This article was co-authored by wikiHow Staff. Our trained team of editors and researchers validate articles for accuracy and comprehensiveness. wikiHow's Content Management Team carefully monitors the work from our editorial staff to ensure that each article is backed by trusted research and meets our high quality standards.

This article has been viewed 61,979 times.

Learn more...

A limited liability company (LLC) has many advantages as a business form. For example, an LLC can shield you as an owner from personal liability for any of the company’s legal obligations. An LLC also typically requires less paperwork.[1] You can easily create an LLC in South Carolina by completing a few forms. Begin by choosing your business name and reserve the name if necessary. Then file Articles of Organization with the state Secretary of State’s office. Before you can open your doors, you must obtain necessary tax IDs and business licenses.

Steps

Choosing a Name

-

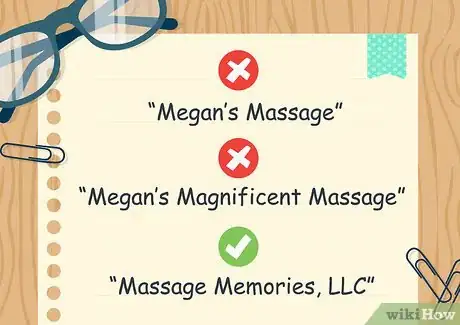

1Come up with an appropriate name. Choose something that is memorable but that also reminds people of your business. Avoid names that are too long or confusing.[2] For example, “Megan’s Massage” is basic but boring. “Megan’s Magnificent Massage” is wordy. “Massage Memories, LLC” might be just right.

- Make sure that your name contains the required designation. Your name must contain the words “Limited Company” or “Limited Liability Company” or the abbreviations “L.C.,” “LC,” L.L.C.,” or “LLC.”

- You can also abbreviate “Limited” to “Ltd.” and “Company” to “Co.”

-

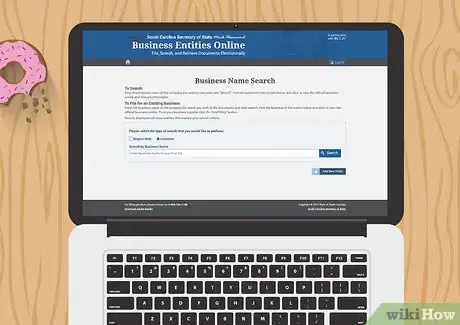

2Search whether the name is available. You can’t use a name if someone else is already using it. Accordingly, search the business name database at the Secretary of State’s website: https://businessfilings.sc.gov/BusinessFiling/Entity/Search.

- Also check whether the URL is available. If you create a website, then you’ll want the URL to be your business name. Check by typing in different combinations of your name and seeing if someone is already using it.

- You can also use websites such as Instant Domain Search or GoDaddy’s domain search.

Advertisement -

3Reserve your name. You can reserve a name for 120 days if you pay $25. Complete the “Application to Reserve Name,” which is available at the Secretary of State’s website. You don’t have to reserve the name if you are ready to file your Articles of Organization.

- Submit two copies of your completed form to Secretary of State, 1205 Pendleton Street, Suite 525, Columbia, SC 29201.

- Make your check payable to the South Carolina Secretary of State.

-

4Register your trademark. Registering your trademark is not required. However, it can provide you with extra protection in case someone uses your name to sell goods or services. You can apply for a trademark by filing an application with the United States Patent and Trademark Office (USPTO). You may register both your name and any logo you use.

- You already have trademark rights as soon as you start using the name in connection with the sale of your goods or services.

- However, registration allows you to sue in federal court and is proof of your right to use the mark exclusively throughout the country.[3]

Filing Your Articles of Organization

-

1Download the form. The Secretary of State provides a printed, fill-in-the-blank form you can use for your Articles of Organization.

- You may also submit your Articles of Organization online at the state’s Business One Stop website. You will need to create a user account first.

