This article was co-authored by Darron Kendrick, CPA, MA. Darron Kendrick is an Adjunct Professor of Accounting and Law at the University of North Georgia. He received his Masters degree in tax law from the Thomas Jefferson School of Law in 2012, and his CPA from the Alabama State Board of Public Accountancy in 1984.

There are 9 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 14,675 times.

Saving money for taxes can be confusing. If you're self-employed, though, putting aside money is a necessity because you don't have an employer to withhold taxes. When you set aside money, you need to know how much to save and have a place to put it. Then when the quarterly payment rolls around, you need to send in your estimated payments.

Steps

Calculating What You Owe

-

1Use Form 1040-ES to estimate your taxes if you know this year's salary. This form helps you figure out what you owe in taxes. It is the most accurate way to make this estimation if you know exactly what you're going to make this year. Find the form at https://www.irs.gov/pub/irs-pdf/f1040es.pdf.

- Fill in your expected income, and follow the instructions line-by-line. You'll need a calculator to figure out percentages, but the form walks you through it.

- Have last year's taxes nearby so you know what deductions you normally take.

- The form will give you one large number and have you divide it into 4 payments. One payment is how much you need to save and send each quarter.

-

2Have an accountant estimate your taxes for accuracy. If you have an accountant do your taxes each year, they can also help you estimate your quarterly payments. That way, you don't have to figure out what you need to save. Your accountant will tell you.[1]Advertisement

-

3Look at last year's taxes as an easy way to figure out what you owe. This method will give you a general figure for how much you'll owe this year, though not exact. Nonetheless, using this figure will keep you from paying a penalty. Use the final amount you paid to figure out this year's estimated payments.[2]

- The IRS may require you to pay a penalty if you don't pay in enough taxes in your quarterly payments. However, if you pay in 100% (or in some cases 90%) of your prior year estimate, the IRS won't penalize you for underpayment.

-

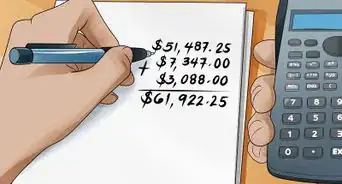

4Take out 25% if your income varies from year to year. If you don't want to do the math, then use 25% as the amount you need to save. It's just an estimate, but it should cover the bulk of the taxes you need to pay. This method works well if you have a variable income since you just take out an even percentage.[3]

- Keep in mind, though, that this number is only an estimate. You may still owe money or be due a refund depending on what you make.

- 30% may be a safer bet if you live in a state that has high income taxes.[4]

-

5Check your state's website to figure out your tax bracket. If you live in a state that collects state income tax, look that up as well. Usually, the state will have a bracket system where you can look up the percentage of income you owe.

- In some states, you may also owe city and county income taxes.

Setting Aside Money

-

1Open a new savings account for your tax money. You may be tempted to just drop the money you save for taxes into your regular savings account. While you can do it that way, you're more likely to spend it if it's easily accessible. Putting it in a separate savings account makes it less tempting.[5]

- Consider opening a new savings account with a separate bank so it takes more time to transfer money back to your regular account. The time difference will act as a deterrent against you taking money out when you shouldn't.

- Try to choose an account with a high interest rate so you make money while you're saving.

-

2Take out money when your checks come in. When you get a check, automatically put aside the percentage you decided on above. Take it out before you do anything else, so you don't accidentally spend it on something else.

- For instance, say you get a check for $1,000 USD. If you determined your percentage to set aside is 25%, you'd put $250 USD in your special savings account.

- If you figured out what you owe quarterly instead of a percentage, estimate how much you'll need to take out of each check to make that payment.

- For instance, if you normally make $15,000 USD over 4 months and your estimated payment needs to be $4,000 USD, then make sure you're saving $1,000 USD per month.

-

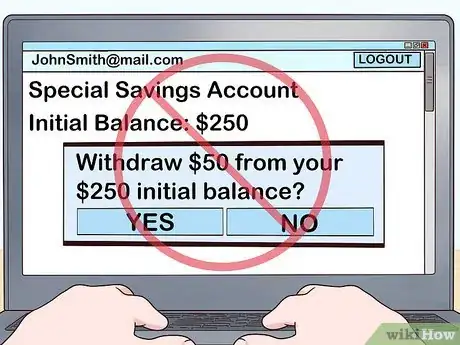

3Leave the money alone until you want to make a payment. It can be tempting to spend the money you're setting aside. However, do not think of it as part of your paycheck. That's why you take it out immediately. This money is tax money, and you don't want to be short when it comes time to pay.[6]

