This article was co-authored by Ryan Baril. Ryan Baril is the Vice President of CAPITALPlus Mortgage, a boutique mortgage origination and underwriting company founded in 2001. Ryan has been educating consumers about the mortgage process and general finance for almost 20 years. He graduated from the University of Central Florida in 2012 with a B.S.B.A. in Marketing.

There are 10 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 183,658 times.

The closing costs on a real estate purchase are the variety of fees that you will have to pay to finalize your sale. These fees can vary significantly depending on a variety of factors and can add up considerably, regardless of which side of the table you will be on. Being able to accurately estimate your closing costs before you even make an offer on a home or put your home on the market is crucial to being prepared for what the process is going to cost you up front.

Steps

Calculating Typical Buyer Closing Costs

-

1Calculate your down payment. This will be determined by how much money you have to put down and what kind of loan you get. Some loans require a 20% down payment, while others will allow you to put down much less.[1] Shop around for a loan that will work well with the amount of money you have to put down.

- If you pay less than 20% down you will need to pay monthly for mortgage insurance, the first installment of which will be added to closing costs. The cost of mortgage insurance can vary widely but will generally cost you over $100 per month. When you get your loan make sure that once you have paid 20% of the cost of the house, meaning you have 20% equity in the home, that your mortgage insurance will end.[2]

-

2Determine what your lender will charge for an origination fee. This pays for the time and effort involved in gathering and consolidating the paperwork and supporting documentation, as well as for creating a client file.

- Some lenders may also charge for providing a specific interest rate. This charge is a set percentage of the loan amount and therefore is referred to as the number of "points" the lender will charge. A charge of 1 point would be equal to 1 percent of the loan amount.[3]

Advertisement -

3Ask about the fees associated with the title company. The title company makes sure that there are no other claims on the property and title insurance protects the lender against any future legal problems.[4] It helps to ensure that the title to your property is free and clear at the time of the sale. The cost for these services vary by location and company. On a $100,000 loan, the title company could charge anywhere between $175 to $900 dollars, if not more.[5]

- The title company used is usually determined by the lender. If you have a strong preference, however, ask your lender if they would be willing to work with the title company you want to use.

-

4Determine how much the appraisal of the home will cost. It will most likely be between $300 and $400 dollars.[6] An appraisal of the property is required by the mortgage lender in order to ensure that the loan amount is in line with the property's value. The lender will hire the appraiser and let you know how much the appraisal will cost.

- This appraisal is likely different from the tax assessor's appraisal

-

5Find out if your lender will charge you for the credit report they run on you. Some lenders may charge you for fees incurred in pulling your credit report from the three major reporting bureaus.

- You can request a copy of your credit report, complete with score, for about $15 per bureau. Question your lender if their charge greatly exceeds this amount.

-

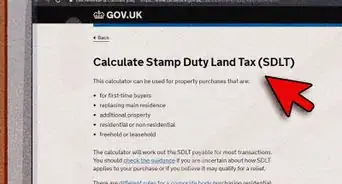

6Determine the annual property taxes for your buyer closing costs. Local property taxes can vary wildly due to the area where your house is located. You can get a history of the property taxes on the house from your real estate agent or from your city or county tax office.

-

7Determine the tax service fee. It's required when your mortgage payment will include an escrow account for property taxes and homeowner's insurance. This fee will be set by the lender but the fee is to pay for a third-party tax professional.

-

8Request estimates for your homeowner's insurance. Your auto insurance agent may be able to give you a package discount if you add homeowner's insurance but be sure to shop around.

- Make sure, when you are comparing insurance policies, that you consider all the terms in each proposal and not just the annual cost.

- Homeowner's insurance should include coverage for loss of the building, personal possessions and contents and liability.

- Ask about provisions for loss of use and the cost to rebuild any and all existing structures.

-

9Determine whether you will be responsible for any other optional fees. Every property sale is different, so there are a lot of variables to consider. If you are unsure, ask your real estate agent. They are working on your behalf and should let you know what is in your best interest.

- Government recording fees also vary by location and are paid to record your title with the appropriate government offices as part of your buyer closing costs.

- A flood certification is required by lenders in some cases, adding to the buyer closing costs. Your lender may require additional flood insurance if it reveals that the property in question lies within a flood zone.

- A property survey is required for some real estate transactions. The survey shows you exactly where your property lines are. Most lenders and brokers can recommend reputable survey firms or professionals.

- There are a variety of other tests you can do on a house, once your offer has been accepted. While most of these, such as radon tests or sewer scopes, are paid for by you upfront, some others may be negotiated into the closing costs.

-

10Compute the buyer closing costs needed for your initial escrow deposit by adding up all of these costs. Some of these are one time costs and some will just be the first installment of a fee that you will pay monthly in your mortgage payment.

- Your initial escrow deposit should include enough to pay for any taxes that will come due in the current year (the seller will pay you for unpaid taxes for the part of the year you did not own the house, if any, so this will be reimbursed to you), two months of property taxes, and two months of homeowner's insurance.

- Taxes are paid in arrears, meaning that you pay after the charges are incurred, but homeowner's insurance is paid in advance.

-

11Compare your calculation to the list the buyer closing costs that are required and selected by the lender. The lender must provide you with an accurate list and estimate of these charges, called a "Good Faith Estimate."[7]

- If you don't understand any of the charges outlined in the Good Faith Estimate you should feel free to ask your mortgage lender about them.

- Some of the fees that go directly to the lender, such as the origination fee, may be negotiable. It doesn't hurt to try to lower it, the worst that can happen is that the lender will say no.

