This article was co-authored by wikiHow staff writer, Jennifer Mueller, JD. Jennifer Mueller is a wikiHow Content Creator. She specializes in reviewing, fact-checking, and evaluating wikiHow's content to ensure thoroughness and accuracy. Jennifer holds a JD from Indiana University Maurer School of Law in 2006.

There are 11 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 67,147 times.

Learn more...

Credit cards may be convenient when you need them, but you can also get in a situation where you are no longer able to make the minimum payment each month. As your balance builds up, so will the interest charged. Before long, you may find yourself in a hole. Fortunately, there is a way out. In many situations, your credit card company will work with you if you write a letter asking for a reduction in your credit card interest rates.

Steps

Sample Letters

Requesting Hardship Relief

-

1Gather documentation of your hardship. Most credit card companies have hardship relief programs to help customers who are unable to make their payments due to an unexpected hardship. However, you must be able to prove what has happened to you, and how it affected your ability to pay your bills.[1]

- For example, if you recently suffered a serious injury, you would need a note from your healthcare provider describing the nature of your condition and how it has affected your income.

- If you recently lost your job or had your hours cut through no fault of your own, a letter from your employer (or former employer) would be sufficient.

-

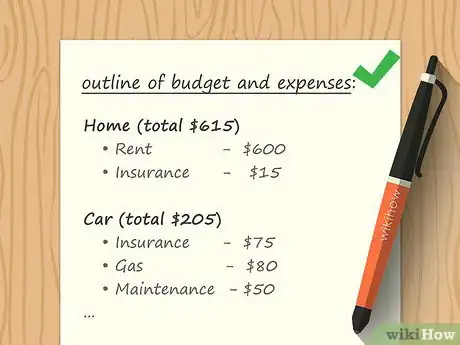

2Create an outline of your budget and expenses. In addition to demonstrating your hardship, it helps if you can show the credit card company that you are taking proactive steps to get back on track financially. A household budget and bank statements proving your expenses will prove that you're doing all you can.[2]

- Your budget should also demonstrate that you'll be able to resume regular payments within a reasonable period of time – ideally, 4 to 6 months or less.

- If it isn't possible for you to resume regular payments in the short-run, provide additional documentation to show that your condition is permanent and there is nothing that can be done about it. For example, if you have a permanent disability that limits your ability to work, the credit card company may be willing to reduce your rate permanently rather than on a temporary basis.

Advertisement -

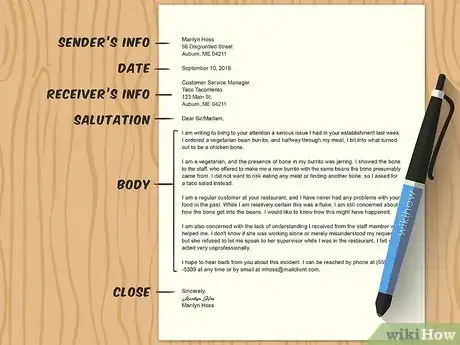

3Format your letter in formal business letter style. Type your letter using a word processing app on a computer. Any of these apps will have a template that will format a formal business letter for you. Using a template ensures you've used the correct format and included all necessary information.[3]

- Find the address and department where you need to send your letter on your credit card company's website. It may also be on your most recent credit card statement.

- Include the type of card you have on the subject line, along with your account number. For example: "Sunshine Visa Platinum Acct. #1234567890102."

