This article was co-authored by Clinton M. Sandvick, JD, PhD. Clinton M. Sandvick worked as a civil litigator in California for over 7 years. He received his JD from the University of Wisconsin-Madison in 1998 and his PhD in American History from the University of Oregon in 2013.

There are 7 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 17,159 times.

When you work more than 40 hours in a week, federal law mandates that you be given overtime pay. This law only applies to workers making an hourly wage and does not apply to managers or independent contractors. Federal law will dictate how your working arrangement is defined. In some situations, however, you may be offered compensatory time, called “comp time.” You can accrue comp time for working extra hours instead of earning overtime. Before choosing between compensatory time and overtime pay, you need to first calculate your overtime pay accurately. Then you need to consider whether you need extra money or extra time off.

Steps

Calculating Your Overtime Pay

-

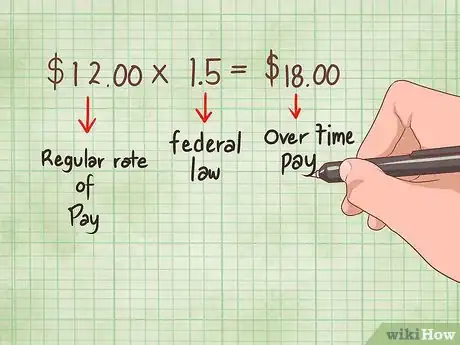

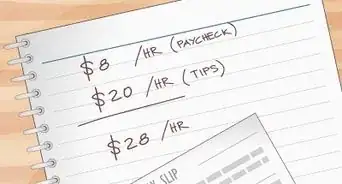

1Calculate your regular rate of pay. Federal law requires that you be paid 1.5 times your base pay for each hour worked over 40 hours in a week.[1] You should first calculate your base rate of pay. For example, if you are paid $12.00 an hour, then this is your regular rate of pay.

- If you are paid a salary, then you need to divide your salary by 40 hours in order to get a regular rate of pay.

- Under federal law, a worker with a base pay of $12.00 will earn $18.00 in overtime pay.

-

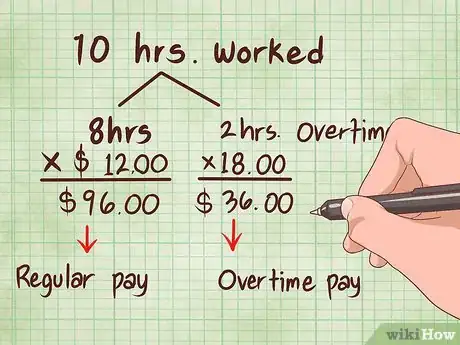

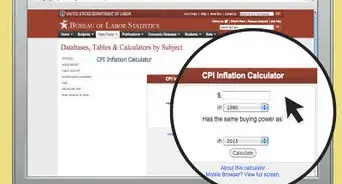

2Find your state overtime laws. States can also pass their own overtime laws provided the state law is more generous to workers than the federal law. In California, for example, you can get overtime pay if you work more than eight hours in a day. If you work more than 12 in a day, then you get double pay.[2]

- For example, if you work 10 hours in a day, then you must be paid overtime for the two extra hours on that day, even if you work 40 hours or less for the entire week.

- California also grants overtime pay if you work seven consecutive days. On the seventh day, you earn 1.5 your regular rate of pay. If you work more than eight hours on the seventh day, then you earn double the pay.

- To find your state’s overtime rules, you should contact your state’s Department of Labor. You can find contact information on the Internet.

Advertisement -

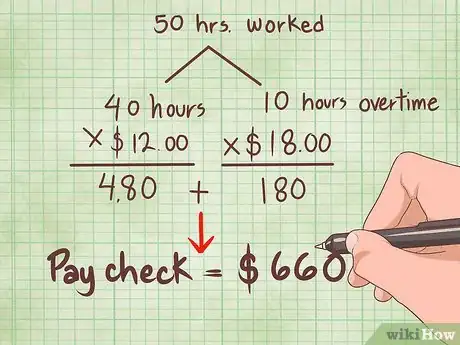

3Estimate how much overtime you would earn. Before you can choose between comp time and overtime pay, you should calculate how much you will be paid if you work overtime. For example, if your regular rate of pay is $12.00, then you will earn $18.00 for every hour of overtime.

- If you worked 50 hours in a week, then you would earn $480.00 in regular pay and then an additional $180.00 in overtime pay. Your total paycheck would be $660.00.

-

4Call your state agency with questions. Each state has an agency that handles wage and hour issues. It is usually the Department of Labor. You can direct any questions you have about how overtime pay is calculated to the agency.

- To find your state agency, you can visit the Workplace Fairness website. They have a map of the United States.[3] Click on your state, and you will be provided with the name and contact information of your state’s agency.

