This article was co-authored by Michael R. Lewis. Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

This article has been viewed 71,001 times.

The US Department of Treasury can help you retrieve savings bonds if they are stolen, lost or damaged. You can check the department's online database or fill out a bond-recovery form to request a replacement bond or redemption of the old one. Retrieving bonds is easiest if you know the bond number and date of issue, but you may be able to replace them without this information.

Steps

Finding Bonds That Have Reached Maturity

-

1Visit the “Treasury Hunt” website. The US Department of Treasury has created a website where you can search for lost savings bonds that have stopped accruing interest. Visit this website and begin searching for your lost, missing, or stolen savings bonds.[1]

-

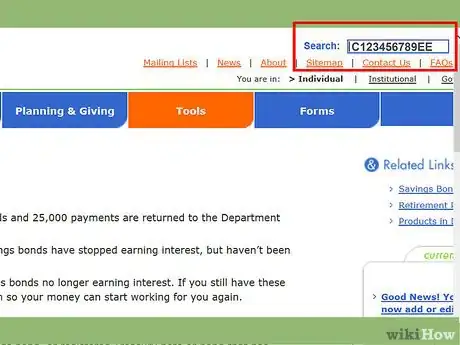

2Utilize the search function. The “Treasury Hunt” database contains information on E and EE bonds issued during or after 1974 that have reached maturity (or have stopped accruing interest).[2]

- The best way to search for mature bonds is by using the bondholder's Social Security number. If the bond was a gift, the registered number might be the giver's Social Security number.

Advertisement -

3Search using the Bond serial number. If you do not have the social security number of the bond holder, another option is to search using the Bond serial number. See if you can locate your missing bonds this way.[3]

-

4Request a copy of the bond. Once your mature bond has been located, you can request an electronic version of the bond, or you may have the bond cashed and the money deposited into a bank account of your choice.[4]

- If Treasury Hunt does not find your bond, you will need to file a Form 1048, which requests the Department of Treasury to search for the bond using other information.

Replacing Bonds That are Still Earning Interest

-

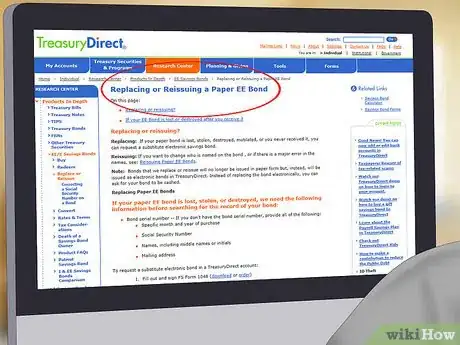

1Ensure that your bond qualifies for replacement. According to the Department of Treasury, a savings bond may be replaced if it has been “lost, stolen, destroyed, mutilated, or you never received it.” If this describes your situation, you can apply for an electronic replacement.[5]

-

2Gather information. In order to replace your lost bond, you are going to need either (a) the bond serial number, or (b) the specific month and year of purchase, the social security number of the bond holder, the full name of the bond holder, and a mailing address. Collect this information before you begin the process of requesting a new bond.[6]

-

3Download FS Form 1048. Visit the US Treasury Department’s “Treasury Hunt” website and download a copy of Form 1048, and print this form out. Alternatively, you can request for a copy of this form to be mailed to you house.[7]

-

4Have your signature certified. Take this form to your local financial institution and speak to a bank officer. This person will be able to certify your signature on this form, which is required for the form to be valid.[8]

-

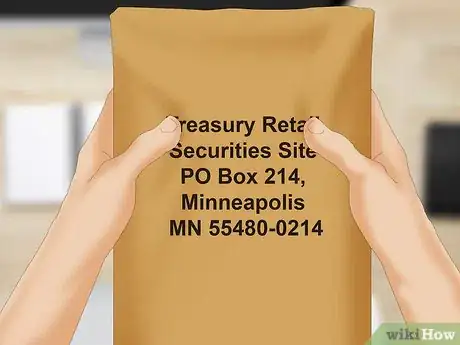

5Send in the form. You will mail this signed and certified form to: Treasury Retail Securities Site, PO Box 214, Minneapolis, MN 55480-0214. When you form has been processed and your ownership of the lost bond(s) verified, you will receive an electronic reissue of the bond in a TreasuryDirect account, where it will continue to accrue interest until it matures.[9]