-

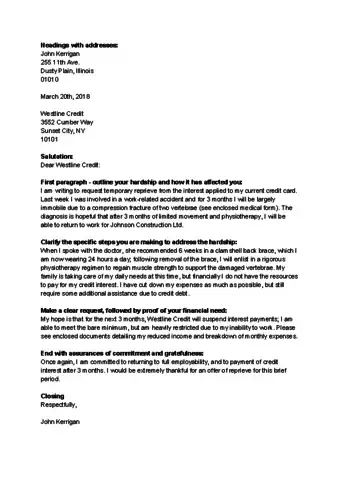

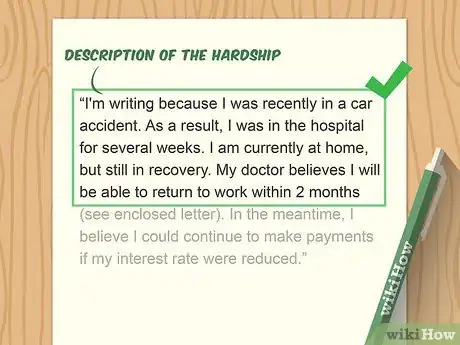

4Describe your hardship. In the first paragraph of your letter, briefly describe the reason you are seeking hardship relief. Stick to the facts, and keep your description to the point. If you're including documentation, simply reference it.[4]

- For example: "I'm writing because I was recently in a car accident. As a result, I was in the hospital for several weeks. I am currently at home, but still in recovery. My doctor believes I will be able to return to work within 2 months (see enclosed letter). In the meantime, I believe I could continue to make payments if my interest rate were reduced."

-

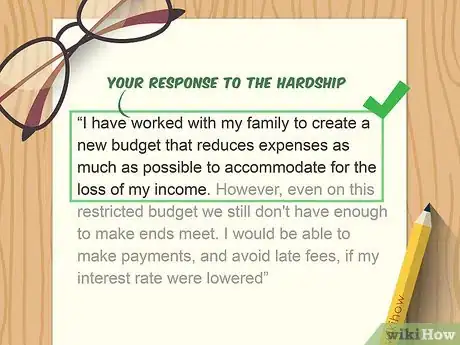

5Explain your response to your hardship. The credit card company is not going to reduce your interest rate simply because you suffered a hardship. You must also show that you have taken responsibility for your finances and made every effort to get back on track.[5]

- For example: "I have worked with my family to create a new budget that reduces expenses as much as possible to accommodate for the loss of my income. However, even on this restricted budget we still don't have enough to make ends meet. I would be able to make payments, and avoid late fees, if my interest rate were lowered."

-

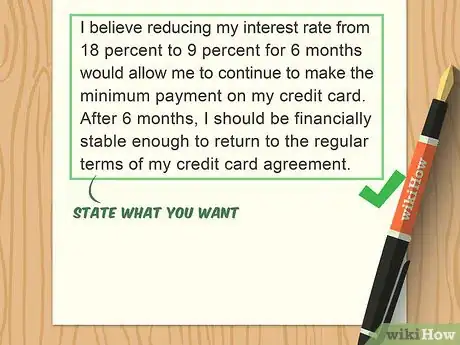

6State specifically what you want from the credit card company. Hardship relief is typically only granted for a brief period of time. In the final paragraph of your letter, tell the credit card company the relief you seek, and why you think it would help.[6]

- For example: "I believe reducing my interest rate from 18 percent to 9 percent for 6 months would allow me to continue to make the minimum payment on my credit card. After 6 months, I should be financially stable enough to return to the regular terms of my credit card agreement."

-

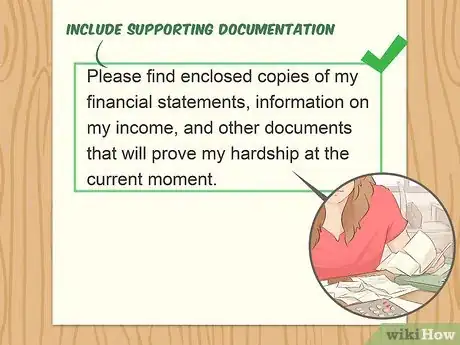

7Include supporting documentation. Make copies of the documents you gathered to provide evidence of your hardship and your response to that hardship. Include these copies along with your letter. Make sure you've sufficiently backed up every statement of fact you made in your letter.[7]

- Your credit card company may contact you and ask for additional documentation before granting any relief.

