This article was co-authored by Michael R. Lewis. Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

There are 11 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 113,851 times.

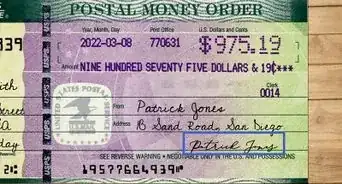

Many banks now offer customers extensive services through online banking. Common transactions, such as paying bills and rent, can be completed by transferring money online. Online banking can also provide a convenient and secure alternative to immediate payment services like cashier's checks and money orders. Once you have an online account with your bank, it is simply a matter of knowing the options your bank offers for transferring money online, and which one is right for your transaction.

Steps

Preparing to Transfer Funds Online

-

1Register for Internet banking. If you have a current account with a bank, and it offers online or mobile banking, sign up for an online account if you are not automatically registered for one. Visit your bank's webpage and search for “online banking” or “internet banking.” Follow the instructions for setting up an account. These will vary somewhat from bank to bank, but generally they will ask you to:

-

2Sign in to your online banking account. Once you have registered for online banking, and created an account, you will need to log in whenever you want to make to send money through Internet banking.Advertisement

-

3Locate the transfer function. After you have logged in to your Internet banking account, you will need to find the section for sending money. Your account interface should have a tab or section labeled “transfers,” “send money,” or something similar.[3] [4] If you cannot locate this section, search for these terms or contact your bank's customer service department.

-

4Select the kind of transfer you would like to make. Common types of transfers available through Internet banking include general transfers (to an account you hold, or to another recipient's account), wire transfers (typically for larger amounts of money), and transfers sent abroad (which need additional information). Your bank's Internet banking interface will allow you to select from among the options that are available to you.

-

5Make sure you understand any fees associated with transfers. Fees associated with sending money by Internet banking vary from bank to bank and may depend on the type of transaction. For instance, many banks will not charge a fee to transfer money between different accounts you have, or to send money to another customer of the same bank, but might charge a fee to send money abroad by wire transfer.[5]

-

6Practice safety when using Internet banking. Banks take many measures to ensure security for their customers, especially for Internet banking.[6] Many banks also have a no-fraud guarantee that reimburses you if you are the victim of fraud.[7] You can help keep your accounts and transactions secure by:

</ref>

-

1

- Creating a strong password.

- Keeping your username and password confidential. Don't write them down, or store them in your phone.

- Logging off of your Internet banking account when you are finished with your transaction, or if you have to leave your computer unattended.

- Not transferring money to individuals, companies, or organizations you don't know or can't verify.

- Checking your balance and transaction history on a regular basis, and letting your bank know of any suspicious activity.

Sending General Transfers

-

1Select the recipient of your funds. Once you are logged in to your Internet banking account and have selected the transfer function, you will need to enter the account information of the person or entity you would like to send money to. Typically, this includes the recipient's bank account number and bank routing number.[8]

- Many banks will allow you to send money to another of your own accounts simply by selecting that account (from a dropdown menu, for example).

- Contact the recipient if you are not sure of the right account number or routing number to use.

- Some banks will allow you to send money using only a recipient's email address or mobile number.[9] [10]

- Many online banking services will allow you to save a recipient's information in your account. This can save you time if you will frequently be sending money to that recipient.

-

2Enter the amount you would like to send. Make sure that you have sufficient funds in your account to cover the amount you would like to send. Remember that recently-deposited funds might take a while to become available in your account.

-

3Select when you would like the transfer to go through. By using a dropdown menu or entering in a date and time, you will be prompted to select when you want to send your money. Typically, you can choose to have a transfer go through immediately, or at a specified later date and time. In many cases, you can also arrange to have a certain transfer be recurring (such as to pay a monthly bill).

- Many banks will set a transfer time of immediately or same day by default, so make sure to check and change this if necessary.[11]

-

4Review your transfer details and confirm the transaction. Once you have selected the kind of transfer you want to make, and have entered all of the required information, you should review the details of your transaction. Make sure that everything (recipient information, amount of money, etc.) looks correct, and click to complete the transfer transaction. Ordinarily, your bank will give you a confirmation of the transfer, through the Internet banking interface, by email or by text message.

Sending Money as a Wire Transfer

-

1Understand the guidelines for wire transfers. If you need to send a large amount of money, your options may include a wire transfer, which is a method for sending funds electronically. You may be able to order a wire transfer through your Internet banking account.

-

2Select the recipient of your funds. Once you are logged in to your Internet banking account and have selected the wire transfer function, you will need to enter the account information of the person or entity you would like to send money to. Typically, this includes the recipient's bank account number and bank routing number.

- Depending on the bank or wire service you use, you may also be asked to enter additional information such as a SWIFT (Society for Worldwide Interbank Financial Telecommunication) Code, which is used for identifying banks.[14] [15] [16] Contact your institution's customer service department if you have trouble locating such information.

-

3Enter the amount you would like to send. Make sure that you have sufficient funds in your account to cover the amount you would like to send. Remember that recently-deposited funds might take a while to become available in your account.

