This article was co-authored by Michael R. Lewis. Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

This article has been viewed 252,309 times.

An implicit interest rate is the nominal interest rate implied by borrowing a fixed amount of money and returning a different amount of money in the future. For example, if you borrow $100,000 from your brother and promise to pay him back all the money plus an extra $25,000 in 5 years, you are paying an implicit interest rate. There are other situations in every day life where you will encounter implicit interest rates.

Steps

Calculating Implicit Interest Manually

-

1Define implicit interest. If you borrow money from someone and agree to pay it back with an additional amount, you are not specifying any interest or interest rate. Let's use the example that you borrow $100,000 from your brother and promise to pay him back in 5 years plus an extra $25,000. In order to find the interest rate that is "implicit" or "implied" in this agreement, you need to do a mathematical calculation.[1]

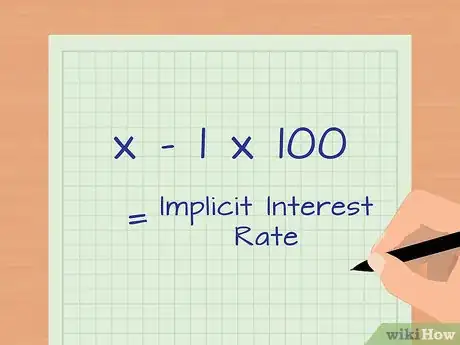

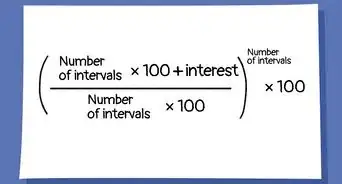

- The formula you will use is total amount paid/amount borrowed raised to 1/number of periods = x. Then x-1 x100 = implicit interest rate.

-

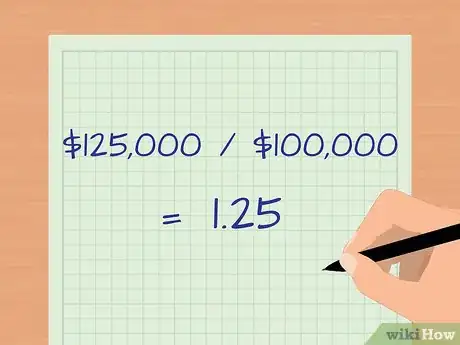

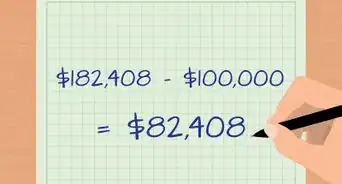

2Calculate the implicit interest amount. For the example in Step 1, first divide the total payback amount by the borrowed amount. In this example, you borrowed $100,000 and pay back a total of $125,000, so $125,000 divided by $100,000 is 1.25.[2]Advertisement

-

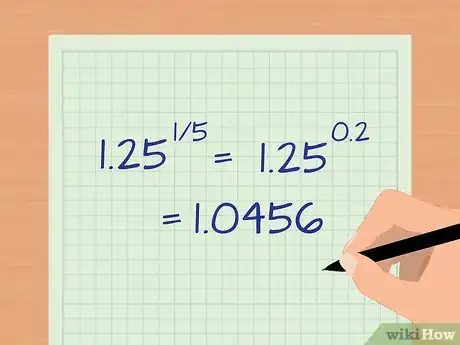

3Determine the number of years to repay. Raise the result of the first step to the power of 1/n, where n is the number of periods interest is paid. For simplicity, we can use n=5 for 5 years to calculate the implied annual interest rate. Thus, 1.25^(1/5) = 1.25^0.2 = 1.0456.[3]

-

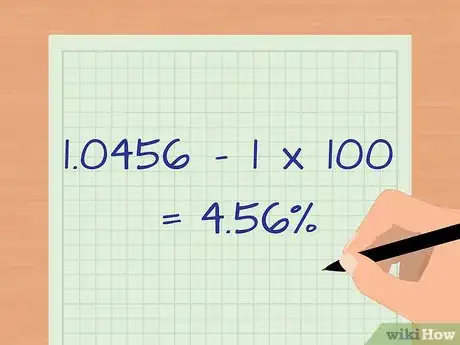

4Calculate the implied interest percent. Subtract 1 from the above result. Thus 1.0456-1 = 0.0456. Then multiply the above result by 100, to arrive at 4.56%, which is the implicit interest rate per year.[4]

Calculating Implicit Interest Using a Spreadsheet

-

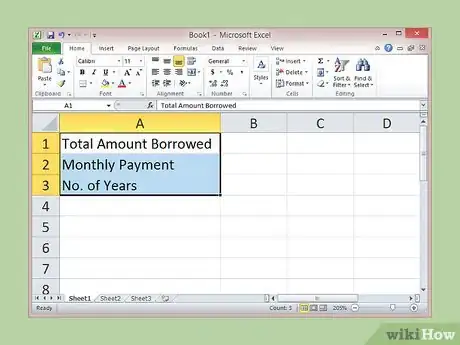

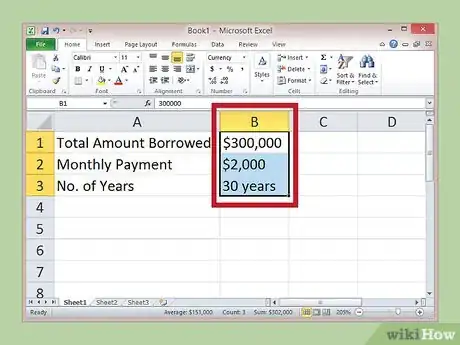

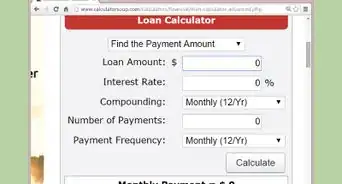

1Collect information needed for the implicit interest spreadsheet formula. This includes the number of periods such as months, total amount borrowed, monthly payment, and total number of years. You can find this information in your loan agreement.[5]

