This article was co-authored by Nathan Miller and by wikiHow staff writer, Janice Tieperman. Nathan Miller is an entrepreneur, landlord, and real estate investor. In 2009, he founded Rentec Direct, a cloud-based property management company. Today, Rentec Direct works with over 16,000 landlords and property managers across the United States, helping them manage their rentals efficiently.

There are 15 references cited in this article, which can be found at the bottom of the page.

wikiHow marks an article as reader-approved once it receives enough positive feedback. In this case, 100% of readers who voted found the article helpful, earning it our reader-approved status.

This article has been viewed 109,330 times.

Ready to take the plunge and buy your very own condo? Purchasing your own place is definitely a big decision, but it doesn’t have to be a difficult one. We’ve outlined plenty of tips and suggestions to help you navigate the market and the condo-buying process, so you can make a smart, informed decision about your future abode. Keep reading to get one step closer to buying the condo of your dreams!

Steps

Expert Q&A

-

QuestionIs there homeowner's insurance that is specific for condos?

Ryan BarilRyan Baril is the Vice President of CAPITALPlus Mortgage, a boutique mortgage origination and underwriting company founded in 2001. Ryan has been educating consumers about the mortgage process and general finance for almost 20 years. He graduated from the University of Central Florida in 2012 with a B.S.B.A. in Marketing.

Ryan BarilRyan Baril is the Vice President of CAPITALPlus Mortgage, a boutique mortgage origination and underwriting company founded in 2001. Ryan has been educating consumers about the mortgage process and general finance for almost 20 years. He graduated from the University of Central Florida in 2012 with a B.S.B.A. in Marketing.

VP, CAPITALPlus Mortgage Yes, there are two types of insurance that primarily cover condos. First is the "walls-out coverage"; this is obtained by the condo association and paid by your monthly dues. This policy covers anything from the walls out, like windows, the roof, the building itself, etc. Then you have the option to obtain an HO6, or "walls-in" policy. This you will pay yourself and covers all of your personal belongings inside the property.

Yes, there are two types of insurance that primarily cover condos. First is the "walls-out coverage"; this is obtained by the condo association and paid by your monthly dues. This policy covers anything from the walls out, like windows, the roof, the building itself, etc. Then you have the option to obtain an HO6, or "walls-in" policy. This you will pay yourself and covers all of your personal belongings inside the property. -

QuestionWhat are questions to ask for HOAs for condos?

Ryan BarilRyan Baril is the Vice President of CAPITALPlus Mortgage, a boutique mortgage origination and underwriting company founded in 2001. Ryan has been educating consumers about the mortgage process and general finance for almost 20 years. He graduated from the University of Central Florida in 2012 with a B.S.B.A. in Marketing.

Ryan BarilRyan Baril is the Vice President of CAPITALPlus Mortgage, a boutique mortgage origination and underwriting company founded in 2001. Ryan has been educating consumers about the mortgage process and general finance for almost 20 years. He graduated from the University of Central Florida in 2012 with a B.S.B.A. in Marketing.

VP, CAPITALPlus Mortgage Ask to see the budget, and pay special attention to special assessments and reserves. Ask when the last special assessment was and when they anticipate the next one to be.

Ask to see the budget, and pay special attention to special assessments and reserves. Ask when the last special assessment was and when they anticipate the next one to be. -

QuestionAt what stage are you interviewed by the HOA?

wikiHow Staff EditorThis answer was written by one of our trained team of researchers who validated it for accuracy and comprehensiveness.

wikiHow Staff EditorThis answer was written by one of our trained team of researchers who validated it for accuracy and comprehensiveness.

Staff Answer wikiHow Staff EditorStaff AnswerYou'll likely have to go through an HOA interview before you officially put a down payment on the condo. Try not to worry, though! This interview is actually a great time to get your own questions answered about the condo complex.

wikiHow Staff EditorStaff AnswerYou'll likely have to go through an HOA interview before you officially put a down payment on the condo. Try not to worry, though! This interview is actually a great time to get your own questions answered about the condo complex.