-

8Talk to a nonprofit credit counselor. If you have multiple credit cards, you may need additional help. A nonprofit credit counselor can help you work on a budget and negotiate with your credit card companies to get you back on track faster.[8]

- If you doubt a short-term hardship relief program will actually help you, talk to a credit counselor about more permanent solutions. Simply kicking the can down the road rather than addressing the problem immediately may result in larger and more serious problems.

-

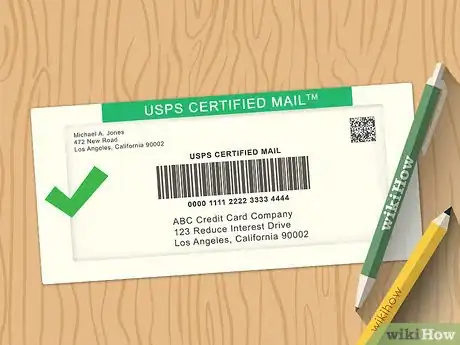

9Mail your letter using certified mail. Proofread your letter very carefully before printing it, then sign it in blue or black ink. Make a copy for your records, then send the letter to your credit card company using certified mail with return receipt requested.[9]

- With certified mail, you'll get a card in the mail when the credit card company has received your letter. It may be as long as 2 weeks before you hear back.

-

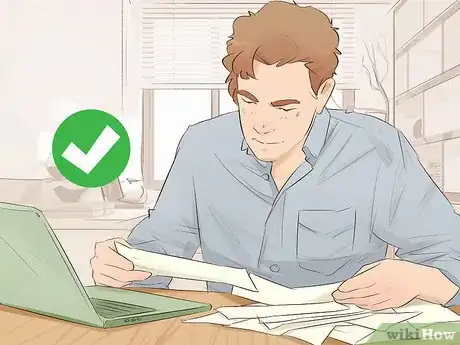

10Follow up with customer service. Unless you included a statement in your letter that you only wanted the credit card company to write, you may receive a phone call from customer service. Keep in touch with the credit card company. As much as you may want to avoid them, don't ignore these calls.[10]

- If you get the card back in the mail and you still haven't heard from your credit card company after 2 weeks, call the customer service number on the back of the card. When you talk to a representative, tell them that you sent a letter requesting hardship relief that was received. Let them know you haven't gotten a response, and ask them to direct you to someone who can help you address the matter.

Seeking an Active Duty Adjustment

-

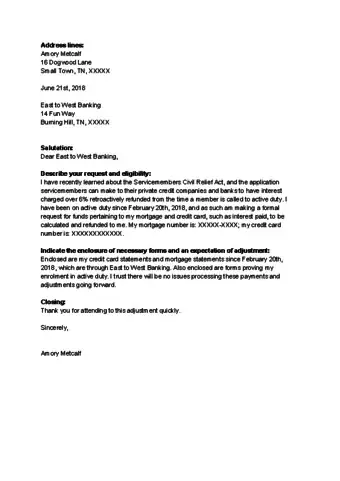

1Gather information for all of your credit cards. The Servicemembers' Civil Relief Act (SCRA) provides for a 6 percent ceiling on credit card interest rates. This ceiling potentially applies to all debts you incurred before you began active duty. To take advantage of this benefit, you need contact information for all of your credit cards or other consumer debt.[11]

- This benefit is provided to new service members as well as activated reservists. In some situations, it may apply to other service members. Speak to someone in the admin department on your base if you are unsure whether the SCRA applies to you.

- The ceiling also covers any service charges or other fees.

-

2Make copies of your orders and earnings statements. In addition to proving when you are on active duty, you must be able to demonstrate that being on active duty has reduced your ability to make payments as previously agreed.[12]

- Clear copies of your activation orders will show the credit card company exactly when you are on active duty.

- Earnings statements that indicate a decreased income while you are on active duty, or delayed receipt of income, will prove that you are unable to make payments as agreed while on active duty.

