This article was co-authored by Michael R. Lewis. Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

wikiHow marks an article as reader-approved once it receives enough positive feedback. In this case, 82% of readers who voted found the article helpful, earning it our reader-approved status.

This article has been viewed 184,039 times.

US Savings bonds from the Department of the Treasury are a low-risk investment you can purchase for yourself or as a gift. The interest earned is exempt from state and local income taxes, though you must pay federal taxes on savings bonds. You can buy US Savings bonds either online at the Treasury Department’s website or by using your tax refund for paper gift bonds.

Steps

Determining the Type of Bonds to Buy

-

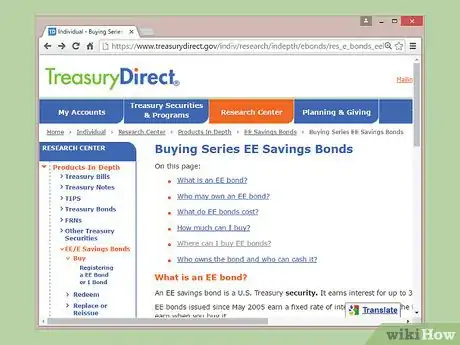

1Learn about the types of US Savings Bonds. There are two different types of US Savings Bonds the Treasury Department offers. Learning about these two types of bonds can help you figure out the best type of bond for your needs.

- The two types of bonds are EE Bonds and I Bonds.[1]

- There are many similarities between EE and I bonds, but there are a few difference including the form in which they come and the amount of interest earnings.[2]

- You can no longer buy savings bonds at financial institutions such as banks or credit unions.[3]

-

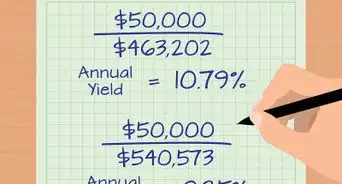

2Consider Type EE Bonds. Type EE bonds are only available online and have a variable rate of interest depending on the purchase date. If you want a fixed rate of interest return and the convenience of tracking the bonds online, Type EE bonds might be the right choice for you.[4]Advertisement

-

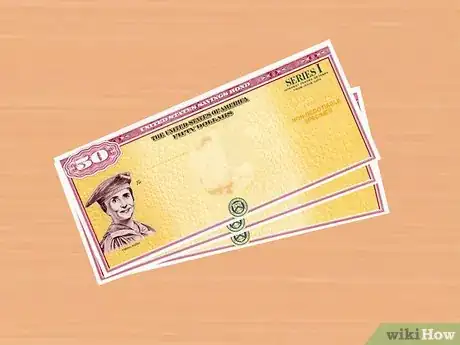

3Think about Type I Bonds. Type I bonds are available in paper form if purchased using your IRS tax return. If you want a combined rate interest return and a physical paper bond, Type I bonds might be the right choice for you.[8]

- You can buy Type I bonds using your IRS tax refund at face value or online at the Treasury Department website.[9]

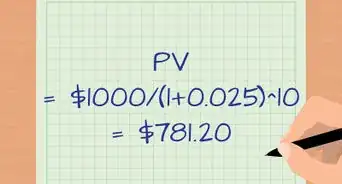

- Type I bonds earn a combined rate of interest.[10] This rate is based on a fixed rate of return either known when you buy the bond and an inflation rate that the Treasury Department calculates twice a year.[11]

-

4Recognize the similarities in Type EE and Type I bonds. Although the format and interest rates of Types EE and I bonds differ, there are many similarities between them. Recognizing these similarities may help you to decide which bond type is the best for you.

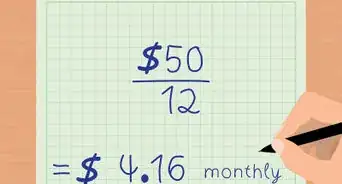

- The purchase price of each bond is the face value of the bond. A $50 bond costs $50 if you buy it either electronically or using your tax refund.[12]

- You can buy electronic bonds in any amount of $25 or more to the penny. Thus, you could buy an electronic bond for $100.15.[13]

- You can buy paper I bonds in $50 increments.[14]

- You can buy up to $10,000 in electronic EE or I bonds each calendar year. You may buy up to $5,000 in paper I bonds with your tax return.[15]

- You may redeem the bond after 12 months.[16] There may be some penalty for cashing in your bond early, except if used for educational purposes.[17]

- Your bonds earn interest monthly and this is then compounded semiannually up to 30 years.[18]

- You must pay federal taxes on your savings bonds but do not need to pay state or local taxes on them.[19]

