This article was co-authored by Lyle Solomon, JD. Lyle Solomon is an Attorney and the Owner of the Law Office of Lyle D. Solomon. With nearly three decades of experience, he practices civil law and specializes in consumer debt relief services and bankruptcy. Lyle is also the author of Think Different! Save More! He holds a BA in Criminal Justice from The University of Nevada, Las Vegas, and a JD from The University of Pacific, McGeorge School of Law.

There are 8 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 67,088 times.

A promissory note is a document that a borrower signs to promise to repay a loan. The promissory note by itself creates a legal obligation. However, by itself, the promissory note is considered “unsecured,” which means that if the borrower is unable to pay, there may not be much that you can do about it. To “secure” a promissory note means that you identify some specific property and attach it to the note. Then, if the borrower defaults on the loan, you will be able to repossess the collateral as compensation for the loan. The method of securing the promissory note varies depending on the type of collateral and the laws where you live.

Steps

Securing a Motor Vehicle Loan

-

1Attach the collateral to the loan. To “attach” collateral is a legal term that means you must identify the specific property that will be the collateral for the loan. A motor vehicle is pretty easy to identify, by its Vehicle Identification Number (VIN) and by a brief description of the make and model. As the lender, you will need to have your borrower sign a security agreement that contains this description and makes reference to the loan.[1]

-

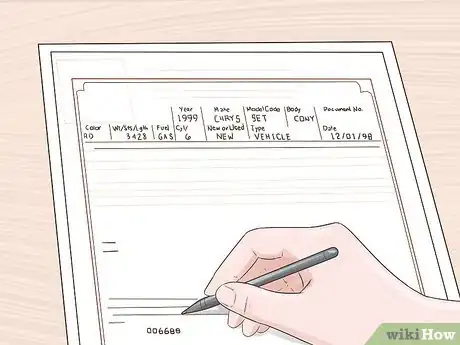

2Note the loan and security interest on the vehicle title. For a loan secured by a motor vehicle, you must make note of the security interest on the actual Title Certificate itself. Each state will have a slightly different procedure for doing this. In general, you first need to obtain the original Title Certificate.[2]

- The owner of the vehicle, who is borrowing the money, should have the Title Certificate. In some cases, if the owner already is paying on a first loan, and you are lending money as a second lien on the vehicle, then the first lienholder might have the Title Certificate. The borrower would have to contact the first lender to get the Title Certificate.

Advertisement -

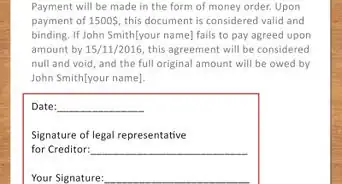

3Complete the lien section on the Title Certificate. On the back of the Title Certificate, you will find a section to report the details of your loan. You will provide the date, amount of the loan, and signatures of both the borrower/owner and the lender.[3] [4]

- Be very clear in the writing. A third party must be able to read the note and understand the terms.[5]

-

4File the documents with the appropriate governmental office. In most U.S. states, to finalize the procedure of securing the promissory note with a motor vehicle, you must deliver the original Title Certificate and the signed security agreement to the DMV. The DMV will then create a new Title Certificate with the loan formally recorded on it. Some states will charge a fee for this.[6]

- Check with your state’s local procedures. For example, in South Dakota, instead of the DMV, you will need to send the Title Certificate and security agreement to the county treasurer in the county where the vehicle owner resides. There is a $10 fee.[7]

- In Tennessee, for example, you will need to send the financing statement and Title Certificate to the local County Clerk’s office. There is a fee of $11 for the lien notation and $5.50 for a state title fee. There also may be a local county fee.[8]

Creating a Secured Real Estate Loan

-

1Begin by having the borrower sign a loan agreement or promissory note. A promissory note is just another term for a loan agreement. Under either title, this is a contract that identifies the loan given to the borrower and specifies the terms of repayment.[9]

- Include all relevant parties, dates, and amounts to make sure the promissory note is enforceable.[10]

-

2Have the borrower sign a mortgage agreement. A mortgage is a legal term used to describe an agreement between the parties that certain real estate will be given as collateral to secure a loan. The simplest mortgage just needs to identify the parties, describe the loan, and identify the property. Depending on the amount of the loan and the identities of the parties, some mortgage documents can become quite complicated.[11]

- Some online resources exist to help you create your own mortgage agreement. One such resource is Rocket Lawyer, which provides templates that are valid for most U.S. states. You simply identify your state, provide the details of your loan, and the program creates a mortgage document for you.