References

- ↑ https://www.bobvila.com/articles/pros-and-cons-of-buying-a-condo/

- ↑ https://portal.ct.gov/DCP/Consumer/Condominium-FAQs

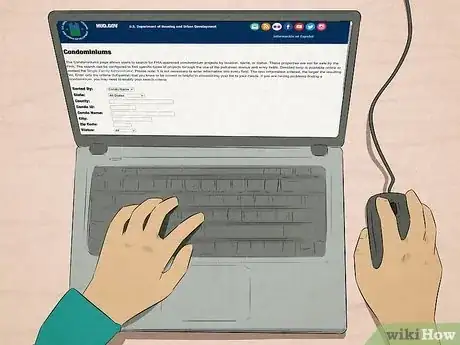

- ↑ https://www.nerdwallet.com/article/mortgages/fha-approved-condos

- ↑ https://www.nerdwallet.com/article/mortgages/fha-approved-condos

- ↑ https://www.hud.gov/program_offices/housing/sfh/ins/sfh_ins_condominiums

- ↑ https://www.nerdwallet.com/article/mortgages/fha-loan

- ↑ https://www.forbes.com/advisor/credit-score/how-to-check-your-credit-score/

- ↑ https://www.forbes.com/sites/lenakatz/2018/06/25/condo-amenities-that-improve-quality-of-life-from-thoughtful-to-playful/?sh=664518243365

- ↑ https://www.bobvila.com/articles/pros-and-cons-of-buying-a-condo/

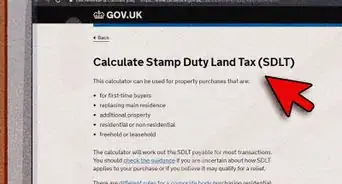

- ↑ https://www.consumerfinance.gov/ask-cfpb/are-condoco-op-fees-or-homeowners-association-dues-included-in-my-monthly-mortgage-payment-en-1945/

- ↑ https://www.consumerfinance.gov/ask-cfpb/are-condoco-op-fees-or-homeowners-association-dues-included-in-my-monthly-mortgage-payment-en-1945/

- ↑ https://www.npr.org/2021/07/19/1016940192/why-steady-low-condo-fees-should-raise-a-flag-and-other-tips-for-owners-and-buye

- ↑ https://cca.hawaii.gov/reb/files/2018/10/Special-Assessments.pdf

- ↑ https://portal.ct.gov/DCP/Consumer/Condominium-FAQs/

- ↑ https://www.nerdwallet.com/article/mortgages/buying-a-condo

- ↑ https://www.caionline.org/Advocacy/Priorities/ReserveStudy/Pages/default.aspx#NV

- ↑ https://www.npr.org/2021/07/19/1016940192/why-steady-low-condo-fees-should-raise-a-flag-and-other-tips-for-owners-and-buye

- ↑ https://portal.ct.gov/DCP/Consumer/Condominium-FAQs

- ↑ https://www.nerdwallet.com/article/mortgages/buying-a-condo

- ↑ https://portal.ct.gov/DCP/Consumer/Condominium-FAQs

- ↑ https://ag.ny.gov/real-estate-finance-bureau/physical_aspects

- ↑ https://www.bobvila.com/articles/pros-and-cons-of-buying-a-condo/

- ↑ https://www.nerdwallet.com/article/mortgages/buying-a-condo

- ↑ https://www.benefits.va.gov/homeloans/

About This Article

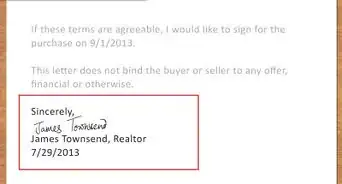

To buy a condo, first research locations to figure out where you want to live. When you’ve decided on an area, look at condo listings, and go to open houses for properties you’re interested in. Consider hiring a realtor, who can help you identify condos in the neighborhoods you like. Also, talk to your banker about getting pre-approved for a loan so you’ll know what you can afford. If you find a place you like, make an offer, then be prepared to review any counter-offers you may receive before you reach an agreement on a final contract. For tips on choosing a realtor who can help you get the condo you want, read on!