Buying U.S. Savings Bonds Online

-

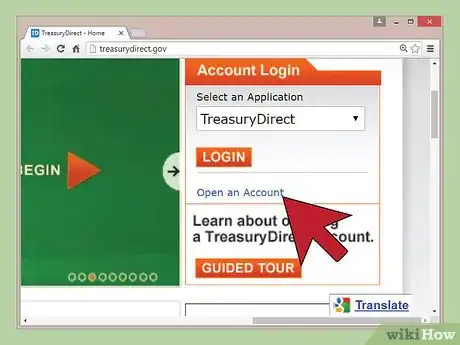

1Set up a TreasuryDirect account. If you want to buy Type EE bonds or Type I bonds electronically, you must purchase them through the Treasury Department’s website. You’ll need to set up a TreasuryDirect account, which will allow you to purchase and manage your savings bonds.[20]

- You can set up your account at http://treasurydirect.gov.[21]

- You must be at least 18 years of age to open a TreasuryDirect account.[22]

-

2Click on “Open an Account” and then “TreasuryDirect”. In order to open your account, follow the prompts on the Treasury Department’s website by clicking on the tabs to open a TreasuryDirect account. You’ll also need to have some basic information available to purchase the bonds online. Following the prompts and having the proper data can help you to effortlessly purchase your bonds.[23]

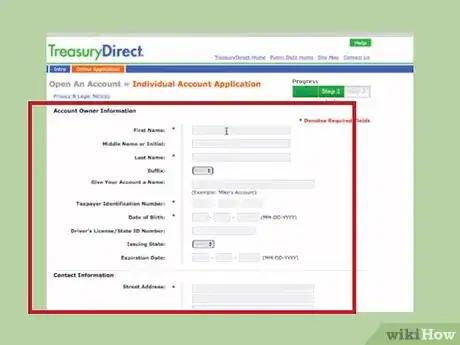

- You need your Social Security number or taxpayer identification, the savings or checking account number from which the Treasury Department can withdraw the funds, and your financial institution’s routing number.[24]

- If you are buying the savings bonds as a gift, you’ll need the recipient’s Social Security number.[25]

-

3Enter your personal information. You'll be required to provide several pieces of personal information to set up your account. Enter your Social Security Number, a valid United States address, driver's license or state ID number, United States bank account and routing information, and email address. Enter this information will allow you to fully set up and manage your account.[26]

-

4Construct a password. You’ll need a password that you can easily remember in order to buy and manage bonds. Construct a password that is simple enough for you to know but secure enough to prevent hacking.[27]

- Consider using a mix of letters and numbers for the most secure password.

- Write down your password and keep it in a safe and easily accessible place for when you need it.

- Select a reminder from the list the Treasury Department provides to help you if you forget your password.

-

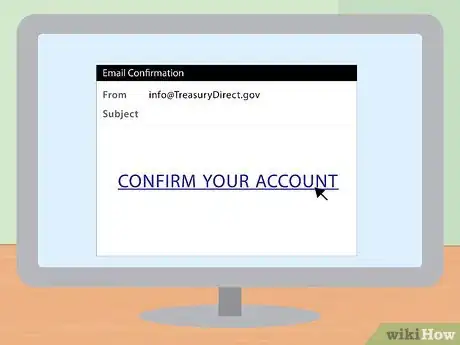

5Confirm your TreasuryDirect account. Once you’ve finished following the account setup prompts, the Treasury Department will email you your account information. Click on the link provided to confirm your account so that you can start buying savings bonds as soon as you like.

-

6Log on to your Treasury Direct account to buy bonds. You’re now ready to buy bonds with your TreasuryDirect account. Log in to your account with the information you provided to start the process of purchasing EE or I bonds.

-

7Select the owner of the bond. Your TreasuryDirect account will prompt you to choose who will own the savings bond. You have the choice of buying the bond for yourself or for someone else as a gift.[28]

- You have the option to purchase as “sole owner” or a recipient who will own the bond.[29]

- If you are giving the savings bond to someone else as a gift, the recipient must have a Treasury Direct account. You will need to indicate the recipient's full name and Social Security Number or taxpayer ID number. You can keep the gift bond in your account until they set up a TreasuryDirect account.[30]

-

8Choose the bond series you want to buy. You can decide which bond series to buy after you’ve designated the owner. Choose either Type EE or I bond based on the type of interest rate you want to accrue.[31]

- Both Series EE and Series I bonds are sold electronically at face value and require a $25 minimum purchase. You can purchase bonds electronically in any dollar amount, however.

