This article was co-authored by Marcus Raiyat and by wikiHow staff writer, Jennifer Mueller, JD. Marcus Raiyat is a U.K. Foreign Exchange Trader and Instructor and the Founder/CEO of Logikfx. With nearly 10 years of experience, Marcus is well versed in actively trading forex, stocks, and crypto, and specializes in CFD trading, portfolio management, and quantitative analysis. Marcus holds a BS in Mathematics from Aston University. His work at Logikfx led to their nomination as the "Best Forex Education & Training U.K. 2021" by Global Banking and Finance Review.

There are 7 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 24,620 times.

Bonds are issued by companies and governments to raise money. As an investor in bonds, you essentially loan money to the bond issuer. When the bond matures, you get your money back. In the meantime, you earn interest as defined by the coupon rate of the bond.[1] Circumstances may change so that you want to sell your bonds before the maturity date. The way you sell bonds before maturity depends on the type of bonds you have.

Steps

Selling Corporate and Municipal Bonds

-

1Sell exchange-traded fund (ETF) bond shares on the exchange. If you have shares in a bond ETF, you generally can sell your shares at any time. ETF shares tend to be more liquid than other bonds. ETFs are typically made up of corporate bonds.[2]

- Some ETF shares are still traded over-the-counter (OTC). If you need to sell your bond shares through an OTC market, you must hire a dealer-broker to complete the sale for you.

-

2Work with a dealer-broker to sell individual bonds. Individual corporate and municipal bonds are typically traded through OTC markets by dealer-brokers. Even if you already have a relationship with a particular firm, it pays to shop around to make sure you're going to get the best rate.[3]

- You can research the background and experience of individual brokers on the website of the Financial Industry Regulatory Authority (FINRA) at https://brokercheck.finra.org/.

- OTC trades are not subject to the oversight and regulations of the major exchanges. Because of the relative lack of regulation and oversight, many view OTC trades as riskier than exchange trades.

Advertisement -

3Decide how you want to sell your bonds. You can issue a limit order, in which you specify the exact amount of money you want for your bonds, or a market order, in which you accept the best bid. How you want to sell your bonds depends on whether timing or price is more important to you.[4]

- In some cases, timing may be more important for outside factors. For example, you may have a financial emergency and need money immediately. If that's your situation, a market order is going to be your best bet.

- Absent outside motivations for the sale, research of the company or municipality typically is necessary to decide which order is best for you.

-

4Give your order to your broker-dealer. Your broker-dealer will handle the sale of your bonds on the OTC market according to your specifications. In some situations, the brokerage firm may be willing to take your bonds off your hands in an internal trade.[5]

- Internal trades can save you on fees and commissions. Many brokers only charge a flat rate for internal trades.

-

5Confirm your order. Before your broker-dealer accepts an offer on your bonds, they will ask you to confirm that you still want to sell your bonds on the same terms. They may also offer you advice, but ultimately the decision to make the deal is yours.[6]

- For example, if you ordered a market trade, your broker-dealer may be confident that a better offer will come along than the one you've received. Listen to their advice, but if you decide you want to take the offer anyway, they have to close the trade for you.

-

6Settle the trade. Once you've confirmed the order, your broker-dealer clears the trade and reports it to FINRA. The trade is settled when you deliver your bonds to the investor who purchased them, and they pay you the agreed amount.[7]

- The process of settling the trade is also your broker-dealer's responsibility. Some brokerage firms handle settlement directly, while others use a third-party service.

Selling U.S. Treasury Bonds

-

1Log into your TreasuryDirect account. If you own U.S. Treasury bonds that you bought directly from the U.S. government, transfer them to a bank or brokerage firm to sell them. You can do this from your TreasuryDirect account.[8]

- Visit https://www.treasurydirect.gov/tdhome.htm to log into your account.

- The U.S. Treasury no longer issues paper bonds. The last paper Treasury bonds matured in 2016. If you don't have a TreasuryDirect account, set one up so you can manage your securities.[9]

-

2Choose "Transfer securities" from the ManageDirect menu. From your account page, click on "ManageDirect" to access the menu that allows you to manage your securities. The option to "Transfer securities" allows you to sell your Treasury bonds.[10]

- Find the bonds you want to sell and mark them for external transfer. You'll then have a form to download and complete. The information about the bonds you selected will be automatically filled in on the form, but you should double-check it to make sure everything is accurate.

-

3Complete FS Form 5511. Form 5511 allows you to transfer your bonds to a brokerage account. You cannot transfer the bonds to a checking or savings account. Transferring the bonds is the equivalent of selling them, in that you'll have cash deposited into your account.[11]

- If you don't have a brokerage account, open one before you start the process of transferring your bonds.

