This article was co-authored by Michael R. Lewis. Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

There are 9 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 47,406 times.

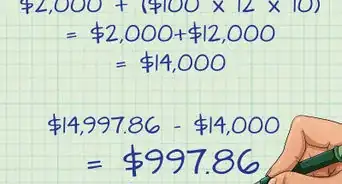

Savings bonds are issued by the U.S. Treasury and reliably build value over time. As a bond purchaser or bondholder, you are compensated for your investment in the form of interest, which is added to the value of the bond according to various schedules (e.g. annually, semi-annually, etc.). Interest is generally calculated on a compounded basis so that even though the bond will not increase in value every month, your interest still accrues according to the schedule set forth in the terms of the bond.

Steps

Locating Bond Information

-

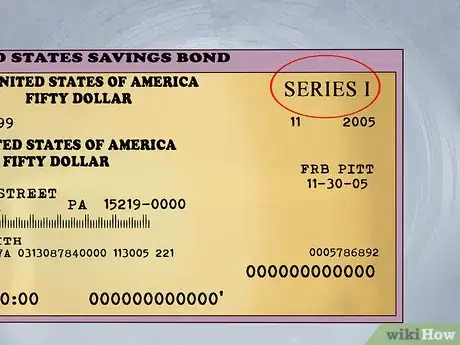

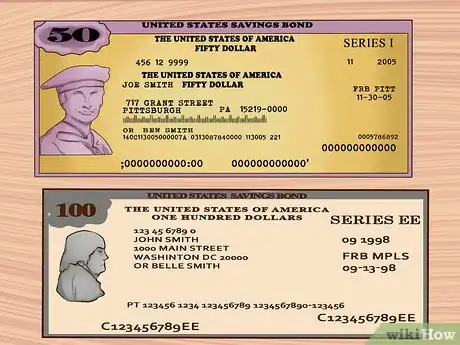

1Determine the bond's series. The bond's series indicates the type and nature of the savings bond. Currently, the active bond series include E, EE, and I bonds. This information can be found in the upper right-hand corner of the bond certificate. If you purchased your bond on Treasury Direct, this information will be available in your account.[1]

- If you're having trouble locating this information, the U.S. Treasury has provided a diagram to help paper savings bondholders find it. Visit https://www.treasurydirect.gov/indiv/help/bc/bc_savings_diagram.htm to see it.

- E bonds were last issued in 1980 as 30-year bonds, so most E bonds should have been cashed in already. If you have an E bond you can still cash it in; however, note that interest would only accrue through the active life of the bond, which ended in 2010.

- HH and H series bonds are no longer in use and their current value cannot be calculated.[2]

-

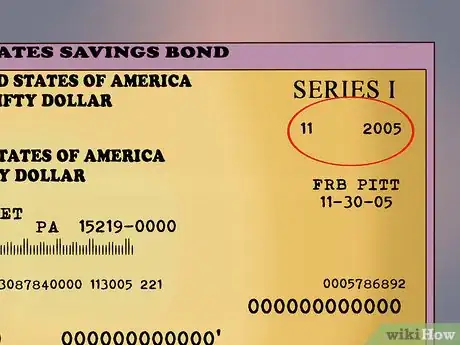

2Look for the date of issue. The issue date indicates the month and year that the bond was issued. This information can be found on the right side of the bond certificate, between the series and serial number. This section may also include information regarding where the bond was purchased.[3]Advertisement

-

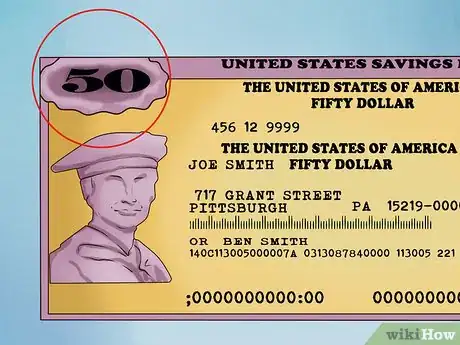

3Figure out the bond's face value. The bond's face value, or denomination, represents how much the bond can be cashed in for before interest is added in. This information is the number if the top left-hand section of the bond certificate.[4]

-

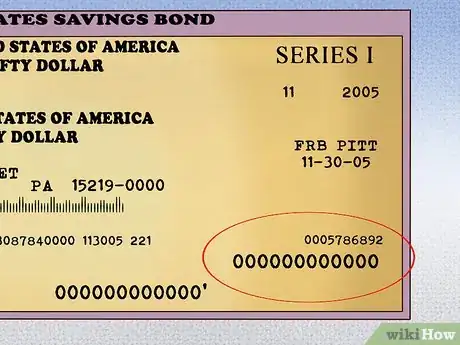

4Identify the serial number. The serial number, shown in the bottom right corner of the bond certificate, identifies your bond. This information is not required for calculating the bond's value. However, it must be recorded in case the bond certificate is damaged or lost.[5]

Calculating Bond Interest

-

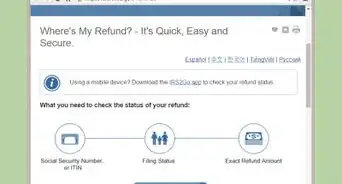

1Locate the savings bond calculator. Due to the complex nature of the interest rates and conditions attached to savings bonds, the only practical way to obtain their value is to use the free savings bond calculator provided by the U.S. Treasury. The calculator can be accessed by visiting https://www.treasurydirect.gov/BC/SBCPrice. Treasury Direct is the U.S. Treasury's online platform that can be used for purchasing Treasury securities.

