This article was co-authored by Michael R. Lewis. Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

This article has been viewed 136,768 times.

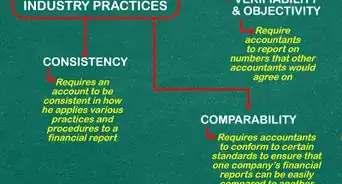

Calculating the cost of goods sold (COGS) gives accountants and managers an accurate estimation of a company's costs. COGS takes into account the specific cost of inventory materials (including the costs associated directly with inventory production in cases where companies make products directly from the purchased raw materials). Inventory costs can be computed in several ways and in order to be in compliance, a company must pick one method and use it consistently. Keep reading to find out how to begin calculating COGS for a business using First In, First Out (FIFO); First In, Last Out (FILO), and Average Cost methods for inventory cost calculation.

Steps

Using Average Inventory Cost

-

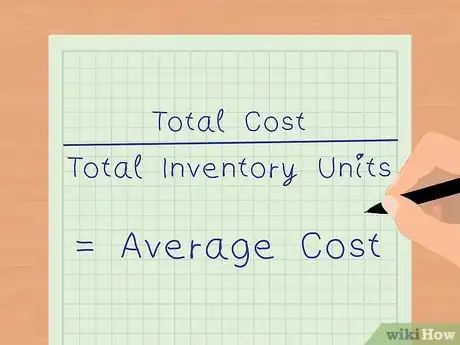

1Find out the average cost of purchased inventory. Average cost is not only an acceptable reporting method but also can be a helpful way to think about the products in your inventory over a longer scale of time. Add all inventory purchase prices for a single product type together and divide by the number of products purchased to get the average cost.

- For example, $1.00 + $1.50/2 = $1.25 average cost.

-

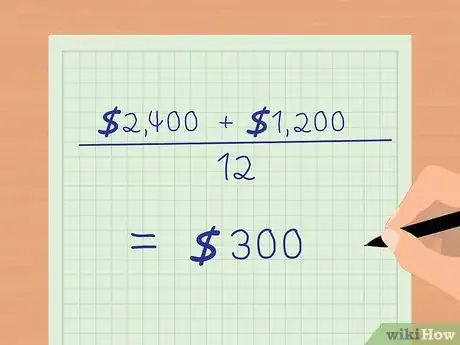

2Find out the average cost of the goods you produced. If instead your company purchases raw materials and then produces its own inventory, this process will require some subjective judgement. Set aside a time period and a number of inventory units produced. Add the total cost (often estimated) of both the materials and the labor specifically used to make the product. Now divide by the total inventory units produced in that time.[1]

- Always be certain you are abiding by the appropriate laws and regulations governing your company's accounting practices as there are regulations governing how to compute inventory cost of produced goods.

- This cost will certainly vary by product but may vary with the same product over time.

Advertisement -

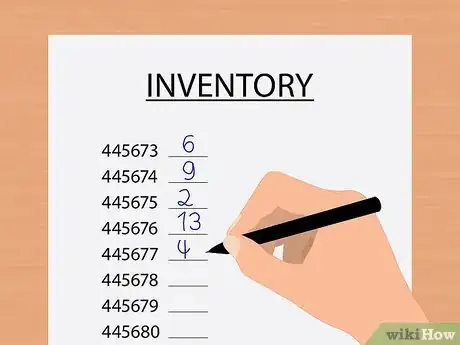

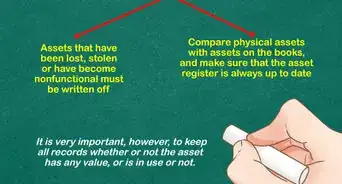

3Take a physical inventory count. Note the amount of inventory on hand at the start date and again at the end date. Multiply the average cost by the difference between your beginning and ending inventory.

-

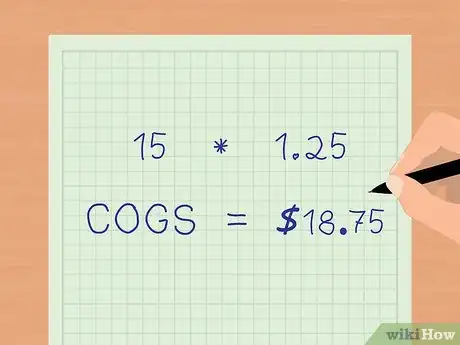

4Calculate COGS using the average cost. The total spent on widgets is $1.25 x 20 widgets = $25. With 15 widgets sold, the total COGS under this method is $18.75 (15 x $1.25).[2]

- Companies use the average cost method when their products are easily substituted or physically indistinguishable from each other, such as commodities like minerals, oil and gas.[3]

- Most companies that use the Average Cost Reporting Method compute the average cost of goods on a quarterly basis.

