This article was co-authored by Trent Larsen, CFP® and by wikiHow staff writer, Jennifer Mueller, JD. Trent Larsen is a Certified Financial Planner™ (CFP®) for Insight Wealth Strategies in the Bay Area, California. With over five years of experience, Trent specializes in financial planning and wealth management as well as personalized retirement, tax, and investment planning. Trent holds a BS in Economics from California State University, Chico. He has successfully passed his Series 7 and 66 registrations and holds his CA Life and Health Insurance license and CFP® certification.

There are 11 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 350,824 times.

Graduating from college is a time of celebration – you made it! Unfortunately, if you're like most American students, you graduated with student loan debt. The months immediately after you graduated are a time to take stock and figure out how you're gonna start making those payments. If you budget carefully, you should be able to repay your student loans without too much difficulty. If you do run into problems, the federal government provides some options, including deference and forbearance, that can help you out.[1]

Steps

Completing Exit Counseling

-

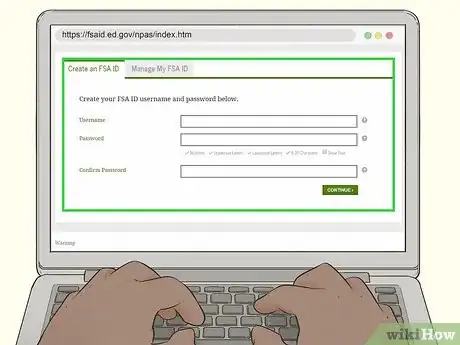

1Create an account on the federal student loans website. Exit counseling is typically done through the federal student loans website. Before you begin the exit counseling program, you have to set up an account. After you've completed exit counseling, you can manage your loans from your account.[2]

- To create a new Federal Student Aid (FSA) ID, go to https://fsaid.ed.gov/npas/index.htm and choose a username and password. You will then be asked some questions to verify your identity.

- You must have a valid email address for your FSA ID. Don't use your school email if you won't have access to it after you graduate. You may miss important notices from the federal government.

-

2Coordinate your exit counseling with the financial aid office. In most schools, you'll complete an online exit counseling program that describes how to repay your student loans and what will happen if you don't make your payments on time. Some schools have an additional meeting or interview with a staff member in the financial aid office.[3]

- If you complete exit counseling through StudentLoans.gov, you'll receive a certificate of completion. Print this out and keep it for your records. You will probably need to submit it to your financial aid office to show that you've completed the program.

Tip: You must complete exit counseling if you graduate, leave school, or drop below half-time enrollment. You will still be required to start paying back your student loans even if you don't graduate.

Advertisement -

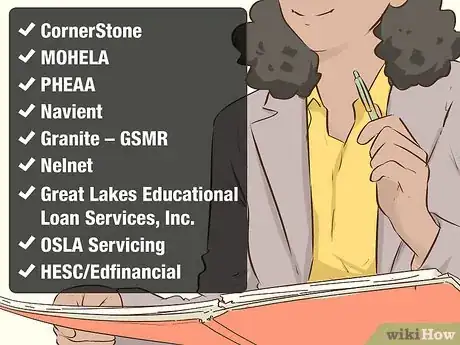

3Identify your loan servicer. Rather than making payments directly to the government, you pay off your student loans through your loan servicer. Each loan servicer has its own website and payment process. You can find out which company your loan servicer is from your FSA account.[4]

- As of 2019, there are 9 loan servicers for federal student loans: CornerStone, MOHELA, FedLoan Servicing (PHEAA), Navient, Granite – GSMR, Nelnet, Great Lakes Educational Loan Services, Inc., OSLA Servicing, and HESC/Edfinancial.

- You do not get to choose which company services your loan or request a change if you don't like your loan servicer.

-

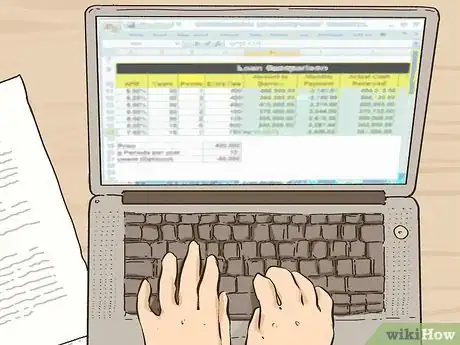

4Make a spreadsheet of all your loans and their balances. If you've taken out loans for multiple years, they're likely listed separately. Some of them may even be with different loan servicers. A spreadsheet can help you organize your loans and keep track of how much you owe and when payments are due.[5]

- Unless you consolidate your federal loans, you may even have different due dates for different loans, particularly if they are different types of loans. For example, if some of your loans are Direct Loans and others are Perkins Loans, you may have different servicers and different due dates for the different types of loans.

-

5Determine when your first payments are due. Most federal loans and some private loans have a 6-month grace period after graduation during which you aren't expected to start repaying your loans. You can use this period to get your finances in order and evaluate different repayment options.[6]

- If you have a Perkins Loan, the length of your grace period depends on the school that gave you the loan. Contact your school's financial aid office to find out your grace period if it wasn't explained to you during exit counseling.

Tip: If you're able to start making payments during the grace period, you'll be able to pay off your loans that much faster.