-

2Launch a computer spreadsheet application to help you calculate the implicit interest. Common spreadsheet programs include Microsoft Excel and iWork Numbers. You will be entering the data from Step 1 into a formula bar on the spreadsheet.[6]

-

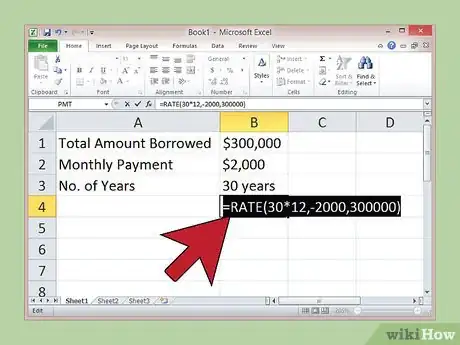

3Click on cell A1 and then on the formula bar located above the column names. If you are taking out a $300,000 real estate mortgage with monthly payments of $2,000 for 30 years, enter this function formula in the formula bar: =RATE(30*12,-2000,300000). Then hit return.[7]

- The function calculates the value at .59%, which is a monthly interest rate. To annualize this monthly rate, multiply it by 12, and you get an implicit annual interest rate of 7.0203%.[8]

Using Implied Interest

-

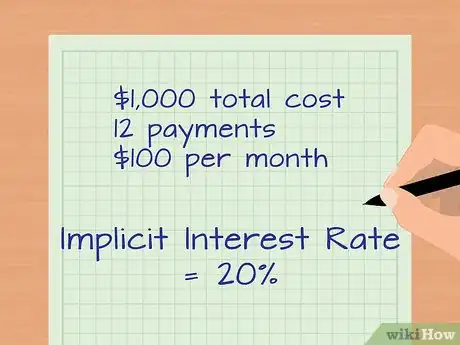

1Determine implicit interest for leases. Many times business owners lease rather than purchase equipment. While lenders do not have to charge an explicit rate in a lease agreement in the U.S., finance firms making the loan are required to calculate the cost of borrowing for you.

- For example, a food products company needs to lease a large pasteurizing machine. They decide to lease rather than purchase it. If the total cost of the lease is $1,000 and the company makes 12 payments of $100 per month, then the lease agreement has an implicit interest rate of 20%.

-

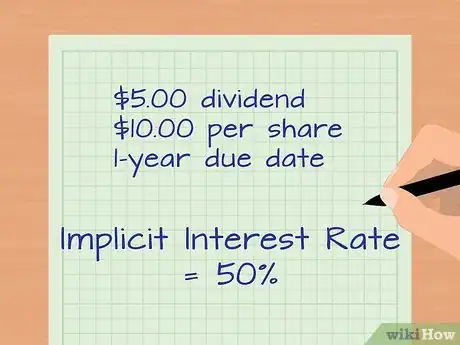

2Determine implicit interest for bond purchases. When purchasing bonds, an implicit interest rate is the difference between the current yield (dividend) paid on a bond and the rate that the bondholder will receive at a fixed point in the future. The implicit rate may change from the rate stated in the bond contract at the time of purchase, since bonds can rise or fall in value during the bond term.

- For example, you purchase bonds with a promised dividend of $5.00 per share to be paid in one year. Due to fluctuations in the marketplace, you receive $10.00 per share on the one-year due date. The implicit interest rate earned is 50%.

-

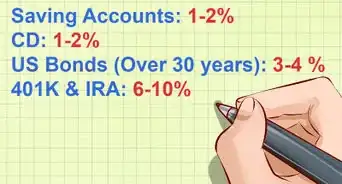

3Calculate implicit interest before borrowing or leasing. If there is not an explicit interest stated, you should always calculate the implied interest rate before signing a lease or taking out a loan. This rate will determine your total financing expense. Do not rely only on monthly payment amounts or short-term yields on bonds before making financing decisions.

References

- ↑ http://www.accountingcoach.com/blog/implicit-interest-rate

- ↑ http://www.accountingcoach.com/blog/implicit-interest-rate

- ↑ http://www.accountingcoach.com/blog/implicit-interest-rate

- ↑ http://www.accountingcoach.com/blog/implicit-interest-rate

- ↑ http://www.articlesfactory.com/articles/business/calculating-interest-rates-with-microsoft-excel.html

- ↑ http://www.articlesfactory.com/articles/business/calculating-interest-rates-with-microsoft-excel.html

- ↑ http://www.articlesfactory.com/articles/business/calculating-interest-rates-with-microsoft-excel.html

- ↑ http://www.articlesfactory.com/articles/business/calculating-interest-rates-with-microsoft-excel.html

About This Article

Implicit interest rate is the interest rate implied when borrowing a fixed amount of money and returning a different amount of money in the future. To calculate the implicit interest rate, divide the amount you’ll pay back by the amount you borrowed. Then, raise the result by the power of 1 divided by the number of periods, in this case years. So, if you borrow 100,000 dollars and promise to pay back 125,000 in 5 years, you’d divide 125,000 by 100,000 to give you 1.25. Then, raise this to the power of 1 divided by 5, which is 0.2, to give you 1.0456. Finally, subtract this by 1, then multiply it by 100 to give you the percentage. 1.0456 minus 1 would give you 0.456. Then, you'd multiply that by 100 and get 4.56. Therefore, the implicit interest rate is 4.56 percent. For more tips from our Financial co-author, including how to use a spreadsheet to calculate implicit interest rates, read on!