-

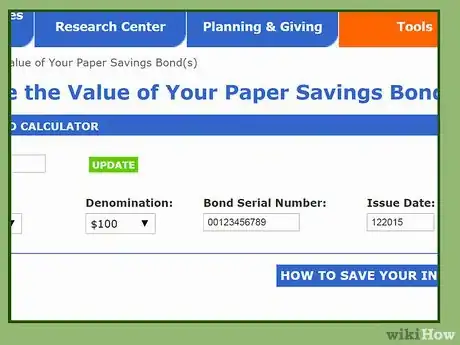

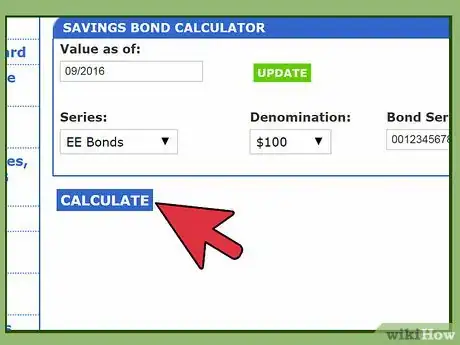

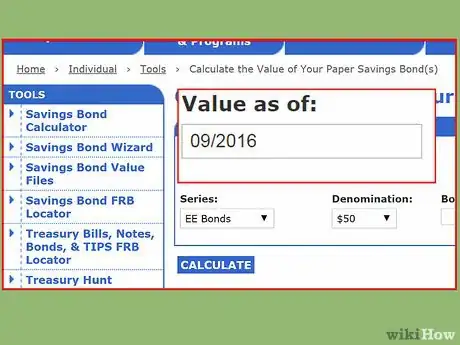

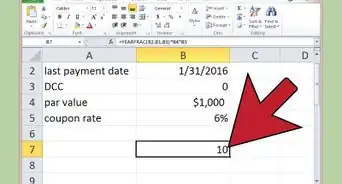

2Input your data. Once you've located the calculator, input your information. You'll need to include the bond's denomination, issue date, and series. You can enter the issue date in the form mm/yyyy. For example, December 2015 would be 122015.

- The serial number field is optional. The calculator will still work if you provide the rest of the required information.[6]

-

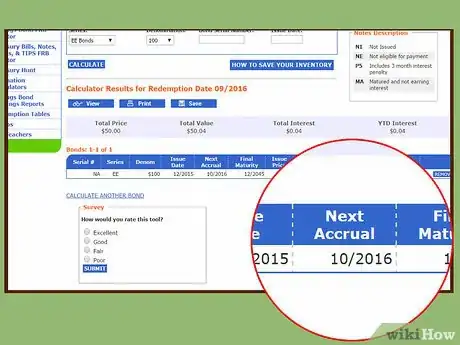

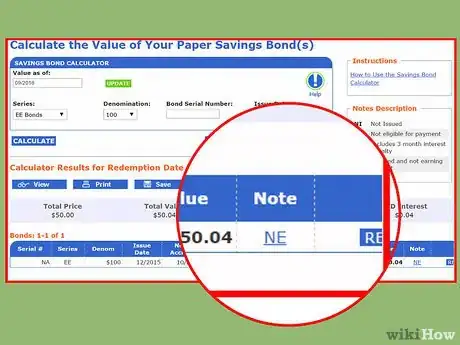

3Calculate bond value. When you've entered all of your data, press the "calculate" button and the page will refresh with your bond's value calculated below the calculator inputs. The readout will include all pertinent information about the bond, including its value for the current date in the "value" field and the interest earned up to this point. You can then click on "calculate another bond" to add in more information if you have more than one savings bond.[7]

- I bonds earn both a fixed rate and an additional variable rate for inflation, which is adjusted and accrues every six months. EE bonds earn a fixed rate over the life of the bond.

- The "Interest Rate" field shows the current interest rate being earned by the bond, not a historical average or previous rate. The rate shown will be earned on the next accrual date.[8]

-

4Identify the next accrual date. The readout will also display data under the "Next Accrual" field that shows when the next interest payment will be credited to the bond's value. This field shows the date when the built-up interest from the period will be added to the value of your bond. If you are thinking about selling, it is advisable to wait until this time. Otherwise you will lose the accrued interest from the last accrual date to the sell date.[9]

-

5Note the interest penalty, if applicable. The "Note" field may display a code that signifies an additional condition on the bond. For example, "NI" indicates that the "value as of" field is set before the issue date. However, another important result is "P5," which means that the bond is under five years old. In this case, selling the bond at the current date would incur a penalty equal to three months of interest.[10]

