This article was co-authored by Jill Newman, CPA. Jill Newman is a Certified Public Accountant (CPA) in Ohio with over 20 years of accounting experience. She has experience working as an accountant in public accounting firms, nonprofits, and educational institutions, and has also honed her communication skills via an MA in English, writing jobs, and as a teacher. She received her CPA from the Accountancy Board of Ohio in 1994 and has a BS in Business Administration/Accounting.

This article has been viewed 154,420 times.

Contribution margin is a concept often used in managerial accounting to analyze the profitability of products. A single product's contribution margin is given with the formula P - V, where P is the cost of the product and V is its variable cost (the costs associate with resources used to make that item, specifically). In some cases, this measure may also be called a product's gross operating margin.[1] This is a useful concept for finding the amount of money a business can make from the sale of a product to pay for fixed costs (costs that don't vary based on production) and generate profit.

Steps

Finding a Product's Contribution Margin

-

1Determine the price of the product. The first variable you need to find for the contribution margin equation is the price the product is sold for.

- Let's follow along with an example problem in this section. For example, if you run a factory that manufactures baseballs, and sell the baseballs at $3 apiece, then you’ll use $3 for your baseballs' price.

-

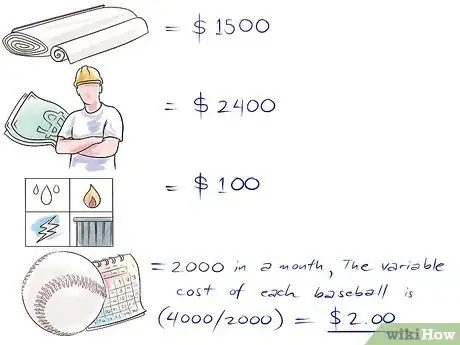

2Determine the variable costs associated with the product. Besides the product's cost, the only other variable we need to find to determine its contribution margin is its total variable cost. The variable costs associated with a product are those that change with the number of products made, like wages, materials, and utilities like power, water, and so on.[2] The more products made, the greater these costs will be — because these costs vary, they're called "variable" costs.

- For instance, in the baseball factory example, assume the total cost of the rubber and leather used to make the baseballs in the last month was $1500. On top of this, you paid your workers $2400 and your factory's utility bill amounted to $100, for a total of $4000 in variable costs. If the company produced 2000 baseballs in that month, then the variable cost of each baseball is (4000/2000) = $2.00.

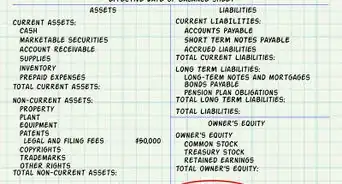

- Note that, in contrast to variable costs, fixed costs are those that do not change as production volume changes. For example, the rent that our company pays on its factory building will be the same no matter how many baseballs are produced. Rent, therefore, represents a fixed cost. Fixed costs are not included in the contribution margin calculation. Other common fixed costs are buildings, machinery, patent applications, etc.[3]

- Utilities might fall under both fixed and variable costs. For instance, the amount of electricity used by a store during operating hours is the same whether or not a single product is sold. But in a manufacturing plant, electricity may be a variable depending on the amount of product being manufactured. Determine whether or not you have any utilities that fall into the category of variable costs.

Advertisement -

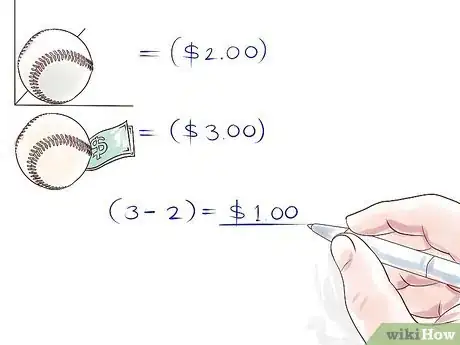

3Subtract the variable cost per unit from the price. When you know the variable cost and the price of a product, you're ready to find the contribution margin by simply subtracting the variable costs from the price. Your answer represents the amount of money from the sale of a single product that the company is able to use to pay fixed costs and generate profit.

