This article was co-authored by Andrew Lokenauth. Andrew Lokenauth is a Finance Executive who has over 15 years of experience working on Wall St. and in Tech & Start-ups. Andrew helps management teams translate their financials into actionable business decisions. He has held positions at Goldman Sachs, Citi, and JPMorgan Asset Management. He is the founder of Fluent in Finance, a firm that provides resources to help others learn to build wealth, understand the importance of investing, create a healthy budget, strategize debt pay-off, develop a retirement roadmap, and create a personalized investing plan. His insights have been quoted in Forbes, TIME, Business Insider, Nasdaq, Yahoo Finance, BankRate, and U.S. News. Andrew has a Bachelor of Business Administration Degree (BBA), Accounting and Finance from Pace University.

There are 10 references cited in this article, which can be found at the bottom of the page.

wikiHow marks an article as reader-approved once it receives enough positive feedback. In this case, several readers have written to tell us that this article was helpful to them, earning it our reader-approved status.

This article has been viewed 73,496 times.

If you are a trader, investor or anyone involved in the bond market, you may want to know how to calculate bond spread. Bond spread refers to the difference between the interest rates of two bonds. This is a key factor in identifying the various risks and benefits of a particular bond within the greater bond market. Many professionals use bond spread to assess relative yields on bonds and the profits that can be made by investing in them. If you need to calculate the bond spread for a particular bond, start by calculating its yield.

Steps

Calculating Bond Yield

-

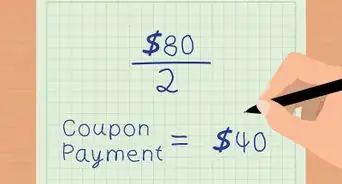

1Locate bond information. In order to calculate bond yields, you will need information about the price of the bond and the values of its payments. Look for its market price, par value, and details about coupon payments. While information is more difficult to find for bonds than for stocks or mutual funds, it can still be located through your broker, online brokerage platform, and through some financial news websites such as Yahoo! Finance and Bloomberg.

- For coupon payments, look for the coupon rate. This information is generally provided with bond quotes.[1]

-

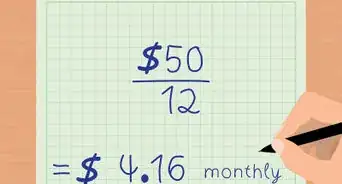

2Calculate nominal yield. The nominal yield is the type of bond yield that is used most frequently. It is simply the coupon rate of the bond. Or, it can be calculating as the annual return divided by the par value (also called the face value) of the bond. It is also called the coupon yield. Many times, this information will be already available in the bond quote, and will require no calculation.

- For example, a bond that pays coupon payments of 5.5 percent per year would have a nominal yield of 5.5 percent.[2]

Advertisement -

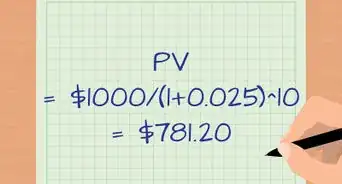

3Find the current yield. The current yield is distinct from the nominal yield in that it used the current market price of the bond rather than the par value. It is calculated as the annual cash flows divided by the current market price. This is the yield most commonly used when calculating bond spreads.[3]

- For example, a bond with a $1,000 par value that pays a 5.5 percent coupon payment annually would pay $55 per year. If the bond is currently trading at $970, the current yield is about 5.67 percent.

Calculating Bond Spreads

-

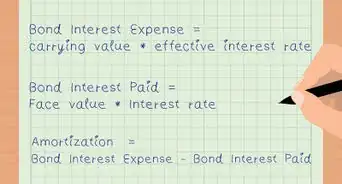

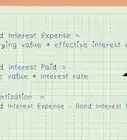

1Analyze yield spreads. In its most basic form, a bond spread is simply the difference, or "spread," between two bond interest rates. Note the interest rate of a given bond, and then select another bond with which to compare it. Note that bond's interest rate. Subtract the lower interest rate from the higher interest rate. That will be the bond spread. This measurement is also called the yield spread.

- Yield spread can also be calculated between other debt securities, such as certificates of deposit.[4]

- For example, if one bond has a yield of 5 percent and another has a yield of 4 percent, the spread is 1 percent.

- Bonds might have different yields for a number of reasons, including their term (the length of their life), quality (bonds viewed as riskier may pay higher interest rates), and other qualities.

-

2Analyze coupon spreads. The coupon spread is the difference between the nominal yields, or coupon rates, of two bonds. For example, two bonds with coupon rates of 7 and 5 percent would have a coupon spread of 2 percent, or 200 basis points. Coupon spreads can be used as a way to analyze yield or credit spreads.