-

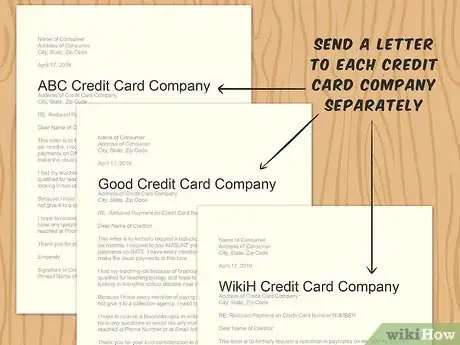

3Draft letters for each of your credit cards. If you have more than one credit card, you'll need to send a letter to each separately. You can use the same letter and wording for all of them, just make sure you change the addresses and account numbers you reference.[13]

- Most military bases have templates you can use to draft your letter. Go to the website for your base or for your military division, or talk to someone in the admin department.[14]

-

4Mail your letter using certified mail. Using certified mail provides you with proof that the credit card company received your letter. When you get the card back, you'll know the date your letter was received. Mark a date on your calendar 2 weeks later to follow up if you haven't heard from your credit card company by then.[15]

- Proofread your letter carefully, even if you used a form, to make sure all the information is complete before sending it out. Print it out and sign it in blue or black ink, then make a copy for your records and send the original to the credit card company.

-

5Be prepared to argue your case. If your credit card company doesn't believe that your being on active leave affects your ability to pay, they may challenge your request for a rate reduction. Details about your budget and expenses can help you fight this challenge.[16]

- If you have dependents, or any other situation that affects your ability to pay, be sure to mention that as well.

Arguing You're Entitled to a Lower Rate

-

1Check your credit report. You are entitled by law to 1 free credit report each year. You can also check your credit score for free by signing up for a free credit monitoring service, such as Credit Karma or Credit Sesame.[17]

- Generally, you'll be more likely to get the credit card company to reduce your interest rate if you have a good-to-excellent credit score.

- A rate reduction is especially likely if your credit score has increased significantly since you opened the card. For example, if you opened the credit account 6 years ago when you had poor credit, the company likely gave you the highest rate legally allowed. If you've raised your score 200 points in that time, you're a good candidate for a rate reduction. You no longer present the risk to the credit card company that you did when you opened the account.

-

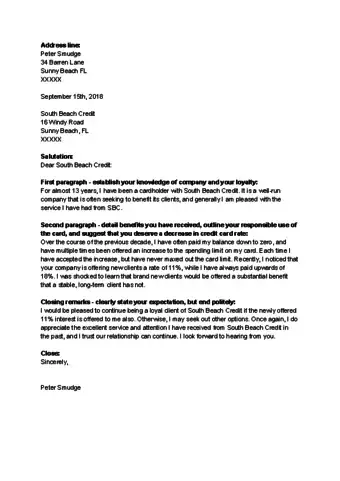

2Verify your payment history with the credit card company. Your credit card company is more likely to lower your interest rate if you have several years of good payment history. Generally, this means you've never had a late payment.[18]

- It also helps if you've paid off your balance in full every month. If you carry a balance, it should ideally be less than 30 percent of your available credit.

- If you do have 1 or 2 late payments, you may still be able to get an interest rate reduction, provided they were isolated instances months or even years in the past.

-

3Research offers from other credit card companies. Credit card companies do compete with each other. If you can get a better rate from another company, this might entice your credit card company to offer you a lower rate so they can keep you as a customer.[19]

- If you get pre-approved offers in the mail, you can use those as a guide to the alternatives available to you.

- If you've screened out of pre-approved offers, you can still get pre-approved rates online from many major credit card companies without damaging your credit. Pre-approved offers typically do a "soft" rather than "hard" pull on your credit report, so they don't impact your score.

-

4Find out the current prime rate. Credit card interest rates are typically set with reference to the most recent federal prime rate reported by the Federal Reserve. If the prime rate is lower than it was when your interest rate was first set, you may be entitled to a rate adjustment.[20]

- For example, suppose your credit card company set your rate at prime + 10.9%. When you opened your account, the prime rate was 9%, so your interest rate was set at 19.9%. However, if the current prime rate is 5%, your rate should be 15.9%.

