You're offered a line of credit based on your credit score and the equity in your home, but you only pay interest on the funds you actually use.[7]

- A HELOC may work best for you if you anticipate needing varying amounts of money over time, or if you aren't sure whether you'll need the total amount you could get from a home-equity loan. For example, if you're starting a business and can't be confident of your income, a HELOC may help with start-up and operational costs in the first few years.

-

3Try a cash-out refinance if your credit has improved. If you qualify for a better rate than you did when you initially applied for your mortgage, cash-out refinancing may be your best option. With a lower rate, you may end up with a lower monthly payment even if the actual loan amount is larger.[8]

- Using cash-out money to pay off other debts can increase your monthly cash flow and improve your credit score – provided you don't take on additional debt after you pay everything off.

- Since you're refinancing your original mortgage, you'll still only have a single monthly mortgage payment, so you won't be adding a new bill.

Applying for a Loan

-

1Shop around for a lender. You don't have to use the same lender for your second mortgage that you used for your first mortgage. Rates and fees for second mortgages typically are higher than those for your first mortgage, because the lender is taking on more risk. Compare the different Annual Percentage Rates (instead of Interest Rates) that different lenders offer to find the best rates you can.[9]

- You typically won't know the exact rate you'll be offered until you apply. However, some lenders may pre-approve you for a rate based on some basic information. Pre-approvals typically aren't guaranteed, but they can help you narrow down your choices.

- If you're getting a second mortgage, you can expect to pay closing costs and other fees similar to those you paid on your first mortgage. With a HELOC, on the other hand, you typically won't have to pay closing costs.

- Start your search with banks where you already have accounts. Sometimes you can get a better deal if you have a pre-existing relationship with the lender.

-

2Complete a lender application. Once you've found the lender you want to use, they'll provide an initial application to start the loan process. If your loan is accepted, you'll have to provide additional information and documentation, such as financial statements and a copy of your appraisal.[10]

- You may be able to complete an application online or over the phone. In addition to the application, the lender will request full personal documentation, including two years of residency history, two years of employment history, two months of bank and financial statements, and documentation of life events such as marriages or divorces.

-

3Discuss payment options with your lender. Depending on the type of loan you requested, you'll typically have fees and closing costs on top of the total loan amount. You may have to pay these fees up front when you close on the loan. It also may be possible to have these costs added to the balance of your loan.[11]

- If you add fees and closing costs to your balance with a HELOC, you'll have to make your first payment within 30 days of closing, even if you don't use any of your HELOC funds during that time.

-

4Receive your funds. If you're approved for a home equity loan (either a cash-out refinance or a second mortgage), you'll get a check from the lender for the total amount of the loan. HELOC lenders typically open a line of credit for you that operates much like a credit card account.[12]

- With a HELOC, you have access to the total amount, but you will only make payments on the amount you actually use. For example, if you got a HELOC for $100,000 and only used $10,000, you would only make monthly payments on that $10,000.

- HELOC lenders typically provide you a debit card tied to your line of credit. If you have another account at the same bank, you may also be able to transfer funds between accounts.

References

- ↑ https://www.investopedia.com/articles/personal-finance/070815/how-use-your-home-equity-cash.asp

- ↑ https://www.mortgagecalculator.org/helpful-advice/second-mortgage.php

- ↑ https://www.wellsfargo.com/equity/before-you-apply/

- ↑ https://www.wellsfargo.com/equity/before-you-apply/

- ↑ https://www.realtor.com/advice/finance/how-to-get-a-second-mortgage/

- ↑ https://www.consumerfinance.gov/ask-cfpb/what-is-a-second-mortgage-loan-or-junior-lien-en-105/

- ↑ http://blog.credit.com/2017/10/5-things-to-know-about-home-equity-loans-76738/

- ↑ https://www.investopedia.com/articles/personal-finance/070815/how-use-your-home-equity-cash.asp

- ↑ https://www.realtor.com/advice/finance/how-to-get-a-second-mortgage/

-Step-18.webp)