-

9Review and send your purchase request. Make sure to review your savings bond purchase before you send the final request. This can help ensure that you haven’t purchased too much—or too little—in savings bonds.

- The Treasury Department will deduct the dollar amount of your bond purchase within five business days of your purchase.[32]

- Confirm your purchase by checking your account. A record of the bond will be in your TreasuryDirect account. If it doesn’t appear within one business day, you can email the Treasury Department for help at treasury.direct@bpd.treas.gov. Include your account number and daytime phone number, but no personal information.[33]

- Remember that you will not receive a paper bond if you purchased online.[34]

Using Your Tax Refund for Paper Bonds

-

1File your tax return. You’ll have to file your income tax return with the Internal Revenue Service (IRS) in order to buy paper bonds. You can only purchase paper bonds by requesting for them once you’ve submitted your taxes and qualify for a return.

- You can get savings bonds as tax refunds by using any IRS tax return form, including streamlined tax refund methods.

-

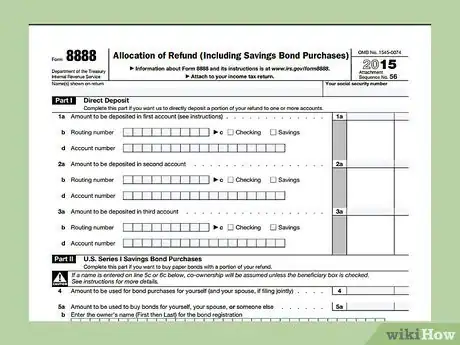

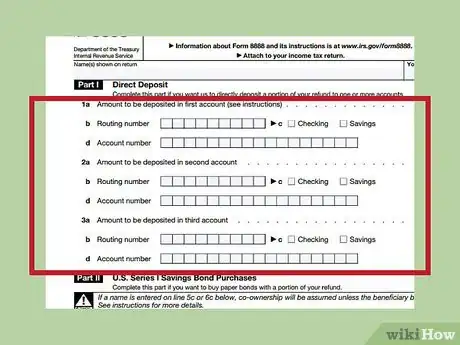

2Designate that you want for savings bonds as a tax refund. When you file your tax return with the IRS, you can designate how you want your refund. By filling out IRS Form 8888, you can tell the IRS the amount of your refund you want as savings bonds.

- Form 8888 is also called “Allocation of Refund.” You have the option of an IRA, US savings bonds, or a direct deposit to a checking or savings account. Make sure to choose “US savings bonds.”

-

3Fill in the refund amount in savings bonds. You may not want or be able to get your entire tax refund to be in the form of savings bonds. Fill in the amount of savings bonds you want in IRS Form 8888.

- Remember that you can only get $5000 in I paper bonds per calendar year.

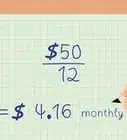

- The amount you designate as savings bonds must be in increments of $50.

- You can designate the owner of the savings bond on Form 8888.

-

4Submit your tax return to the IRS. Make sure to submit your tax return to the IRS in order to collect your Type I savings bonds as a refund. The general submission date for taxes is April 15 of any calendar year, unless you have filed for an extension.

- Remember to include Form 8888 with your return.

-

5Wait for your paper Type I bonds. If you choose to receive Type I bonds as a tax return, you will receive physical paper bonds in the mail once you’ve submitted your taxes. It can take up to three weeks to receive paper bonds once the IRS completes processing your tax return.

- The IRS will send the paper bonds to the address on your tax return or Form 8888.

- If you do not receive your bonds, you can check their status by using the IRS’s online system “Where’s My Refund” at http://www.irs.gov/Refunds. You can also call the IRS hotline at 1-800-829-1954.

- If you do not receive your bonds or they are lost or destroyed, you can also file a claim with the Bureau of Public Debt. You’ll submit BPD Form PD F1048 to Bureau of Public Debt; Parkersburg, WV 26106-7012.