- Contrary to popular belief, prime rates aren't "set" by the Federal Reserve. Rather, they are reported by the Federal Reserve as the prime rate posted by the majority of the largest 25 US banks.[21]

- You can check the most recent prime rate on the Federal Reserve's website at https://www.federalreserve.gov/releases/h15/.

-

5Try calling customer service first. You'll get a more immediate response if you call, rather than write a letter. You also have a greater opportunity of being heard. If you simply mail a letter, it's likely you'll get no response.[22]

- Write yourself notes before you call outlining the reasons you believe your interest rate should be lowered. Highlight your positive payment history, strong credit score, and length of time with the company.

- Ask the customer service agent if your interest rate is fixed to prime. If they say it is, ask when it was last adjusted. Have the current prime rate ready.

-

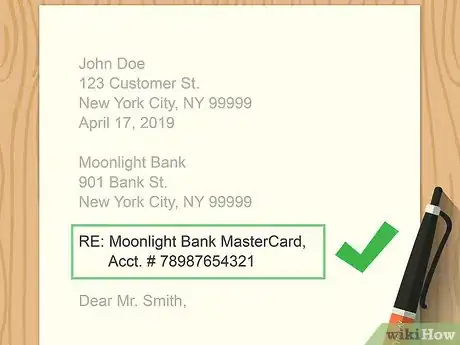

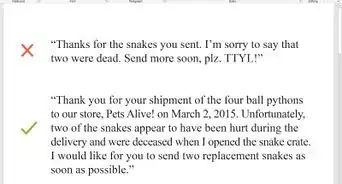

6Use a business letter format. Type your letter so it is taken seriously. All word processing applications have a business letter template. Using that ensures your margins and spacing are correct. Choose a standard, readable font in 12-pt type.[23]

- Put the type of card or account you have, and your account number, in the subject line of the letter. For example: "Moonlight Bank & Trust Rewards MasterCard, Acct. # 78987654321."

-

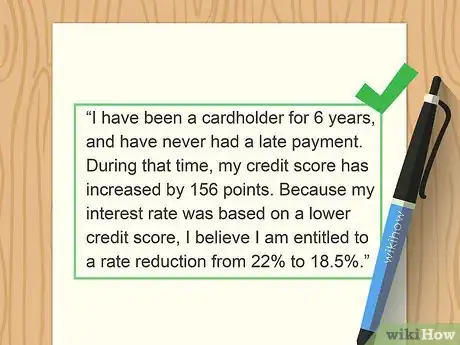

7Draft a brief letter making your case. Keep your letter to a page. Start by stating succinctly that you would like your interest rate reduced, and provide the rate you want. In the next paragraph, tell the credit card company why you believe your rate should be reduced.[24]

- For example: "I'm writing because I believe the interest rate on my account should be reduced from 19.9% to 15.9%. My credit card agreement states that my interest rate is calculated based on the current prime rate plus 10.9%. However, the current prime rate is 5%."

- You can also open with details about your relationship with the company. For example: "I have been a cardholder for 6 years, and have never had a late payment. During that time, my credit score has increased by 156 points. Because my interest rate was based on a lower credit score, I believe I am entitled to a rate reduction from 22% to 18.5%."

- If you have offers from other credit card companies, you can mention those in closing. For example: "While I've had a wonderful experience with Moonlight Bank and would prefer to remain as a customer, Sunshine Savings & Loan has offered me a card with a higher limit and a permanent rate of 16.5%. Unless you are willing to work with me on my interest rate, I may have to consider moving on."

-

8Mail your letter using certified mail. Once you've carefully proofread your letter, print it and sign it using a blue or black ink pen. Sending it using certified mail with return receipt requested ensures you'll know when the credit card company received your letter.[25]

- Make a copy of your letter for your records before you mail it. Keep the letter along with any other correspondence or statements from that credit card company.

-

9Call to follow up if you don't get a response. When you get the green card back from the post office indicating that your letter was received, mark your calendar for 2 weeks from the date of receipt. If you don't hear back from the credit card company by that point, call the customer service number on the back of your card.[26]

- When you talk to a representative, let them know that you sent a letter that you know was received, but you've not yet received any response. From there, the representative may ask you what the letter concerned. They may be able to help you, or you may need to speak to their supervisor.