- In the example, it's easy to find the contribution margin of each baseball. Simply subtract the variable costs per ball ($2.00) from the price per ball ($3.00) to get (3 - 2) = $1.00.

- Note that in real life, the contribution margin can be found on a business's income statement, a document companies publish for investors and the IRS[4] [5]

-

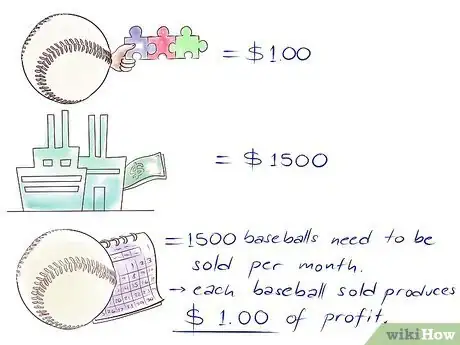

4Use the contribution margin to pay fixed costs. A positive contribution margin is almost always a good thing - the product recoups its own variable costs and contributes (hence "contributing" margin) a certain amount towards the fixed costs. Since the fixed costs don't increase with the amount of product produced, once they're paid off, the contributing margin from the remaining products sold becomes pure profit.

- In the example, each baseball has a contribution margin of $1.00. If the rent at the factory is $1500 and there aren't any other fixed costs, 1,500 baseballs need to be sold per month to recoup the fixed costs. After this point, each baseball sold produces $1.00 of profit.

Using the Contribution Margin

-

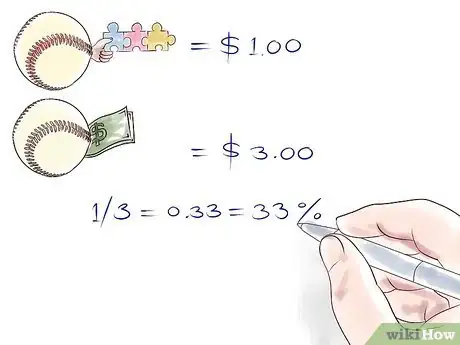

1Find the contribution margin ratio by dividing by the price. Once you find the contribution margin for a certain product, you can use it to perform a few basic financial analysis tasks. For instance, you can find the contribution margin ratio, a related value, by simply dividing the contribution margin by the price of the product. This represents the portion of each sale that makes up the contribution margin — in other words, the portion that's used for fixed costs and profit.[6]

- In the example above, the contribution margin per baseball was $1.00 and the price was $3.00. In this case, the contribution margin ratio was 1/3 = 0.33 = 33%. 33% of each sale goes towards paying fixed costs and making profit.

- Note that you can also find the contribution margin ratio for more than one product by dividing the total contribution margin for the products by the total price of the products.

- Keep in mind that you can calculate the contribution margin in a ratio, in total, and per unit, depending on what analysis is most useful. For example, you might use a total contribution margin figure to prepare a contribution margin income statement. Using a contribution margin income statement can help managers to better understand their own companies’ operations.

-

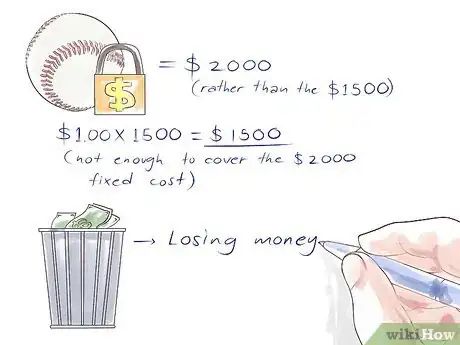

2Use the contribution margin for quick break-even analysis. In simplified business scenarios, if you know the contribution margin of a company's product and the fixed costs of the company, you can quickly estimate whether the company is profitable or not. Assuming the company isn't selling the product at a loss, all it needs to do to generate a profit is to sell enough products to pay for its fixed costs — the products already pay for their own variable costs. If enough products are sold to cover the fixed costs, the company begins to turn a profit.[7]

- For instance, let's say that our baseball company has fixed costs of $2,000, rather than the $1,500 given above. If we still sell the same number of baseballs, we'll generate $1.00 × 1,500 = $1,500. This isn't enough to cover the $2,000 in fixed costs, so in this situation we're losing money.