- For example, if the two bonds mentioned earlier in this step (with the coupon spread of 2 percent) only had a bond spread of 1 percent, you could conclude that there are other factors reducing the value of the bond that pays 7 percent.[5]

-

3Convert the spread's interest rate into a set of "basis points". Many professionals use basis points to assess bond spreads. To make the conversion, simply multiply the bond spread percentage by 100. A basis point is 1/100 of a percentage point. Thus, for example, a spread of 0.25 percent, when multiplied by 100, is 25 basis points. This calculation results in a slightly more convenient system of making comparisons (instead of using very small numbers).[6]

- Basis points are abbreviated as "BP" or "bps" and may be referred to verbally as "beeps."[7]

Using Bond Spread

-

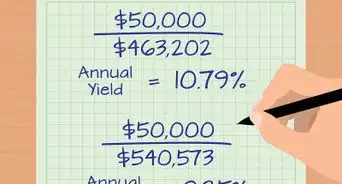

1Calculate credit spread. A credit spread is a specific type of bond spread that calculates the difference in yield between a U.S. Treasury bond and another bond of the same maturity. For example, a 10-year corporate bond might be compared to a 10-year Treasury note. The credit spread is a representation of the perceived credit risk (the risk that the issuer will default on bond payments) between bond issuers, with the U.S. Treasury being the most reliable and any bond compared to it being of lower reliability.[8]

- For example, if a bond has a yield of 5.5 percent and a Treasury note with the same maturity has a yield of 2.7 percent, the credit spread is 2.8 percent, or 280 basis points.

-

2Take a look at historical bond spreads. With new computing tools, traders, investors and others can assess bond spreads over time. This might tell more about the difference between two bonds than just a simple bond spread can. The same can be done when comparing the same bond or bond type now and in the past. A smaller current bond spread than a historical average can indicate higher than average investor confidence in that security.[9]

- The bond spread between two different bonds can change over time for a number of reasons. Try to determine a trend, and then the reason for the increase decrease. Yields change as the market interest rate changes (the two move inversely to each other), while coupon remains the same. Two bonds of same quality should have similar yields.

-

3Relate your bond spread to credit risk. Bond spreads, and particularly credit spreads, are related to the perceived risk of investing in a bond. That is, the risk that the issuer (the foreign entity or corporation that backs the bond) will not make payments on that bond as promised. As the risk increased, the credit spread also increases. Spreads are then higher for less reliable corporation and developing nations.[10]

- Determine the credit spread for a bond you are considering investing in. The size of the spread will help you get an idea of the risk that the market believes the bond carries.

- Bond rating agencies, like Moody's, Standard and Poor's, and Fitch rate bond issuers according to their credit risk. Bonds are rated from AAA to C (or a similar scale, depending on the rating agency), which represents the scale from safe, investment-grade bonds to risky, "junk" bonds.[11]

- Yields offered by bonds are inverse to their credit rating. For example, a AAA-rated issuer may only need to offer 6 percent, whereas a B-rated issuer might need to offer 9 percent for a bond with the same terms.[12]

-

4Assess market performance. Credit spreads can also be used to assess investor uncertainty. For example, if investors on the whole are feeling unsure about the future, they will turn to AAA-rated bonds. This demand then causes a price increase for AAA-rated bonds, leading to a decrease in their current yields. This then leads to wider credit spreads, which can be interpreted as a sign of investor uncertainty.[13]

- For example, as investor confidence falls, they seek more security by selling B-rated bonds and investing in AAA-rated ones. This causes the price of the poor quality bonds to fall, increasing their yields. The higher quality bonds will simultaneously increase in price due to demand, while reducing their yield.

- This can be further divided into analyses of different industries, sectors, or bond markets. If the bond spreads are increasing (widening) for one of them, this means that the industry is outperforming others.[14]

-

5Use credit spreads as part of a trading strategy. Bond traders, like any other type of trader, are trying to buy low and sell high. In terms of bond spreads, this means buying when spreads are wide and selling when they are narrow. Or, in other words, buying when investor confidence is low and selling when it is high. However, this practice is risky and should only be practiced by professional or very experienced bond traders.[15]

References

- ↑ http://www.investopedia.com/ask/answers/06/bondquote.asp

- ↑ http://www.investopedia.com/terms/n/nominalyield.asp

- ↑ http://www.investopedia.com/terms/c/currentyield.asp

- ↑ http://www.fool.com/knowledge-center/how-to-calculate-spread.aspx

- ↑ http://www.finpipe.com/bond-spreads/

- ↑ http://www.fool.com/knowledge-center/how-to-calculate-spread.aspx

- ↑ http://www.investinganswers.com/financial-dictionary/bonds/yield-spread-2740

- ↑ http://www.investopedia.com/terms/c/creditspread.asp

- ↑ http://www.investinganswers.com/financial-dictionary/bonds/yield-spread-2740

- ↑ http://www.investopedia.com/terms/c/creditspread.asp

- ↑ http://www.investopedia.com/terms/b/bondrating.asp

- ↑ http://www.investinginbonds.com/learnmore.asp?catid=5&subcatid=19&id=190

- ↑ http://www.investopedia.com/terms/c/creditspread.asp

- ↑ http://www.investopedia.com/terms/y/yieldspread.asp

- ↑ http://www.investinganswers.com/financial-dictionary/bonds/yield-spread-2740