-

4Select when you would like the transfer to go through. By using a dropdown menu or entering in a date and time, you will be prompted to select when you want to send your money. Typically, you can choose to have a transfer go through immediately, or at a specified later date and time. In many cases, you can also arrange to have a certain transfer be recurring (such as to pay a monthly bill).

- Many banks will set a transfer time of immediately or same day by default, so make sure to check and change this if necessary.[17]

-

5Review your transfer details and confirm the transaction. Once you have selected the kind of transfer you want to make, and have entered all of the required information, you should review the details of your transaction. Make sure that everything (recipient information, amount of money, etc.) looks correct, and click to complete the transfer transaction. Ordinarily, your bank will give you a confirmation of the transfer, through the Internet banking interface, by email or by text message.

Sending Money Abroad

-

1

-

2Select the recipient of your funds. You will need to enter the account information of the person or entity you would like to send money to. Typically, this includes the recipient's bank account number and bank routing number.

- Depending on the bank or wire service you use, you may also be asked to enter additional information such as a SWIFT (Society for Worldwide Interbank Financial Telecommunication) Code, which is used for identifying banks.[20] Contact your institution's customer service department if you have trouble locating such information.

-

3Choose the currency you want to use. Many banks offer the option of sending money abroad in either your local currency or in the currency of the recipient's country.[21] [22] [23]

- If you choose to send money in the currency of your recipient's location, your bank will typically use a current rate based on currency exchange markets, and let you know this rate before you complete your transaction. This option is a good choice if you need to send an exact amount in the recipient's currency.

- If you choose to send money in your local currency, the exchange rate may be set by the recipient's bank. This option is a good choice if you want to know exactly how much money in your local currency will be debited from your account.

-

4Enter the amount you would like to send. Make sure that you have sufficient funds in your account to cover the amount you would like to send. Remember that recently-deposited funds might take a while to become available in your account.

-

5Select when you would like the transfer to go through. By using a dropdown menu or entering in a date and time, you will be prompted to select when you want to send your money. Typically, you can choose to have a transfer go through immediately, or at a specified later date and time. In many cases, you can also arrange to have a certain transfer be recurring (such as to pay a monthly bill).

- Many banks will set a transfer time of immediately or same day by default, so make sure to check and change this if necessary.[24]

-

6Review your transfer details and confirm the transaction. Once you have selected the kind of transfer you want to make, and have entered all of the required information, you should review the details of your transaction. Make sure that everything (recipient information, amount of money, etc.) looks correct, and click to complete the transfer transaction. Ordinarily, your bank will give you a confirmation of the transfer, through the Internet banking interface, by email or by text message.

Expert Q&A

-

QuestionWhat is a clean bill certificate code?

Michael R. LewisMichael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

Michael R. LewisMichael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

Business Advisor According to the U.S. Comptroller of the Currency, the term is associated with a Nigerian scam to get funds for this fictions code as well as private information that can be used for identification theft.

According to the U.S. Comptroller of the Currency, the term is associated with a Nigerian scam to get funds for this fictions code as well as private information that can be used for identification theft.

References

- ↑ http://promo.bankofamerica.com/sendmoney/

- ↑ http://www.bankofscotland.co.uk/aboutonline/

- ↑ http://promo.bankofamerica.com/sendmoney/

- ↑ https://www.53.com/personal-banking/account-management/internet-banking/transfer-funds.html

- ↑ https://www.bankofamerica.com/onlinebanking/education/ways-to-send-money.go

- ↑ https://www.bankofamerica.com/onlinebanking/online-banking-security-guarantee.go

- ↑ http://www.bankofscotland.co.uk/aboutonline/

- ↑ https://www.bankofamerica.com/onlinebanking/education/ways-to-send-money.go

- ↑ http://promo.bankofamerica.com/sendmoney/

- ↑ https://www.53.com/personal-banking/account-management/internet-banking/transfer-funds.html

- ↑ http://www.bankwest.com.au/help/personal/online-banking/payments-transfers

- ↑ https://www.bankofamerica.com/onlinebanking/education/ways-to-send-money.go

- ↑ http://www.us.hsbc.com/1/2/home/personal-banking/pib/money-transfers/wire

- ↑ https://www.bankofamerica.com/deposits/manage/faq-wire-transfers.go#question2

- ↑ http://www.us.hsbc.com/1/2/home/personal-banking/pib/money-transfers/wire

- ↑ http://www.bankwest.com.au/help/personal/online-banking/payments-transfers

- ↑ http://www.bankwest.com.au/help/personal/online-banking/payments-transfers

- ↑ http://www.barclays.co.uk/P1242593395280

- ↑ http://www.bankwest.com.au/help/personal/online-banking/payments-transfers

- ↑ http://www.barclays.co.uk/P1242593395280

- ↑ http://www.barclays.co.uk/P1242593395280

- ↑ https://international.lloydsbank.com/guidance/sending-money-abroad/

- ↑ http://www.bankofscotland.co.uk/onlinebankinghelp/international-payments/

- ↑ http://www.bankwest.com.au/help/personal/online-banking/payments-transfers

- ↑ http://promo.bankofamerica.com/sendmoney/

- ↑ https://international.lloydsbank.com/guidance/sending-money-abroad/

- ↑ http://www.bankwest.com.au/help/personal/online-banking/payments-transfers