- Some bonds can be split, so you can take out less than the face value of the bond. However, Series EE and Series I savings bonds cannot be split and must be transferred in their entirety.

-

4Have your form certified. Take your form to your bank or brokerage firm to have it certified by an authorized certifying officer. You must provide them a government-issued photo ID so they can verify your identity.[12]

- Don't sign your form until you are in the presence of the officer. They must observe your signature. They will sign and seal the form indicating that they observed your signature and verified your identity.

- Once the form is signed and certified, make a copy of it for your records.

-

5Mail your form to the Treasury. The form includes instructions on how to mail the signed and certified form. Make sure you don't include the instructions with your form. Once your request is processed, the Treasury will transfer the bonds to the brokerage account you identified on the form.[13]

- In some circumstances, the Treasury may request additional evidence or documentation from you before completing your request. Avoid sending originals, since they won't be returned to you.

-

6Direct your broker to sell your bonds. Once the Treasury has transferred your bonds to your brokerage account, your broker can sell the bonds according to your specifications. You can enter an order to sell them at a specific price (a limit order), or to take the best offer (a market order).[14]

- Once your broker completes the sale, they will settle the trade and deposit the money in your brokerage account.

Expert Q&A

-

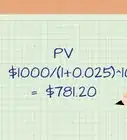

QuestionHow do you calculate the present value of a bond?

Marcus RaiyatMarcus Raiyat is a U.K. Foreign Exchange Trader and Instructor and the Founder/CEO of Logikfx. With nearly 10 years of experience, Marcus is well versed in actively trading forex, stocks, and crypto, and specializes in CFD trading, portfolio management, and quantitative analysis. Marcus holds a BS in Mathematics from Aston University. His work at Logikfx led to their nomination as the "Best Forex Education & Training U.K. 2021" by Global Banking and Finance Review.

Marcus RaiyatMarcus Raiyat is a U.K. Foreign Exchange Trader and Instructor and the Founder/CEO of Logikfx. With nearly 10 years of experience, Marcus is well versed in actively trading forex, stocks, and crypto, and specializes in CFD trading, portfolio management, and quantitative analysis. Marcus holds a BS in Mathematics from Aston University. His work at Logikfx led to their nomination as the "Best Forex Education & Training U.K. 2021" by Global Banking and Finance Review.

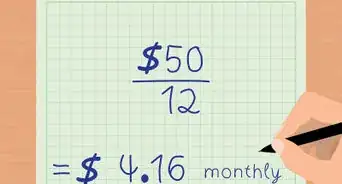

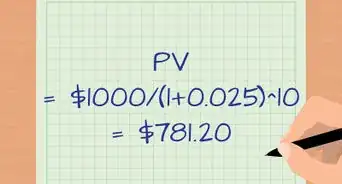

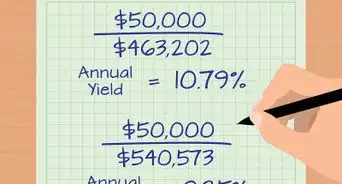

Foreign Exchange Trader The present value of a bond is essentially a battle between the demand for the price of the bond versus the interest that's paid. Generally, as the price of the bond goes down, the interest goes up, and vice versa.

The present value of a bond is essentially a battle between the demand for the price of the bond versus the interest that's paid. Generally, as the price of the bond goes down, the interest goes up, and vice versa.

References

- ↑ https://www.investor.gov/introduction-investing/basics/investment-products/bonds

- ↑ http://www.etf.com/etf-education-center/bond-etfs-vs-bonds-which-are-better?nopaging=1

- ↑ https://www.aaii.com/journal/article/2-bond-basics-for-individuals-a-guide-to-buying-and-selling

- ↑ https://www.otcmarkets.com/learn/market-101/trading

- ↑ https://www.otcmarkets.com/learn/market-101/trading

- ↑ https://www.otcmarkets.com/learn/market-101/trading

- ↑ https://www.otcmarkets.com/learn/market-101/trading

- ↑ https://www.treasurydirect.gov/indiv/research/indepth/tbonds/res_tbond_sell.htm

- ↑ https://www.treasurydirect.gov/indiv/research/indepth/tbonds/res_tbond_faq.htm

- ↑ https://www.treasurydirect.gov/indiv/research/indepth/tbonds/res_tbond_sell.htm

- ↑ https://www.treasurydirect.gov/pdf/rs/PDF5511.pdf

- ↑ https://www.treasurydirect.gov/pdf/rs/PDF5511.pdf

- ↑ https://www.treasurydirect.gov/pdf/rs/PDF5511.pdf

- ↑ https://www.treasurydirect.gov/indiv/research/indepth/tbonds/res_tbond_sell.htm