This article was co-authored by Cassandra Lenfert, CPA, CFP®. Cassandra Lenfert is a Certified Public Accountant (CPA) and a Certified Financial Planner (CFP) in Colorado. She advises clients nationwide through her tax firm, Cassandra Lenfert, CPA, LLC. With over 15 years of tax, accounting, and personal finance experience, Cassandra specializes in working with individuals and small businesses on proactive tax planning to help them keep more money to reach their goals. She received her BA in Accounting from the University of Southern Indiana in 2006.

There are 7 references cited in this article, which can be found at the bottom of the page.

wikiHow marks an article as reader-approved once it receives enough positive feedback. In this case, 82% of readers who voted found the article helpful, earning it our reader-approved status.

This article has been viewed 85,149 times.

Money is a major worry for many people. It can be easy to overspend and be left with buyer's remorse. If you want to more wisely manage your money, it starts with a budget. Figure how much you can reasonably spend each month. From there, work on making wise spending choices. Spend your money on what you truly need and enjoy. Lastly, work on ways to cut down on spending. Small tweaks to your routine, like eating at home more, can result in you saving a lot over the course of a month.

Steps

Developing Wise Spending Habits

-

1Spend on experience over physical goods. When it comes to spending your money wisely, it may be a good idea to spend on experiences over objects. Instead of buying an expensive new blu-ray player for the living room, consider taking a weekend trip to a nearby city and seeing the town.[1]

- Experiences tend to stay with you. They will take on new meaning with time, and provide happy memories you can treasure. A physical object may lose some of the newness with time, especially an object like food or drink that will be gone. The pleasure of an experience, however, tends to last longer.

- You may want to save for bigger experiences instead of spending extra income on goods one month. For example, sacrifice your monthly dinner with your wife for a few months. Put the money you're saving towards a family vacation.

-

2Savor small pleasures. When making purchases, you can sacrifice some luxury for smaller pleasures. People tend to think if they spend more on a purchase or experience it will somehow be better or more enjoyable. This is actually not the case. People tend to enjoy small, inexpensive luxuries more than large, pricey treats.[2]

- Instead of getting front row tickets for a baseball game, opt for seats in back and go twice. You'll get two outings for the price of one, and will probably have a better time without the pressure. If you spent a lot on something, you may feel obligated to enjoy it, creating stress if anything inadvertently goes wrong.

- When it comes to food, consider spending less when eating out. Make a meal out of appetizers instead of ordering a main course. You'll enjoy the small treat just as much, if not more, than a major indulgence, and you'll save some money in the process.

Advertisement -

3Hold off on big expenses. If you're planning a certain purchase, wait on it. Studies show people tend to be happier when anticipating an event than when the event is occurring, so you'll get more happiness from your money by waiting a bit. Also, if you wait, you'll make wiser choices in the present. If you know you'll be treating yourself soon, you're more likely to cut back on spending in the present in anticipation. If you know you're taking your wife to a very expensive restaurant for your anniversary next month, you'll likely spend less on groceries in the present.[3]

- Also, with some purchases, prices may go down if you wait. If you want the latest version of the iPhone, for example, you may find the phone goes down quite a bit a few months after its release.

-

4Have an e-mail folder for coupons. People are often tempted to make purchases simply because certain items are on sale. This results in spending money on products you do not truly want. A good way to combat this is to create a separate e-mail address for coupons and offers from your favorite stores. Prior to a planned shopping trip, browse this e-mail and see if there are any relevant sales prices. This way, you'll go for sales when you planned to shop anyway.

-

5Keep track of how you spend your money. Hold yourself accountable for what you're paying for. You'll find yourself spending less and less when you realize how much of your hard-earned money goes towards frivolous purchases.[4]

- Jot down how much you spent at lunch, and on things like a coffee on the way to the train. Calculate this number at the end of the day. Calculate all your totals for the day at the end of the week.

- You may be surprised at how much money you spend on small, easily avoidable purchases. For example, say you spend $3.00 on coffee 5 days a week on your way to work. That's $15 a week, which results in $60 a month. You can easily cut out this expense by investing in a thermos and taking coffee from home.

Planning and Budgeting

-

1Write down all your expenses. To start making a budget, you'll have to write down all the expenses you have during the course of a month. This includes the obvious, like rent and utilities payments. However, think of the not so obvious things as well. Do you have medical bills? Credit card payments? Insurance payments? Student loans? Take these into account as well.[5]

- You should also consider expenses that aren't necessary, but that you pay for each month. This includes eating out, shopping, entertainment, as well as food in general. You may not know exactly how much you spend each month, but try to get a rough estimate. If you have an online bank account, you may be able to go through your purchases that month and get a more accurate sense of how much you spend on unnecessary expenses.