- You should have the mortgage witnessed and notarized. In some states, this is a requirement, such that failure to do so will nullify the mortgage. In others, it may not be required but is still a good practice.

-

3File the mortgage and loan agreement with the appropriate office. To finalize the secured loan with the real estate collateral, you must file the completed mortgage and loan agreement with a state office where the property is located. The requirements for filing differ from state to state. You should check with a local attorney or the secretary of state’s office for the state where the property exists to determine the appropriate filing method.[12]

- For example, in Massachusetts, the loan documents are filed with the Registry of Deeds in the county where the property is located.

- In Connecticut, mortgages are recorded with the town clerk where the property exists.

- In New York, you must file the mortgage with the county clerk for the county where the property exists.

Using Inventory or Other Business Assets as Collateral

-

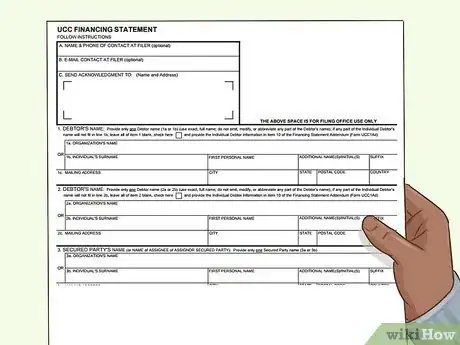

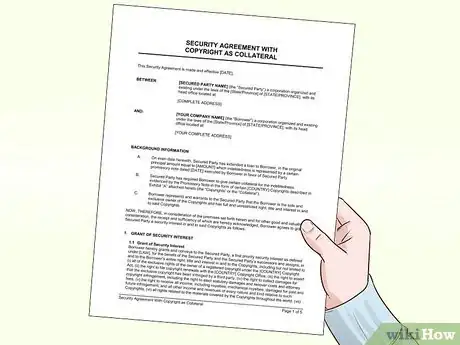

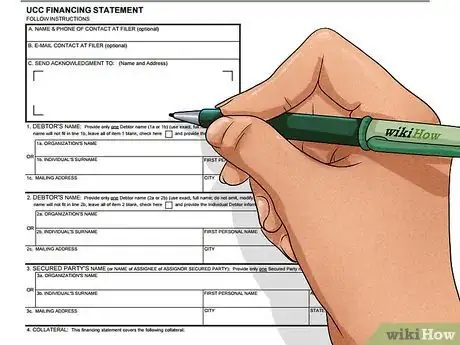

1Attach the loan to some company assets. If you are giving a loan to a company or to an individual who is operating a business, you may want to secure your loan with some property of the business. This may include the company’s own equipment, inventory that it has for sale, or even something less tangible, like its accounts receivable. To attach the loan to any such property, you will need to have the owner sign a financing statement, which is sometimes also referred to as a “UCC” or “UCC-1” statement. [13]

- Be careful that the individual or company signing the financing statement is the actual owner of the collateral. For example, if you are giving a loan to John Smith, an individual, and John Smith is the president of XYZ Corporation, you will need to identify carefully whether the collateral is owned by John Smith or by XYZ Corporation. The person or company giving the collateral should be the same as the person or company getting the benefit of your loan.

-

2Identify the collateral carefully. To complete the financing statement, you need to identify the parties to the loan and provide an adequate description of the collateral. The description must be sufficiently clear so that any third party reading the financing statement will understand what it is meant to cover.[14]

- For example, if you intend to secure the loan with a particular photocopy machine that the borrower owns, you should identify it by description, make, model, and even serial number, if possible. On the other hand, if you intend to secure the loan with all of the borrower’s office equipment, you may use a more general description, such as “Equipment.” Other general descriptive terms that are allowable are “Goods,” “Inventory,” or “Fixtures.”