- If you aren't able to get the rate that you want, decide whether you want to wait and try again in a few months. If you have an offer from another credit card company, you may want to move to them. However, keep in mind that closing an account can negatively affect your credit score – especially if that account has been open and in good standing for several years.

Warnings

- This article primarily deals with reducing credit card interest rates with credit cards issued by US banks and credit card companies. If you have a credit card from another country, seek advice from your nearest consumer advocacy or debt relief organization.⧼thumbs_response⧽

References

- ↑ https://www.nomoredebts.org/debt-help/dealing-with-creditors/communicating-with-creditors-and-collection-agencies.html

- ↑ https://www.nomoredebts.org/debt-help/dealing-with-creditors/communicating-with-creditors-and-collection-agencies.html

- ↑ https://www.nomoredebts.org/debt-help/dealing-with-creditors/debt-letters/reduced-payment-request-letter.html

- ↑ https://credit.org/blog/writing-a-good-hardship-letter/

- ↑ https://credit.org/blog/writing-a-good-hardship-letter/

- ↑ https://credit.org/blog/writing-a-good-hardship-letter/

- ↑ https://credit.org/blog/writing-a-good-hardship-letter/

- ↑ https://credit.org/blog/writing-a-good-hardship-letter/

- ↑ https://www.balancepro.net/education/pdf/samplehardshipletter3.pdf

- ↑ https://www.nomoredebts.org/debt-help/dealing-with-creditors/communicating-with-creditors-and-collection-agencies.html

- ↑ https://statesidelegal.org/sites/default/files/STATIC%20FORM%20PACKET%20-%20Letter%20for%20Credit%20Card%20Interest%20Rate%20Reduction_0.pdf

- ↑ https://statesidelegal.org/sites/default/files/STATIC%20FORM%20PACKET%20-%20Letter%20for%20Credit%20Card%20Interest%20Rate%20Reduction_0.pdf

- ↑ https://statesidelegal.org/sites/default/files/STATIC%20FORM%20PACKET%20-%20Letter%20for%20Credit%20Card%20Interest%20Rate%20Reduction_0.pdf

- ↑ https://www.pendleton.marines.mil/Staff-Agencies/Legal-Services-Support-Team/Legal-Assistance/Service-Members-Civil-Relief-Act/

- ↑ https://statesidelegal.org/sites/default/files/STATIC%20FORM%20PACKET%20-%20Letter%20for%20Credit%20Card%20Interest%20Rate%20Reduction_0.pdf

- ↑ https://statesidelegal.org/sites/default/files/STATIC%20FORM%20PACKET%20-%20Letter%20for%20Credit%20Card%20Interest%20Rate%20Reduction_0.pdf

- ↑ https://www.creditkarma.com/credit-cards/i/how-to-lower-credit-card-interest-rate/

- ↑ https://uspirg.org/blogs/blog/usp/lowering-your-apr-might-be-easier-you-think

- ↑ https://www.bankrate.com/finance/credit-cards/want-a-lower-credit-card-rate-just-ask.aspx

- ↑ https://www.creditcards.com/credit-card-news/herigstad-lower-credit-card-interest-rates-1272.php

- ↑ https://www.federalreserve.gov/faqs/credit_12846.htm

- ↑ https://www.creditcards.com/credit-card-news/herigstad-lower-credit-card-interest-rates-1272.php

- ↑ https://www.creditcards.com/credit-card-news/herigstad-lower-credit-card-interest-rates-1272.php

- ↑ https://www.creditcards.com/credit-card-news/herigstad-lower-credit-card-interest-rates-1272.php

- ↑ https://www.creditcards.com/credit-card-news/herigstad-lower-credit-card-interest-rates-1272.php

- ↑ https://www.creditkarma.com/credit-cards/i/how-to-lower-credit-card-interest-rate/