- There are lots of budget tracking programs available to help you understand where your money is going. For instance, you could use Intuit's mint.com to keep track of your expenses.

-

2Add up all income. Once you have a sense of how much you spend, add up your income. This includes, of course, how much you make in a month. There are also other things to take into consideration. Do you get money from other places each month? Do you have a part time job or do you do any freelance work on the side? Do you receive any benefits? Do you receive money from your family? Write all these sources of income down, and add up the total.[6]

-

3Subtract your non-discretionary expenses from your income. Non-discretionary expenses include mortgage or rent payments, taxes, insurance, utilities, childcare, and groceries. Don't include entertainment expenses or eating out, since these are discretionary expenses. Subtracting non-discretionary expenses from your income will show you how much disposable income you have.[7]

- Your number may be lower than you expect. You may be surprised to find that you do not have a lot of disposable income. Realizing this can help you learn to spend your money more wisely in the future.

- You may realize you end up with a negative number. This is a sign you're spending more than you earn. While this can be startling to realize, take this as an opportunity to take a hard look at your spending habits. Are you accruing credit card debt? Where are you spending most of your money? Do you need a higher paying job? If you're spending more than you earn, you'll have to cut back on expenses or seek work that can pay for your lifestyle.

-

4Decide how to spend your disposable income. If you have some extra money it can be helpful to breakdown how you want to spend it. You can return to your list of monthly expenses and look at the extras. Where is most of your extra money going? Are you happy spending so much extra money on, say, going out on the weekends? Or would you rather put that extra money elsewhere?

- You can give yourself a rough breakdown of how much you will spend on extras each month. You'll have to decide what you really enjoy. If you could stand to miss Friday night happy hour a couple times a month, but love taking your wife out to dinner on Sundays, take this into consideration.

- Let's say you have $500 a month of disposable income. As Sunday dinners are important to you, allocate $150 of this to eating out. This should give you more than enough for a few nice meals, and a bit of extra if you want order pizza on a busy weeknight. You'll have $350 left that you can allocate to different extras and treats throughout the month or save to put toward a larger goal, like a retirement fund or a downpayment on a home.

- Write your budget down and track your expenses during the month, trying not to go over-budget. During the first few months of budgeting, it may be hard to stick to your budget and you may occasionally overspend in some areas. That's okay. Just keep at it, and eventually you'll find it easier to spend within your limits.

-

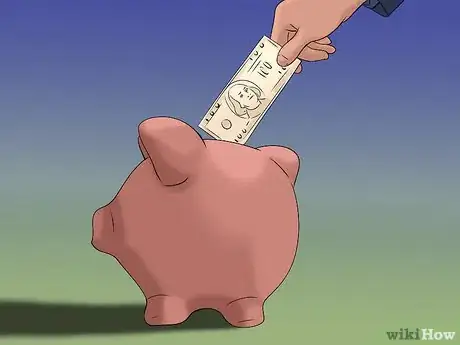

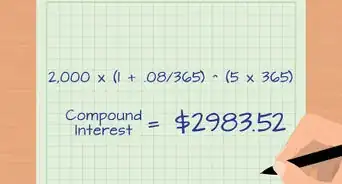

5Consider saving. It's a good idea not to spend all your disposable income in a single month. You may want to transfer some extra money to a savings account. If you do online banking, you may be able to set up automatic transfers. For example, on the 15th of each month $150 from your checking account will go to savings. You may also want to simply write a check at the end of each month, and place extra money in your savings.[8]

Cutting Costs

-

1Downsize your home if you don't use all of the space. Mortgage payments are a huge expense each month. If you have a large home and don't use all the space you have, downsizing to a smaller home can save you quite a bit of money. Consider whether you have seldom-used rooms, whether that may be bedrooms, bathrooms, rec rooms, basement space, etc., and if so, think about moving into a smaller home.

- As a bonus, you'll pay less to heat and cool a smaller space. Plus, it will be easier to clean!

-

2Shop around for your insurance. Insurance for vehicles, properties, and medical expenses can really add up. Take the time to shop around for similar plans from different companies each year. You could save hundreds or even thousands of dollars per year if you take the time to get quotes from various providers and choose the cheapest option.