- You can describe intangible business assets as “Accounts,” which includes the borrower’s right to receive payments from its customers, “Chattel paper,” which includes other secured loans that the borrower may have the right to collect, or “General intangibles,” which simply includes other intangible assets that are not covered by the first two categories.

-

3Perfect the security interest by filing the loan documents with the appropriate office. The most common and most effective method of perfecting a security interest in tangible or intangible business assets is by filing the security agreement and financing statement. Each state has different regulations for the proper filing location. You will need to check with the Secretary of State’s office for the state where your borrower is located, in order to determine the correct place and method for filing. If your borrower operates in multiple states, you may need to file your loan documents in more than one state. In some states, you may be required to file with the Secretary of State, generally in the state capital, and also file in the clerk’s office for any county within the state where the borrower does business.[15]

- It is a good idea to work with an attorney who is familiar with the laws of the state where you wish to perfect your security interest, in order to be sure that you file appropriately.

- If you neglect to file your loan documents in the appropriate offices, you may lose your position of priority. The borrower will still owe you the money, but if another lender files in a place where you have not, then that lender may be able to collect the collateral before you.

-

4Take possession of the collateral to perfect a security interest. A second method, which may be more difficult than filing, is to take actual possession of the collateral. This is often referred to as repossession. You must be careful, if using this method, that you do so in a peaceful and lawful manner. You may not break in to a property to take possession of collateral, and you may not take possession in such a way that creates a disturbance.[16]

-

5Take legal control of the collateral to perfect a security interest. A final alternative for perfecting a security interest in property is to take “control” over the collateral. This does not require actual possession of the property, but it does require you to take sufficient legal steps so that you control what can be done with the collateral. This method generally applies to intangible assets like accounts receivable, deposit accounts or investment accounts.[17]

Securing a Loan with Other Personal Property

-

1Attach the loan to some identified collateral. If you are lending to an individual, you may wish to secure your promissory note with some of that person’s personal property. Personal property can be anything that is not a motor vehicle or real estate. This could include anything of sufficient value, such as a big screen television, bank accounts, valuable antiques, or anything else you identify.[18]

-

2Complete a financing statement to attach the collateral to the promissory note. To attach the loan to any personal property, you will need to have the borrower complete a financing statement, which is sometimes also referred to as a “UCC” or “UCC-1” statement. [19]

- The financing statement requires you to provide the borrower’s name and address, the lender’s name and address, and a description of the collateral. The description must be specific enough to identify the property for any third party.

-

3Perfect your security interest. To perfect a security interest in personal property, the most common method is to file the loan documents with the secretary of state’s office in the state where the borrower resides. Depending on the laws of your state, you may also need to file in the county clerk’s office or in some other location. You should check with an attorney or the secretary of state to verify the filing requirements for your state.[20]

- As with business loans, you may also perfect your security interest by taking possession or control over the collateral. If using one of these methods, you must do so in a peaceful and lawful manner. You may not break in to someone’s home to take possession of any property or take any action that causes a public disturbance.

Expert Q&A

-

QuestionWhat makes a promissory note enforceable?

Lyle Solomon, JDLyle Solomon is an Attorney and the Owner of the Law Office of Lyle D. Solomon. With nearly three decades of experience, he practices civil law and specializes in consumer debt relief services and bankruptcy. Lyle is also the author of Think Different! Save More! He holds a BA in Criminal Justice from The University of Nevada, Las Vegas, and a JD from The University of Pacific, McGeorge School of Law.

Lyle Solomon, JDLyle Solomon is an Attorney and the Owner of the Law Office of Lyle D. Solomon. With nearly three decades of experience, he practices civil law and specializes in consumer debt relief services and bankruptcy. Lyle is also the author of Think Different! Save More! He holds a BA in Criminal Justice from The University of Nevada, Las Vegas, and a JD from The University of Pacific, McGeorge School of Law.

Attorney A promissory note is a contract, a contract in law is defined legally as a meeting of the minds or agreement of the parties. Also, it's imperative that the promissory note must be for a legal item, as you cannot make a contract for an illegal action or item.

A promissory note is a contract, a contract in law is defined legally as a meeting of the minds or agreement of the parties. Also, it's imperative that the promissory note must be for a legal item, as you cannot make a contract for an illegal action or item. -

QuestionIs there a promissory note prototype I can copy and then customize for free?