-

6Calculate value for a different date. The calculator will automate show your bond's value on the current date. However, you can also change the date using the box at top left labeled "Value as of." If you have an I bond, the date chosen must be between the beginning of 1996 and the end of the next compounding period. It cannot extend to future dates because the interest rate cannot be predicted, as I bonds have a variable interest rate. If you have an EE bond with a fixed rate, you can accurately calculate the earnings.[11]

- Dates must be entered in the form mm/yyyy. For example, September 2015 would be entered as 09/2015.[12]

Understanding Savings Bonds

-

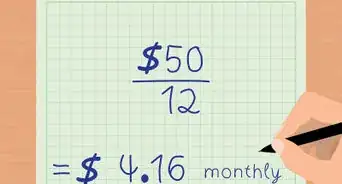

1Understand the purpose of savings bonds. Savings bonds are designed for two purposes: to give Americans an easy, cheap, and reliable way to build wealth and to service the government's financing needs. They can be purchased in denominations as low as $25 and can be held for up to 30 years. Upon maturity, they provide a reliable payout of their face value. Savings bonds are considered to be one of the safest investments.

- Earnings from savings bonds are not subject to state and local taxes.[13]

- Bonds purchased after 1989 may qualify for an education tax exclusion. In this case, earnings on qualifying bonds used for your child's education are tax-free. However, this is subject to restrictions and qualification. See the Treasury Direct website for details.[14]

-

2Compare different series of savings bonds. The two types, or series, of savings bonds are mostly similar, but differ in a few key ways. EE Bonds are no longer sold as paper bonds and earn interest at a fixed rate (since 2005). I Bonds are only available for purchase as paper bonds with your IRS tax refund. Otherwise they must be purchased electronically on the Treasury Direct website. They earn a "composite" interest rate that fluctuates with inflation. Both bonds:

- Are purchased at face value. A $100 bond costs $100.

- Are available in non-standard denominations to the penny. For example, you can buy a $28.73 savings bond.

- Limit buyers to $10,000 in savings bond purchases each year.

- Can be redeemed after a year.

- Carry a penalty if redeemed in under five years — three months of interest will be withheld.

- Earn interest monthly.[15]

-

3Know where to purchase savings bonds. Electronic savings bonds are only available through Treasurydirect.gov. They can be purchased by inputting your bank account information and personal information in the appropriate fields. You can buy one bond, several bonds at once, or schedule future purchases. This method requires no paperwork.[16]

- Paper I Bonds can be purchased using your tax refund.[17]

-

4Compare savings bonds to other investments. Investments typically display a positive relationship between returns and risk. That is, low-risk investments have low returns and high-risk investments have higher returns. Savings bonds are on the far end of the safe side of the risk spectrum, and their returns reflect that. Today, they offer about half of the interest rate that 10-year Treasury notes bills earn (which are themselves considered very safe); however, I Series savings bonds are technically safer due to their built-in inflation protection.

- Other investments, like shares of stock, mutual funds, and corporate bonds can offer much higher, much riskier returns than savings bonds.

- Consult with a financial professional to see if savings bonds can meet your saving needs.[18]

Warnings

- Before investing in bonds based on your bond interest calculations, you may want to consult a financial advisor to ensure you are making the best decision based on your financial situation.⧼thumbs_response⧽

References

- ↑ https://www.treasurydirect.gov/indiv/tools/tools_savingsbondcalc_instructions.htm

- ↑ https://www.treasurydirect.gov/indiv/products/prod_hhbonds_glance.htm

- ↑ https://www.treasurydirect.gov/indiv/tools/tools_savingsbondcalc_instructions.htm

- ↑ https://www.treasurydirect.gov/indiv/tools/tools_savingsbondcalc_instructions.htm

- ↑ https://www.treasurydirect.gov/indiv/tools/tools_savingsbondcalc_instructions.htm

- ↑ http://finance.zacks.com/use-savings-bond-calculator-4984.html

- ↑ http://finance.zacks.com/use-savings-bond-calculator-4984.html

- ↑ http://www.bankrate.com/finance/savings/cash-in-savings-bonds-carefully.aspx

- ↑ http://www.bankrate.com/finance/savings/cash-in-savings-bonds-carefully.aspx

- ↑ https://www.treasurydirect.gov/indiv/tools/tools_savingsbondcalc_instructions.htm

- ↑ https://www.treasurydirect.gov/indiv/tools/tools_savingsbondcalc_instructions.htm

- ↑ http://finance.zacks.com/use-savings-bond-calculator-4984.html

- ↑ https://www.sec.gov/answers/savingsbond.htm

- ↑ http://www.treasurydirect.gov/indiv/planning/plan_education.htm

- ↑ https://www.treasurydirect.gov/indiv/research/indepth/ebonds/res_e_bonds_eecomparison.htm

- ↑ ftp://ftp.publicdebt.treas.gov/marsbom.pdf

- ↑ https://www.treasurydirect.gov/indiv/research/indepth/ebonds/res_e_bonds_eecomparison.htm

- ↑ http://www.moneycrashers.com/series-i-savings-bonds/