X

This article was co-authored by Clinton M. Sandvick, JD, PhD. Clinton M. Sandvick worked as a civil litigator in California for over 7 years. He received his JD from the University of Wisconsin-Madison in 1998 and his PhD in American History from the University of Oregon in 2013.

This article has been viewed 24,421 times.

Closing costs are fees that you must pay whenever real estate is conveyed. There are many kinds of closing costs which can total around three percent of the purchase price of a piece of real estate.[1] Accordingly, if you take out a loan for $100,000 you could owe around $3,000 in closing costs alone. To pay, you can take out a larger loan or ask the seller of the real estate to pay for the costs.

Steps

Part 1

Part 1 of 2:

Calculating Closing Costs

-

1Identify types of closing costs. Closing costs are fees that you must pay in order to purchase real estate. These fees are in excess of the purchase price set by the seller. What fees you must pay will depend on the type of loan that you get. For example, the Federal Housing Authority allows the following closing costs to be charged to the buyer when taking out an FHA loan:[2]

- lender’s origination fee

- deposit verification fees

- home inspection fees (up to $200)

- attorney’s fees

- fees for an appraisal and inspection

- a credit report

- a property survey

- the costs of preparing the documents

- government recording charges and transfer taxes

-

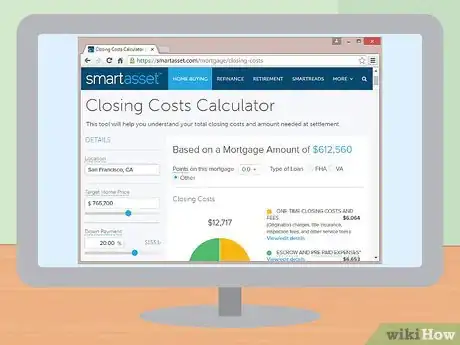

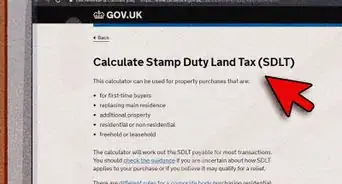

2Use a closing costs calculator. You can estimate your closing costs by using one of the many calculators on the Internet. The Bank of America calculator asks that you enter the following information:[3]

- your zip code

- the purchase price

- down payment (as a percentage of the purchase price)

- how long the loan term is (15/20/30 years)

- the type of loan (whether fixed-rate or an adjustable-rate mortgage)

Advertisement -

3Talk to your real estate agent. If you have questions about closing costs, you should talk to your real estate agent. Your agent may also have tips for lowering your closing costs.

- For example, you should probably try to close at the end of the month. If you close earlier in the month, then you will have to pay per diem interest on the remaining days in the month.[4]

Advertisement

Part 2

Part 2 of 2:

Paying Closing Costs

-

1Ask for a seller credit. Sellers can contribute up to six percent of the sales price. This is a “credit” which the seller can deduct as a tax expense.[5] You can have your realtor ask the sellers if they are willing to extend the credit to cover the closing costs.

- Whether you are successful will largely depend on whether the seller has multiple bids on the property. In a hot real estate market, you probably will not be successful.

-

2Wrap the costs into the loan. Another way to pay the closing costs is to take out a slightly larger loan so that you can cover the costs. The lender will probably charge you more if you choose to wrap the closing costs into the loan, but it may be your only option.[6]

- Not every lender will allow you to roll in your closing costs with the loan. You should call your lender and ask.

-

3Look into discount programs. There are many programs that exist for certain groups that help with closing costs. For example, programs exist for union members or for bank members. Look into whether or not your bank offers a “loyalty program.” These programs can offer reduced origination fees for certain customers.[7]

- You should contact your bank or union to ask if any program is available for you.

-

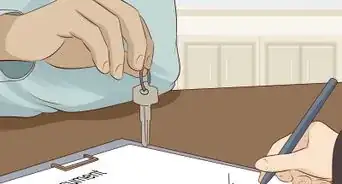

4Get a certified check or a cashier’s check. If you can’t get the seller to give you credit or can’t get the costs wrapped into a loan, then you need to pay by check. Borrow the money from relatives if you need to. You can’t close on the property without paying for closing costs.

- Typically, you cannot pay with a personal check. Instead you will need a cashier’s or certified check.[8]

- To get a certified check, you need to go to your bank and ask the teller for one. The teller will then make sure that the amount of the check is made unavailable to you. For example, if you have $5,000 in your checking account and get a $4,000 certified check, then you will only have access to $1,000. A certified check, therefore, provides assurance to the title company that the money is in your account.[9]

- You can get a cashier’s check from the bank as well. With a cashier’s check, the bank moves the money out of your account and into the bank’s own account. Then the teller will draw a check from the bank’s account.[10]

Advertisement

References

- ↑ https://www.bankofamerica.com/home-loans/mortgage/closing-your-loan/what-happens-at-closing.go

- ↑ http://www.fha.com/fha_requirements_closing_costs

- ↑ https://www.bankofamerica.com/home-loans/mortgage/closing-costs-calculator.go

- ↑ http://www.realtor.com/advice/reduce-closing-costs/

- ↑ http://www.realtor.com/advice/reduce-closing-costs/

- ↑ http://www.realtor.com/advice/reduce-closing-costs/

- ↑ http://www.realtor.com/advice/reduce-closing-costs/

- ↑ https://www.bankofamerica.com/home-loans/mortgage/closing-your-loan/what-happens-at-closing.go

- ↑ http://www.mybanktracker.com/news/2013/02/07/when-need-certified-checks/

About This Article

Advertisement