Community AnswerYes, there are several such resources online. Just search for "promissory note template."

Community AnswerYes, there are several such resources online. Just search for "promissory note template." -

QuestionWhat happens if the property you have first position in on your note is sold? Is the borrower obligated to notify me? What happens to my note security?

Community AnswerIf you have loaned money, and secured that loan with certain collateral, your financing statement should contain a provision that requires the borrower to notify you before selling the collateral. Even if it does not contain such a provision, you still retain your secured position regarding that property. As a result, if the borrower has already sold the collateral, you have the legal right to go to the buyer and take possession or foreclose on the property. You may need to get a lawyer involved with this.

Community AnswerIf you have loaned money, and secured that loan with certain collateral, your financing statement should contain a provision that requires the borrower to notify you before selling the collateral. Even if it does not contain such a provision, you still retain your secured position regarding that property. As a result, if the borrower has already sold the collateral, you have the legal right to go to the buyer and take possession or foreclose on the property. You may need to get a lawyer involved with this.

Warnings

- The requirements for perfecting a security interest in most kinds of property are very specific. Particularly if large amounts of money are involved, you should consult with a lawyer to make sure that you satisfy all the requirements correctly.⧼thumbs_response⧽

- This article focuses primarily on the laws of the United States. Although procedures are generally similar, you should consult with a local attorney if you live in another country or if you are dealing with a borrower who lives in another country.⧼thumbs_response⧽

References

- ↑ http://www.nolo.com/legal-encyclopedia/how-attach-perfect-security-interest-under-the-ucc.html

- ↑ https://www.nolo.com/legal-encyclopedia/what-secured-debt.html

- ↑ Lyle Solomon, JD. Attorney. Expert Interview. 18 August 2021.

- ↑ https://www.nolo.com/legal-encyclopedia/what-secured-debt.html

- ↑ Lyle Solomon, JD. Attorney. Expert Interview. 18 August 2021.

- ↑ https://www.nolo.com/legal-encyclopedia/what-secured-debt.html

- ↑ http://dor.sd.gov/Motor_Vehicles/Electronic_Lien_and_Title/Liens.aspx

- ↑ https://www.tn.gov/revenue/title-and-registration/vehicle-titling---registration/vehicle-titling/lien-notation.html

- ↑ http://www.lexology.com/library/detail.aspx?g=74ab3d88-fea7-47f5-860a-d95f4f09cc0e

- ↑ Lyle Solomon, JD. Attorney. Expert Interview. 18 August 2021.

- ↑ https://www.rocketlawyer.com/document/mortgage-agreement.rl#/

- ↑ http://www.lexology.com/library/detail.aspx?g=74ab3d88-fea7-47f5-860a-d95f4f09cc0e

- ↑ http://bhlawpllc.com/wp-content/uploads/2014/04/CREATION-AND-PERFECTION-OF-SECURITY-INTERESTS-RKW1.pdf

- ↑ http://bhlawpllc.com/wp-content/uploads/2014/04/CREATION-AND-PERFECTION-OF-SECURITY-INTERESTS-RKW1.pdf

- ↑ http://bhlawpllc.com/wp-content/uploads/2014/04/CREATION-AND-PERFECTION-OF-SECURITY-INTERESTS-RKW1.pdf

- ↑ http://bhlawpllc.com/wp-content/uploads/2014/04/CREATION-AND-PERFECTION-OF-SECURITY-INTERESTS-RKW1.pdf

- ↑ http://bhlawpllc.com/wp-content/uploads/2014/04/CREATION-AND-PERFECTION-OF-SECURITY-INTERESTS-RKW1.pdf

- ↑ http://bhlawpllc.com/wp-content/uploads/2014/04/CREATION-AND-PERFECTION-OF-SECURITY-INTERESTS-RKW1.pdf

- ↑ http://bhlawpllc.com/wp-content/uploads/2014/04/CREATION-AND-PERFECTION-OF-SECURITY-INTERESTS-RKW1.pdf

- ↑ http://bhlawpllc.com/wp-content/uploads/2014/04/CREATION-AND-PERFECTION-OF-SECURITY-INTERESTS-RKW1.pdf