Filing Form 1048 to Locate Mature Bonds

-

1Download form 1048. Visit the US Treasury Department’s “Treasury Hunt” website. Here you can either download and print FS Form 1048, or request for a copy to mailed to your address.[10]

-

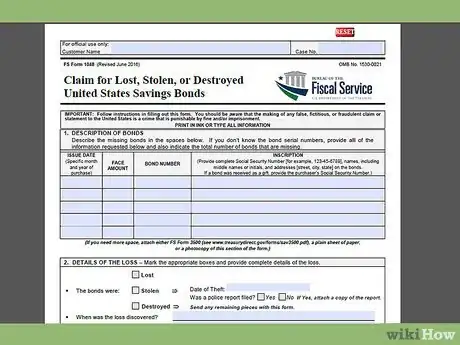

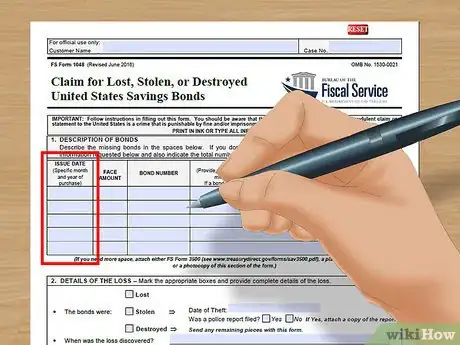

2Provide the bond's approximate date of issue. Provide the exact date if possible, or you can submit a date range during which the bond was issued. [11]

-

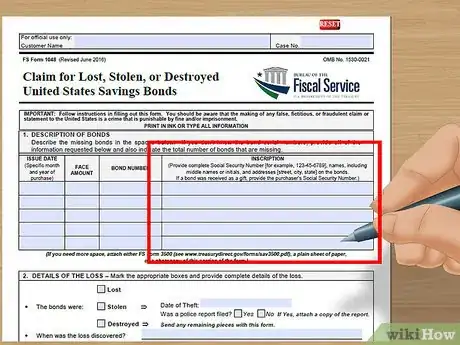

3Complete the Social Security information. Include your Social Security number, full name and address. If the bond was a gift, include the giver's information if you have it.[12]

-

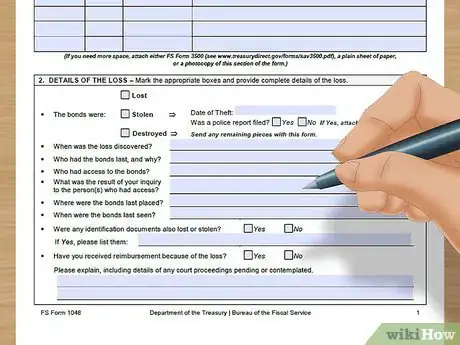

4Provide information about the bond's loss. You will be asked some questions about the loss of the bond. Fill in this section as honestly as you can. If the bond was stolen, provide a police report (if one was filed).[13]

-

5Sign and notarize the form. Visit your local bank and speak to a bank officer. Treasury Form 1048 must be signed and certified by a bank officer in order for it to be valid.[14]

-

6Decide how you want your bond issued. The Treasury Department can issue a new bond, redeem the old one with a check, or directly deposit the bond's value in the bank account of your choosing.[15]

-

7Submit Form 1048. Finally, you will mail this signed and certified form to: Treasury Retail Securities Site, PO Box 214, Minneapolis, MN 55480-0214. When you form has been received and processed, and your mature bond has been located, you will be contacted, and you will receive a re-issue of the bond in the format you have requested.[16]

References

- ↑ http://www.treasurydirect.gov/indiv/tools/tools_treasuryhunt.htm

- ↑ http://www.treasuryhunt.gov/

- ↑ https://www.treasurydirect.gov/indiv/research/indepth/ebonds/res_e_bonds_eereplace.htm

- ↑ http://www.treasuryhunt.gov/

- ↑ https://www.treasurydirect.gov/indiv/research/indepth/ebonds/res_e_bonds_eereplace.htm

- ↑ https://www.treasurydirect.gov/indiv/research/indepth/ebonds/res_e_bonds_eereplace.htm

- ↑ https://www.treasurydirect.gov/indiv/research/indepth/ebonds/res_e_bonds_eereplace.htm

- ↑ https://www.treasurydirect.gov/indiv/research/indepth/ebonds/res_e_bonds_eereplace.htm

- ↑ https://www.treasurydirect.gov/indiv/research/indepth/ebonds/res_e_bonds_eereplace.htm