-

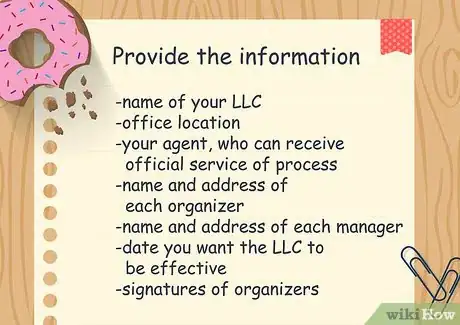

2Provide the requested information. You can type your information into the form or print neatly in black ink. Provide the following information in the space provided:

- name of your LLC

- office location

- your agent, who can receive official service of process

- name and address of each organizer

- name and address of each manager

- date you want the LLC to be effective (if not immediately)

- signatures of organizers

-

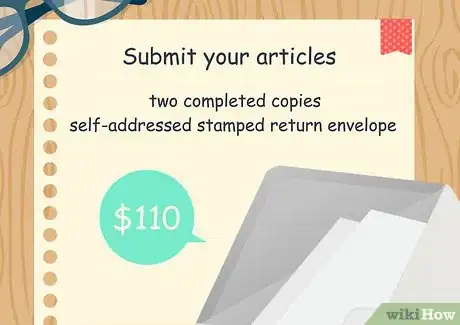

3Submit your articles. You must submit two completed copies of the form along with a self-addressed stamped return envelope. The filing fee is $110, made payable to the South Carolina Secretary of State.

- Send to the following address: South Carolina Secretary of State’s Office, Attn: Corporate Filings, 1205 Pendleton Street, Suite 525, Columbia, SC 29201.

Completing Other Requirements

-

1Draft your operating agreement. The operating agreement contains important information about the LLC. Although it isn’t required, your business will benefit from having one. Keep a copy at your primary business address. A properly drafted operating agreement will contain the following information:[4]

- members’ percentage ownership in the LLC

- members’ voting powers

- members’ rights and responsibilities

- rules for daily management of the LLC

- rules for how meetings may be called

- provisions for members selling their interest in the LLC

-

2Obtain an Employer Identification Number (EIN). You can get the EIN from the IRS website: https://www.irs.gov/businesses/small-businesses-self-employed/apply-for-an-employer-identification-number-ein-online. If your LLC has only one member, you can use your Social Security Number provided you don’t have any employees.[5] However, if you have two or more members, then get the EIN.

-

3Register with the state Department of Revenue. You’ll need a state tax ID if you collect sales tax or if you have employees. Register with the state’s Department of Revenue.[6]

- You can register at the MyDORWAY website here: https://dor.sc.gov/mydorway. Click on the green button to start the registration process.

-

4Get required business licenses. Before you can begin business, you’ll need certain local business licenses or permits. There is no statewide business license in South Carolina. Instead, you’ll need a business license in all municipalities where you conduct business.

- You can find out what you need by visiting the South Carolina Business One Stop website.

-

5Hire employees appropriately. If your LLC will have employees, then you need to take additional steps. For example, do the following:

- Obtain a Withholding number from the Department of Revenue.

- Get unemployment insurance from the South Carolina Department of Employment and Workforce.

- Verify your employees’ legal authorization to work using E-Verify. Retain Form I-9 for each employee.

- Report new employees to the Department of Social Services.

Community Q&A

-

QuestionI don't have to have an attorney to form an LLC?

Community AnswerNo, but you do need a registered agent which can be yourself. I recommend having an attorney be your registered agent, though. It will save you on junk mail and you won't have to publish your personal address online.

Community AnswerNo, but you do need a registered agent which can be yourself. I recommend having an attorney be your registered agent, though. It will save you on junk mail and you won't have to publish your personal address online. -

QuestionDo I have to be a citizen to form an LLC in South Carolina?

Community AnswerNo, there isn't any citizenship requirement.

Community AnswerNo, there isn't any citizenship requirement.

References

- ↑ https://www.sba.gov/starting-business/choose-your-business-structure/limited-liability-company

- ↑ https://www.entrepreneur.com/article/21774

- ↑ https://www.uspto.gov/trademarks/basics/register.jsp

- ↑ http://www.nolo.com/legal-encyclopedia/llc-operating-agreement-30232.html

- ↑ http://www.nolo.com/legal-encyclopedia/south-carolina-form-llc-32017.html

- ↑ http://www.nolo.com/legal-encyclopedia/south-carolina-form-llc-32017.html