Using the FIFO Reporting Method for Inventory

-

1Choose a beginning and ending date. FIFO is an alternate method used to account for inventory costs. To calculate COGS using the FIFO method, first take a physical inventory count at the start date and again at the end date. It is important that these counts be 100% accurate.

- It is helpful to have a different part number for each type of material.

-

2Find out the cost that you paid to purchase the goods. You can refer to the invoices sent by the vendors. The costs may vary even if it is all the same kind of inventory. Be sure to count the ending inventory value for a better understanding of how values are affected. The FIFO method assumes the first goods purchased or produced will be the first goods sold.

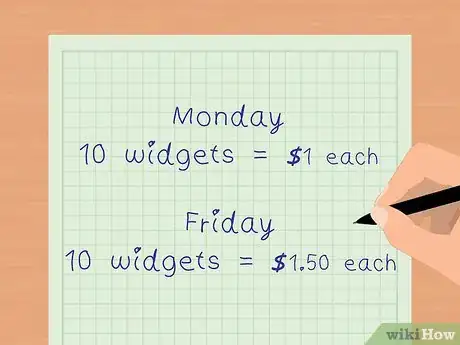

- For example, imagine you stocked your inventory with 10 widgets at $1 each on Monday and another 10 at $1.50 each on Friday.

- Also, assume that your ending inventory showed you sold 15 widgets by Saturday.

-

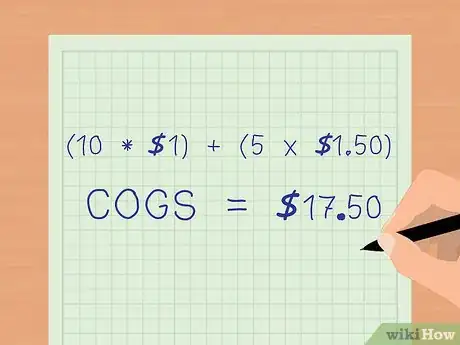

3Calculate COGS. Subtract the quantities sold from your inventory beginning with the earliest date. Then multiply them by the purchase cost.[4]

- Your COGS would be 10 x $1 = $10 plus 5 x $1.50 = $7.50 for a total of $17.50.

- Your COGS is lower under the FIFO reporting method and your profit is higher when inventory costs are rising. In this case your earlier inventory cost less than the inventory acquired later in the week, assuming both are sold to the consumer at the same price.

- Use the FIFO method if the cost of your inventory tends to increase over time AND you need to have a strong balance sheet to impress investors or get a bank loan. This is because the value of your remaining inventory will be higher.[5]

Using the FILO Reporting Method for Inventory

-

1Sort your inventory purchases by the most recent purchases. The FILO method operates on the basis that the most recent inventory acquisitions will be the first sold. You will still need to do an inventory count at the beginning and end of the period.

-

2Find out the cost that you paid to purchase the goods. You can refer to the invoices sent by the vendors. The costs may vary even if it is all the same kind of inventory.

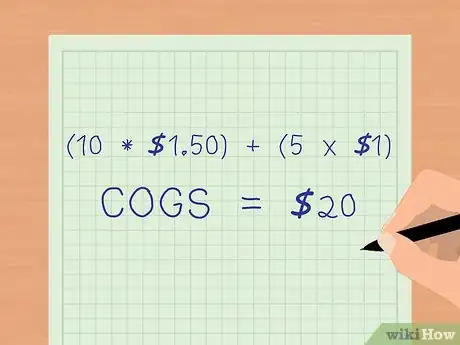

- Again imagine you stocked your inventory with 10 widgets at $1 each on Monday and another 10 at $1.50 each on Friday. By Saturday you sold 15 widgets.

-

3Tally the cost of the goods you have sold. This time COGS would be all 10 of the widgets purchased at $1.50 each (sold first under FILO) (10 x $1.50 = $15.00). Then add 5 of the widgets purchased for $1 each (5 x $1 = $5) sold last for a total COGS of $20. When the remaining inventory (5 widgets) gets sold, COGS for that will be $5 (5 x $1). [6]

- Companies use the FILO method when they carry large inventories with increasing costs. This method can result in lower profits and therefore lower taxes.[7]

Things You'll Need

- Inventory counts

- Inventory purchase records

- Sales records

- Calculator

References

- ↑ http://www.investopedia.com/terms/c/cogs.asp

- ↑ http://www.accountingcoach.com/inventory-and-cost-of-goods-sold/explanation/4

- ↑ http://www.inc.com/jeff-haden/how-to-choose-between-lifo-and-fifo-accounting.html

- ↑ http://www.investopedia.com/ask/answers/111714/how-do-i-calculate-cost-goods-sold-cogs-using-first-first-out-fifo-method.asp

- ↑ http://www.inc.com/jeff-haden/how-to-choose-between-lifo-and-fifo-accounting.html

- ↑ https://xplaind.com/131468/lifo-method

- ↑ http://www.inc.com/jeff-haden/how-to-choose-between-lifo-and-fifo-accounting.html