-

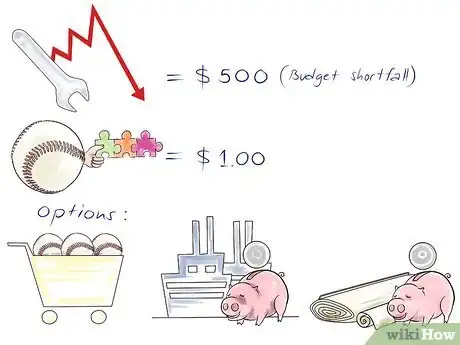

3Use the contribution margin (and ratio) to critique a business plan. Contribution margins can also be used to help make decisions about the way a business is run. This is particularly true if the business isn't making a profit. In this case, you can use your contribution margin to help set new sales goals or alternatively find a way to reduce your fixed or variable costs.

- For example, the measure may be used to identify areas where expenses need to be reduced. Let's say that we've been tasked with fixing the $500 budget shortfall from the example problem above. In this case, we have several options. Since the contribution margin is $1.00 per baseball, we might try to simply sell 500 more baseballs. However, we could also try moving our operations to a building with cheaper rent, lowering our fixed costs. We might even try using more affordable materials to drive down our variable costs.

- For instance, if we could shave $0.50 from the manufacture of each baseball, we'd make $1.50 per ball instead of $1.00, so if we sold the same 1,500 balls, we'd make $2,250, turning a profit.

-

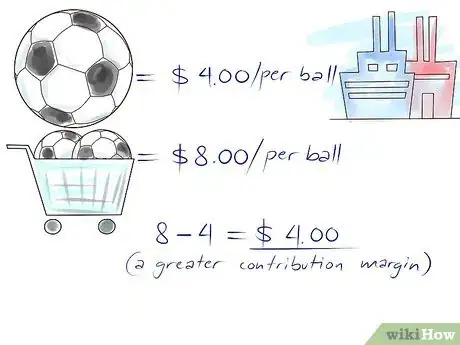

4Use the contribution margin to prioritize products. The contribution margin tells you how profitable one item in a product line is compared with another product, and this can help you to make decisions about a product line. If your company makes more than one product, the contribution margins of each product can help you decide how many of each to make. This is especially important if the products use the same materials or processes for their manufacture. In these situations, you must choose one product over the other, so you want to choose the one with as big of contribution margin as possible.[8]

- For instance, let's say our factory makes footballs in addition to baseballs. Footballs are more expensive to produce at $4 per ball but sell for $8 per ball, giving a greater contribution margin of 8-4= $4.00. If the footballs and baseballs are made from the same type of leather, we'd definitely want to prioritize football production — we get four times the contributing margin compared to our baseballs' $1.00.

- More importantly, in this situation the footballs offer a higher contribution margin ratio of 0.50 as compared to baseballs at 0.33. This means that they are more efficient at producing revenue for the company.[9]

References

- ↑ http://www.investopedia.com/terms/c/contributionmargin.asp

- ↑ http://economics.fundamentalfinance.com/micro_costs.php

- ↑ http://economics.fundamentalfinance.com/micro_costs.php

- ↑ http://www.myaccountingcourse.com/financial-ratios/contribution-margin

- ↑ http://www.investopedia.com/terms/i/incomestatement.asp

- ↑ http://www.investopedia.com/terms/c/contributionmargin.asp

- ↑ http://www.financeformulas.net/Contribution-Margin.html

- ↑ http://www.accountingtools.com/contribution-margin

- ↑ http://www.investopedia.com/terms/c/contributionmargin.asp

About This Article

To calculate contribution margin, start by finding out how much the product sells for. Next, determine the variable costs of the product, such as wages, materials, and utilities. Then, subtract the total variable costs from the price to find the contribution margin. For example, let's say a company sells baseballs for $3.00 each, with a variable cost of $2.00 per baseball. In that case, you would subtract $2.00 from $3.00 to get a contribution margin of $1.00. For more tips from our Accountant co-author, including how to use the contribution margin to critique a business plan, keep reading!