Calculating Comp Time

-

1Figure out how comp time is calculated. It is a common misconception that you will earn one comp time hour for each extra hour worked in a week.[4] However, federal law mandates that you be given 1.5 hours in compensatory time for each extra hour worked in a week unless you are exempt from the federal overtime laws.[5]

- Before you can choose between overtime pay and comp time, you should understand how the comp time is calculated. Look at your employee manuals, which should explain the formula. If nothing is listed in the manual or in your employment contract, then contact Human Resources.

- If you are unionized, then read your collective bargaining agreement. This agreement should spell out how compensatory time is calculated.

-

2Ask if you can take comp time whenever you want. Your employer might try to put limits on when you can take your extra time off. You should know this before choosing between comp time and overtime pay. You don’t want to choose comp time based on a false belief that you can take the time whenever you want.

- You can ask your supervisor about the policy on taking comp time. However, you should also check with coworkers, who are more likely to be honest with you. If you are new to a workplace, then ask other people in comparable positions if they have had a problem taking time off.

- If you have been with the organization for some time, then think about how difficult it has been to get vacation days off. An employer who tries to limit your use of vacation or personal days is unlikely to let you take comp time.

- Your employer may also decide to send you home when work is slow. To get paid, you would then use your comp time.[6] This might not be an ideal situation for you because you do not control when you take your comp time. You should ask your employer whether this is a possibility.

-

3Ask about “cashing out” comp time. You should understand the policies for “cashing out” accrued comp time. For example, you might want to accrue comp time during the year and then decide at year’s end whether to cash out the comp time.

- If your employer is flexible about cashing out comp time, then it is a more attractive option than overtime, since you can’t convert overtime pay into extra time off from work.

-

4Check the maximum number of hours you can accrue. You might be limited in the maximum number of comp time hours you can accrue. You should know this fact as well. For example, federal law generally limits the maximum number of comp hours to 240.[7] State law and workplace policies might also limit the total amount of comp hours you can carry at any one time.

- If you work in a seasonal, emergency response, or public safety activity, then you can accrue up to 480 hours under the federal law.[8]

Determining Your Needs

-

1Determine how much money you need. If you are given the choice between comp time and overtime pay, you should consider which you need more: extra money or extra time off. This may or may not be an easy choice.

- Think about any major expenses you have on the horizon: home repairs, health care costs, trips for vacation, etc. Check if you have the money to cover the costs. If not, you might want to take overtime over comp time.

- Also consider demands on your time. You might need time off to take care of a sick relative, take an extended vacation, recover from surgery, or finish education requirements. If you can’t easily fit these demands into your schedule, then you might decide that comp time is more important than overtime pay.

- Be sure to discuss your decision with friends and family. You should get feedback from the people closest to you about whether or not you should take compensatory time or overtime. Your children, for example, can let you know about upcoming events that you might want to attend.

-

2Figure out if your employer has a preference. You might not care whether or not you take overtime or comp time; nevertheless, your employer might have a strong preference for one over the other. Sometimes, employers are worried about paying too much in salary and would prefer that their employees take comp time.

- You should consider how important it is to keep your employer happy. If you are new at a job or do not want to make waves for any reason, then you should try to take whichever your employer prefers. You can ask your boss if he or she has a preference for whether or not you accept overtime or comp time.

-

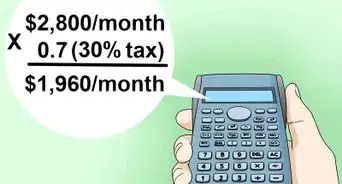

3Understand the tax consequences. Your income tax is based on the income that you earn in a year.[9] This includes your overtime pay. Before accepting overtime pay, you need to calculate how the extra pay will impact your taxes.

- You should meet with a tax professional to discuss the consequences of taking overtime pay. To find a qualified tax professional, see Hire an Accountant.

References

- ↑ http://www.dol.gov/whd/overtime_pay.htm

- ↑ http://www.dir.ca.gov/dlse/faq_overtime.htm

- ↑ https://www.workplacefairness.org/state-agencies

- ↑ http://www.twc.state.tx.us/news/efte/advanced_flsa_issues.html

- ↑ http://www.wagehourinsights.com/wage-and-hour-faqs/can-employers-offer-compensatory-time-to-exempt-employees-wage-hour-faq/

- ↑ http://canons.sog.unc.edu/?p=7019

- ↑ http://www.wagehourinsights.com/wage-and-hour-faqs/can-employers-offer-compensatory-time-to-exempt-employees-wage-hour-faq/

- ↑ http://www.wagehourinsights.com/wage-and-hour-faqs/can-employers-offer-compensatory-time-to-exempt-employees-wage-hour-faq/

- ↑ https://turbotax.intuit.com/tax-tools/tax-tips/Taxes-101/What-are-Income-Taxes-/INF14797.html