Calculating Typical Seller Closing Costs

-

1Calculate the real estate agent's fee, which is usually 6 to 7 percent of the sale price. This percentage should have been established when you hired your agent but the total cost will ultimately be determined by the final sale price of the home.

- If the buyer and seller each have their own agent, the fee is split between the two. The buyer of your home will not pay their agent directly, you will.

-

2Determine whether to offer a home warranty as part of your seller closing costs. This warranty will protect the new buyer from major appliance breakdowns or structural problems occurring within the first year or so and also protects the seller from any liability for these problems.

- Home warranties are relatively inexpensive, especially for the benefit provided. In a weak housing market, where people are having a hard time selling their homes, this may be a good incentive for a buyer to purchase your home.

-

3Figure the amount of unpaid taxes that would be assessed on the property from the last paid bill until the closing date. You will need to pay this to the buyer, so that they don't have to pay the taxes on the house for a period in which they did not own it.

-

4Negotiate any other seller closing costs. In some cases sellers will take on a portion of the closing costs, lessening the initial financial burden on buyer. This amount will be negotiated once an initial offer is accepted, usually after the buyer does a home inspection.

- Many states, lenders, and mortgage programs have specific rules and guidelines concerning seller closing costs. Some limit them to a small percentage of the purchase price.

- You may be able to work out a mutually beneficial situation with the buyer, depending upon which party has more upfront cash to work with and the state of the housing market in your area.

-

5Add up all these costs. This will give you a good idea of the cost of selling your property. Unlike the buyer, who in most cases has to come up with quite a bit of cash, most of the cost of selling your property will come out of the money you get for the house. In other words, you will have very little up front cost.

Expert Q&A

-

QuestionWhat is the impact of a 20 to 25 percent down payment on closing costs?

Ryan BarilRyan Baril is the Vice President of CAPITALPlus Mortgage, a boutique mortgage origination and underwriting company founded in 2001. Ryan has been educating consumers about the mortgage process and general finance for almost 20 years. He graduated from the University of Central Florida in 2012 with a B.S.B.A. in Marketing.

Ryan BarilRyan Baril is the Vice President of CAPITALPlus Mortgage, a boutique mortgage origination and underwriting company founded in 2001. Ryan has been educating consumers about the mortgage process and general finance for almost 20 years. He graduated from the University of Central Florida in 2012 with a B.S.B.A. in Marketing.

VP, CAPITALPlus Mortgage The amount of down payment offered has very little if any affect on closing costs. Closing costs are typically independent of down payment and are applicable to any type of loan. Think of costs like the appraisal, taxes, survey etc. There may be some effect on fees or taxes, but they will not likely be significant. Ask your lender for comparisons just in case.

The amount of down payment offered has very little if any affect on closing costs. Closing costs are typically independent of down payment and are applicable to any type of loan. Think of costs like the appraisal, taxes, survey etc. There may be some effect on fees or taxes, but they will not likely be significant. Ask your lender for comparisons just in case. -

QuestionHow do I calculate closing costs when paying cash for home?

Ryan BarilRyan Baril is the Vice President of CAPITALPlus Mortgage, a boutique mortgage origination and underwriting company founded in 2001. Ryan has been educating consumers about the mortgage process and general finance for almost 20 years. He graduated from the University of Central Florida in 2012 with a B.S.B.A. in Marketing.

Ryan BarilRyan Baril is the Vice President of CAPITALPlus Mortgage, a boutique mortgage origination and underwriting company founded in 2001. Ryan has been educating consumers about the mortgage process and general finance for almost 20 years. He graduated from the University of Central Florida in 2012 with a B.S.B.A. in Marketing.

VP, CAPITALPlus Mortgage If you are paying cash, you can call the title company or law office that is handling the transaction and ask them to estimate the closing costs for you.

If you are paying cash, you can call the title company or law office that is handling the transaction and ask them to estimate the closing costs for you. -

QuestionDoes the buyer pay for the realtor's commission?

Community AnswerNo, the seller pays commission to both realtors. It comes directly out of the seller's pay.

Community AnswerNo, the seller pays commission to both realtors. It comes directly out of the seller's pay.

Warnings

- Check with a reputable real estate broker or agent to determine any local or state laws regarding mortgage closing costs and related fees. It would be disastrous to arrive at closing only to discover that your contract between the buyer and seller is not valid.⧼thumbs_response⧽

References

- ↑ http://bucks.blogs.nytimes.com/2013/05/29/a-calculator-to-compare-closing-cost-options/?_r=0

- ↑ http://michaelbluejay.com/house/pmi.html

- ↑ http://michaelbluejay.com/house/closingcosts.html

- ↑ http://www.zillow.com/mortgage-rates/buying-a-home/closing-costs/

- ↑ http://www.zillow.com/mortgage-rates/buying-a-home/title-company/

- ↑ https://www.realtor.com/advice/what-you-should-know-about-the-appraisal-process/

- ↑ http://michaelbluejay.com/house/closingcosts.html

- ↑ http://www.hsh.com/closing-cost-calculator.html

- ↑ http://www.fha.com/fha_loan_requirements

About This Article

To calculate typical buyer closing costs, start by determining your down payment and what kind of loan you'll get. For example, your lender may require you to pay mortgage insurance if you put less than 20% down, so the first installment will be added to your closing costs. Your lender will also charge you for an origination fee, which pays for the time and effort involved in gathering the paperwork and documentation. Additionally, factor in fees associated with the title company, the home appraisal, and the credit report when calculating closing costs. To learn how to calculate typical seller closing costs, keep reading!