Warnings

- Interest on your U.S. savings bond is subject to federal income tax.⧼thumbs_response⧽

- Savings bond interest is subject to gift, inheritance, estate, or other excise taxes, whether federal or state.⧼thumbs_response⧽

References

- ↑ https://www.treasurydirect.gov/indiv/research/indepth/ebonds/res_e_bonds_eecomparison.htm

- ↑ https://www.treasurydirect.gov/indiv/research/indepth/ebonds/res_e_bonds_eecomparison.htm

- ↑ https://www.treasurydirect.gov/indiv/research/indepth/ebonds/res_e_bonds_eecomparison.htm

- ↑ https://www.treasurydirect.gov/indiv/research/indepth/ebonds/res_e_bonds_eecomparison.htm

- ↑ https://www.treasurydirect.gov/indiv/research/indepth/ebonds/res_e_bonds_eecomparison.htm

- ↑ http://www.consumerreports.org/cro/magazine/2012/09/the-new-way-to-buy-savings-bonds/index.htm

- ↑ https://www.treasurydirect.gov/indiv/research/indepth/ebonds/res_e_bonds_eecomparison.htm

- ↑ https://www.treasurydirect.gov/indiv/research/indepth/ebonds/res_e_bonds_eecomparison.htm

- ↑ https://www.treasurydirect.gov/indiv/research/indepth/ebonds/res_e_bonds_eecomparison.htm

- ↑ https://www.treasurydirect.gov/indiv/research/indepth/ebonds/res_e_bonds_eecomparison.htm

- ↑ https://www.treasurydirect.gov/indiv/research/indepth/ebonds/res_e_bonds_eecomparison.htm

- ↑ https://www.treasurydirect.gov/indiv/research/indepth/ebonds/res_e_bonds_eecomparison.htm

- ↑ https://www.treasurydirect.gov/indiv/research/indepth/ebonds/res_e_bonds_eecomparison.htm

- ↑ https://www.treasurydirect.gov/indiv/research/indepth/ebonds/res_e_bonds_eecomparison.htm

- ↑ https://www.treasurydirect.gov/indiv/research/indepth/ebonds/res_e_bonds_eecomparison.htm

- ↑ https://www.treasurydirect.gov/indiv/research/indepth/ebonds/res_e_bonds_eecomparison.htm

- ↑ https://www.treasurydirect.gov/indiv/research/indepth/ebonds/res_e_bonds_eecomparison.htm

- ↑ https://www.treasurydirect.gov/indiv/research/indepth/ebonds/res_e_bonds_eecomparison.htm

- ↑ https://www.treasurydirect.gov/indiv/research/indepth/ebonds/res_e_bonds_eecomparison.htm

- ↑ http://www.consumerreports.org/cro/magazine/2012/09/the-new-way-to-buy-savings-bonds/index.htm

- ↑ http://treasurydirect.gov

- ↑ http://www.consumerreports.org/cro/magazine/2012/09/the-new-way-to-buy-savings-bonds/index.htm

- ↑ http://www.consumerreports.org/cro/magazine/2012/09/the-new-way-to-buy-savings-bonds/index.htm

- ↑ http://www.consumerreports.org/cro/magazine/2012/09/the-new-way-to-buy-savings-bonds/index.htm

- ↑ http://www.consumerreports.org/cro/magazine/2012/09/the-new-way-to-buy-savings-bonds/index.htm

- ↑ http://www.consumerreports.org/cro/magazine/2012/09/the-new-way-to-buy-savings-bonds/index.htm

- ↑ http://www.consumerreports.org/cro/magazine/2012/09/the-new-way-to-buy-savings-bonds/index.htm

- ↑ http://www.consumerreports.org/cro/magazine/2012/09/the-new-way-to-buy-savings-bonds/index.htm

- ↑ http://www.consumerreports.org/cro/magazine/2012/09/the-new-way-to-buy-savings-bonds/index.htm

- ↑ http://www.consumerreports.org/cro/magazine/2012/09/the-new-way-to-buy-savings-bonds/index.htm

- ↑ http://www.consumerreports.org/cro/magazine/2012/09/the-new-way-to-buy-savings-bonds/index.htm

- ↑ http://www.consumerreports.org/cro/magazine/2012/09/the-new-way-to-buy-savings-bonds/index.htm

- ↑ https://treasurydirect.gov/rs/30-ContactUs.htm

- ↑ http://www.consumerreports.org/cro/magazine/2012/09/the-new-way-to-buy-savings-bonds/index.htm

About This Article

U.S. savings bonds are low-risk investments you can buy from the Treasury Department. Although you used to be able to buy these from banks and credit unions, you can only get them through the Treasury now. You can buy either EE bonds or type I bonds. EE bonds are only available online and have a variable interest rate depending on the purchase date. Set up a Treasury Direct account to purchase these online. Type I bonds are only available in paper form and can be purchased using your IRS tax return instead of a cash refund. When you file your tax return, designate how many bonds you want to buy. These have to be in 50 dollar increments with a maximum of 5,000 dollars in bonds. You’ll receive your paper bonds in the mail. For more tips from our Financial co-author, including how to gift a savings bond to someone, read on!