- Make sure your insurance provider is applying all of the discounts you qualify for!

-

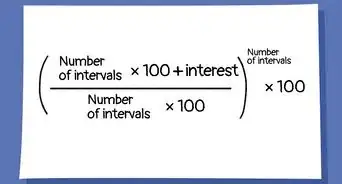

3Consolidate your debt. If you have a lot of debt, consolidating it can save you money. Generally, a consolidation loan has a lower interest rate than many credit cards or other loans. Speak to a financial advisor to see if this option is right for you.

-

4Take advantage of tax deductions and credits. Paying income tax can set you back a pretty penny. Whether you do your own taxes or use a professional tax preparer, make sure that you are getting each and every deduction and credit you qualify for. The tax law often changes from year to year so just because you weren't eligible for something last year doesn't mean that the same is true of this year.

Avoiding Overspending

-

1Eat at home. It can be tempting to order take out at the end of a long day, or buy lunch out during a stressful work week. However, this can get expensive with time. You should work on eating most of your meals at home. Spending $40 to $50 on groceries for the week is much less expensive than spending between $10 and $20 a few days a week eating out.[9]

- Try to plan meals for the week. On Sunday, for example, you can make a big batch of something like soup of casserole. You can eat this for lunch each week, bringing a Tupperware container to the office.

- Plan dinners as well. If you don't like to cook, keep it simple. You can do breakfast for dinner, and make yourself a quick omelet. You can also make an easy, healthy sandwich with whole wheat bread, veggies, and lean proteins.

-

2Buy in bulk. Certain items may be cheaper to buy in bulk. Some warehouse stores specialize in selling certain items in bulk. At the beginning of each month, try stocking up on paper towels or toilet paper. You should also look into purchasing non-perishable foods, like beans and rice, in bulk. [10]

- If you always have basic food staples and kitchen and bathroom supplies on hand, you'll save yourself an extra $5 to $10 making these purchases during your regular shopping trip.

-

3Watch out for ATM fees. Many ATMs have a fee or surcharge when you withdraw money. While this is usually only $3 to $5, it can add up if you're using the ATM a lot. Try to find ATMs associated with your bank, which you can usually do with the assistance of a smartphone. You can also get cash back at the register when checking out at many locations, allowing you to avoid ATMs altogether.

-

4Do not shop for fun. Oftentimes, people go shopping out of boredom. You may have a few hours to kill in the afternoon, so you head to your favorite store to browse outfits. Shopping for fun is a temptation it's better to avoid, however, as you'll end up spending on things you do not really need or want. A new shirt may seem like a worthy investment in the moment, but be honest with yourself. Do you really need another shirt? Is this really worth the extra $20?[11]

- If recreational shopping is something you really enjoy, there are ways to fit it into a healthy budget. You could agree to shop recreationally once a month, and make sure you do not go over your clothing budget for that month. This way, you'll get to do something you enjoy without ruining your budget.

-

5Avoid specialized products. Specialized products are probably best avoided. While it may be convenient to have an ice cream scooper, can't you save $10 and just use a spoon? You don't need to buy a special tool to peel an orange when you can just use your hands. These are the kinds of items it can be fun to get as a gift, but are probably unnecessary to buy for yourself.[12]

-

6Stick to a shopping list at the grocery store. A list is a great way to cut down on spending at a grocery store. If you shop with a list, and do not deviate, you'll be far less likely to make impulse buys. Each time you go grocery shopping, write down a list on a piece of paper or on your phone. Do not purchase items that deviate from this list.

References

- ↑ http://www.spring.org.uk/2011/11/buy-more-experiences-and-less-stuff.php

- ↑ http://www.spring.org.uk/2011/10/why-many-small-pleasures-beat-fewer-larger-ones.php

- ↑ http://www.spring.org.uk/2011/11/how-to-get-more-pleasure-from-your-money.php

- ↑ https://theuniversityblog.co.uk/2008/08/01/use-your-cash-wisely-10-major-money-tips/

- ↑ http://www.consumer-action.org/modules/articles/manage_your_money_en

- ↑ http://www.consumer-action.org/modules/articles/manage_your_money_en

- ↑ http://www.consumer-action.org/modules/articles/manage_your_money_en

- ↑ http://www.consumer-action.org/modules/articles/manage_your_money_en

- ↑ http://www.consumer-action.org/modules/articles/manage_your_money_en

-Step-3.webp)