This article was co-authored by wikiHow staff writer, Jack Lloyd. Jack Lloyd is a Technology Writer and Editor for wikiHow. He has over two years of experience writing and editing technology-related articles. He is technology enthusiast and an English teacher.

The wikiHow Tech Team also followed the article's instructions and verified that they work.

This article has been viewed 526,595 times.

Learn more...

This wikiHow teaches you how to calculate the Net Present Value (NPV) of an investment using Microsoft Excel. You can do this on both the Windows and the Mac versions of Excel.

Steps

-

1Make sure that you have the investment information available. To calculate NPV, you need to know the annual discount rate (e.g., 1 percent), the initial amount invested, and at least one year of investment return.[1]

- Having three or more years of investment return is ideal, but not necessary.

-

2Open Microsoft Excel. Its app icon resembles a green box with a white "X" on it.Advertisement

-

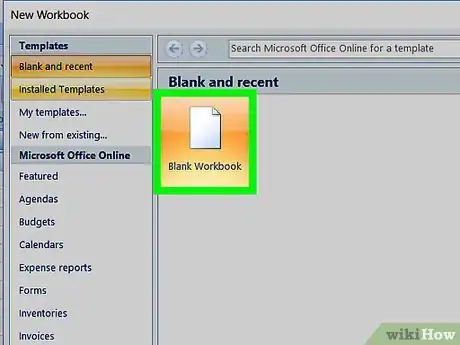

3Click Blank workbook. It's in the upper-left side of the Excel window.

-

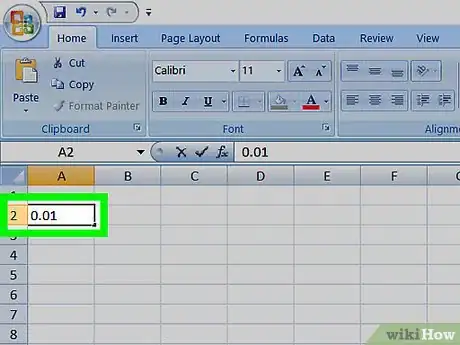

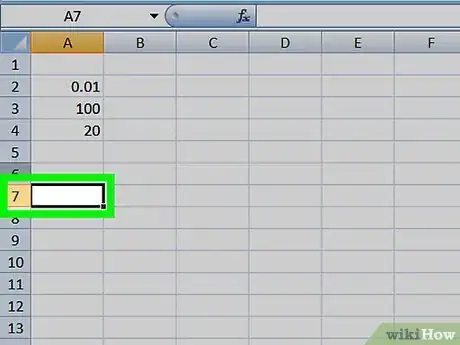

4Enter your investment's discount rate. Select a cell (e.g., A2), then type in the decimal equivalent of your investment's annual discount percentage.

- For example, if the discount rate is 1 percent, you'd enter 0.01 here.

-

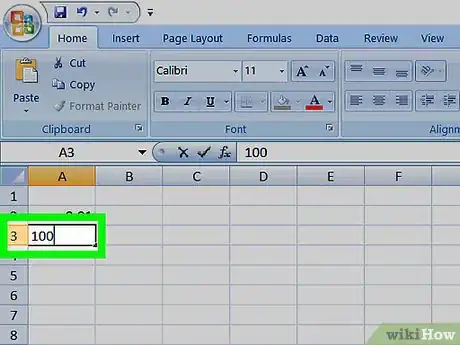

5Enter the initial investment amount. Select an empty cell (e.g., A3) and type in the amount that you initially invested.

-

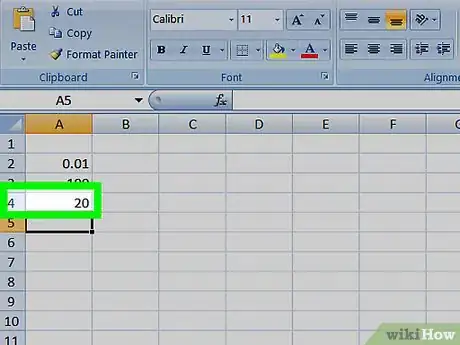

6Enter each year's return amount. Select an empty cell (e.g., A4), enter the first year's return amount, and repeat for each subsequent year for which you have a return number.

-

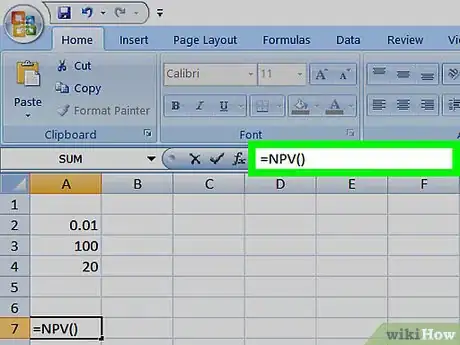

7Select a cell. Click a cell in which you want to calculate the NPV.

-

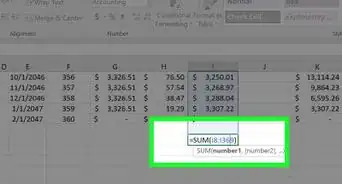

8Enter the NPV formula beginning. Type in =NPV() here. Your investment data will go in between the parentheses.

-

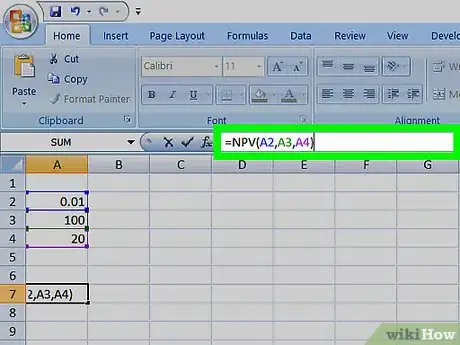

9Add values to the NPV formula. Inside of the parentheses, you'll need to add the cell numbers that contain discount rate, investment amount, and at least one return value.

- For example, if your discount rate is in cell A2, the investment amount is in A3, and the return value is in A4, your formula would read =NPV(A2,A3,A4).

-

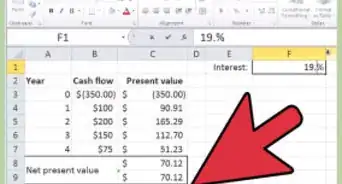

10Press ↵ Enter. This will prompt Excel to calculate the NPV and display it in the selected cell.

- If the NPV displays in red, the investment's value is negative.

Community Q&A

-

QuestionWhat is the NPV for investments using assumed cost of capital or discount rate?

Community Answerif the interest rate is not given, then cost of capital will be the assumed discount rate.

Community Answerif the interest rate is not given, then cost of capital will be the assumed discount rate.

Warnings

- If you don't have at least one year of investment return, you won't be able to calculate NPV.⧼thumbs_response⧽

References

About This Article

1. Enter the investment's discount rate into a cell.

2. Enter the initial investment amount below it.

3. Enter each year's return amount below.

4. Select a blank cell.

5. Type "=NPV( )".

6. Put each cell address in the parentheses separated by commas.

7. Press Enter.