Sending in Payments

-

1Send in your estimated tax payment 4 times a year. The due dates for estimated taxes are 4 times a year, mid-April, mid-June, mid-Sept, and mid-January. Check the current year schedule to find the exact dates.[7]

-

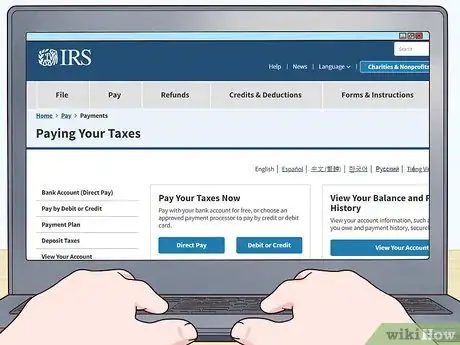

2Pay online at https://www.irs.gov/payments. The easiest way to make a payment is through the IRS website. Pay using your bank account for free or with a credit or debit card for an extra fee.[8]

- Choose between 3 websites to make a payment by credit or debit card. Each site has different fees for both types of cards.[9]

- You can also use the phone numbers to pay phone on this page: https://www.irs.gov/payments/pay-taxes-by-credit-or-debit-card.

-

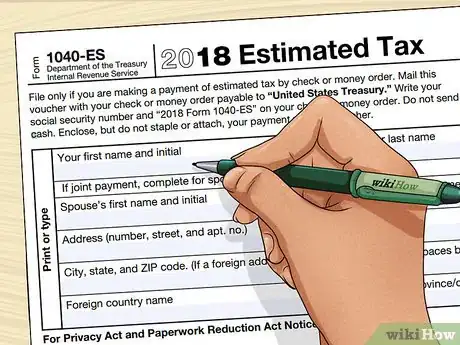

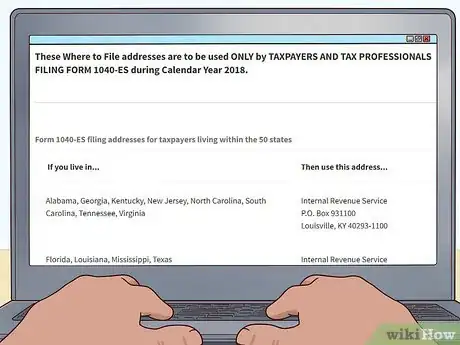

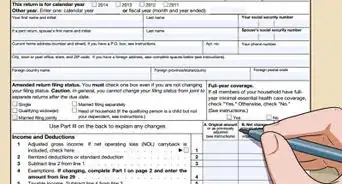

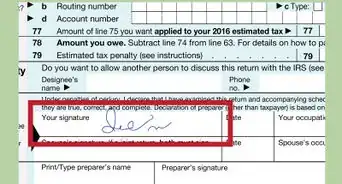

3Use the Estimated Tax Payment Voucher to pay by mail. This voucher is included in the 1040-ES form. Tear off the section for each payment, and place the amount you're paying at the top. Fill in your name, Social Security number, address, and spouse's information.[10]

- Include a check or money order with the amount you owe.

- Mail the voucher to the address listed on this page: https://www.irs.gov/filing/where-to-file-addresses-for-taxpayers-and-tax-professionals-filing-form-1040-es.

-

4Pay when you file your taxes with a penalty. You can wait to pay all your taxes when you file them in the following year. However, if you owe more than $1,000 USD, the IRS will likely charge you a penalty that will be added on to your tax bill. You can pay your tax bill using the same methods as above.[11]

References

- ↑ https://www.forbes.com/sites/laurashin/2014/07/18/freelancers-heres-how-to-do-your-taxes/2/#47539cb74e49

- ↑ https://www.forbes.com/sites/laurashin/2014/07/18/freelancers-heres-how-to-do-your-taxes/2/#47539cb74e49

- ↑ https://www.thebillfold.com/2014/03/heres-a-surefire-tax-estimating-process-for-freelancers-rebooted-and-updated/

- ↑ https://www.forbes.com/sites/laurashin/2014/07/18/freelancers-heres-how-to-do-your-taxes/2/#47539cb74e49

- ↑ https://www.thebillfold.com/2014/03/heres-a-surefire-tax-estimating-process-for-freelancers-rebooted-and-updated/

- ↑ https://www.thebillfold.com/2014/03/heres-a-surefire-tax-estimating-process-for-freelancers-rebooted-and-updated/

- ↑ https://www.irs.gov/pub/irs-pdf/f1040es.pdf

- ↑ https://www.irs.gov/payments

- ↑ https://www.irs.gov/payments/pay-taxes-by-credit-or-debit-card