Choosing a Repayment Plan

-

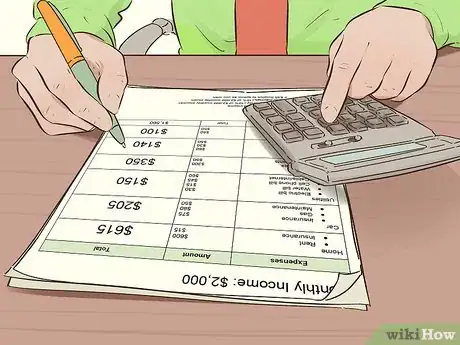

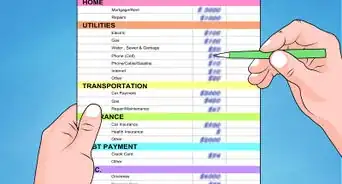

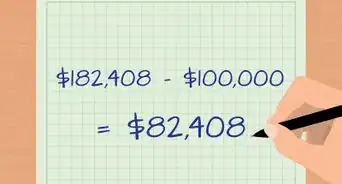

1Create a household budget so you know how much you can afford to pay. Once you've settled into a job after college, sit down and make a list of your basic expenses each month.[7] [8] Then take a look at your paystubs for the past few months and estimate your monthly income.[9]

- Generally, you want to estimate your expenses high and your income low. For example, if you get paid twice a month and your pay varies between $850 and $650, you might budget your income at $700 a month. However, if you have expenses that are always the exact same amount, it's okay to use that exact amount in your budget.

- Track your expenses over the past 2 or 3 months so your budget is based on reality, not on an ideal. If you find that you need to cut expenses, you'll have a realistic picture of where your money goes and can figure out what to trim or eliminate entirely.[10]

Tip: Living on a budget doesn't mean you aren't allowed to have any fun. Include budgeted amounts for activities such as going to the movies or taking a weekend trip occasionally. If your budget is too restrictive, you'll have trouble sticking to it.

-

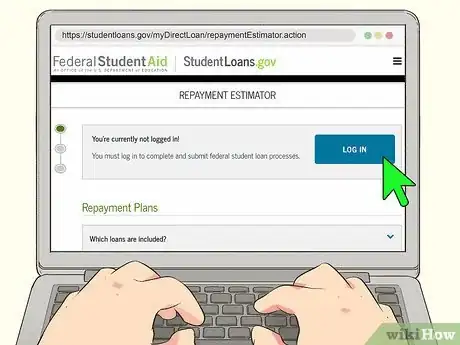

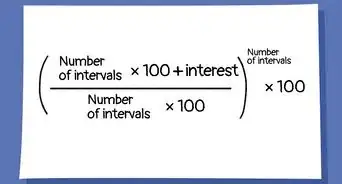

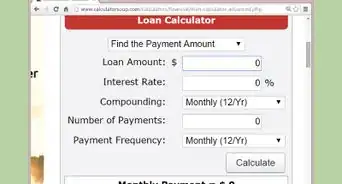

2Use the online repayment estimator to find out what your payments will be. The federal government has a repayment estimator available at https://studentloans.gov/myDirectLoan/repaymentEstimator.action. You must be logged in with your FSA ID to use this service.[11]

- Even though the calculator produces an estimate, that estimate is based on your actual loan information, so it should be fairly accurate. It also allows you to compare the repayment plans available and see what your monthly payments will be, how long it will take for you to pay off your loans, and what the total amount you pay back will be.

-

3Start with the default repayment plan if possible. If you stick with the default, or standard, repayment plan for federal loans, you will have them paid off in 10 years. As long as the monthly payment is something you can afford, this is the easiest way to pay off your student loans.[12]

- The standard repayment plan is by far the most popular. If you don't choose an alternate repayment plan, you'll be automatically enrolled in the standard plan.

Tip: Consider your monthly payment to be the bare minimum. You can always make additional payments with no penalty. If you put extra money towards your student loans when you have it, you'll pay them off much more quickly and pay less in interest overall.

-

4Try the graduated repayment plan if you're confident your income will increase. The graduated repayment plan starts with a relatively low monthly payment that increases each year. If you've started an entry-level job in your chosen career and are confident you have pay raises and promotions coming in your future, this plan may be ideal for you.[13]

- If it later turns out that you aren't making as much money as you thought you would and won't be able to make the larger payments, you may be able to switch to a different plan. However, doing so will likely mean that you end up taking longer to pay off your student loans, as well as paying more overall.

-

5Look at the extended repayment plan if you need lower payments. If you aren't confident that your income will go up in the future enough to afford later payments under the graduated repayment plan, an extended payment plan may work for you. This repayment plan typically works best for students who are in lower-paying fields, such as education.[14]

- You may also want an extended repayment plan if you left school before graduating and aren't able to earn the same kind of money you would if you had a degree.

-

6Apply for income-based repayment if you have limited income. The federal government offers 3 different income-based repayment plans if you aren't earning enough money to make your student loan payments under the other plans. All of the plans take your income and expenses into consideration and ensure your monthly payment is no more than 10 to 20 percent of your discretionary income.[15]

- Income-based repayment plans typically aren't available for parent-borrowers of PLUS Loans.

- Income-based repayment plans last for either 20 or 25 years, as long as you remain eligible during that time. After 25 years, any remaining loan balance will be forgiven. You may be responsible for income taxes on the portion of your student loans that are forgiven.

Tip: There is no way to both lower your monthly payments and shorten the period of time that you pay off your loans. Under income-based repayment plans, you must continue to pay for 20 or 25 years, compared to 10 years under the standard repayment plan.

-

7Sign up for automatic payments. Automatic payments ensure that you're making your payments on time every month (assuming you have the money in your bank account to cover the payment). Additionally, you may be eligible for a lower interest rate if you sign up for automatic payments.[16]

- Only use automatic payments if you're confident the money for your student loan payment will be in your bank account. You might consider using a separate savings account for student loans and transferring money there for your monthly payments. If you can start the account with a cushion of 2 or 3 loan payments you can make sure there will always be enough in the account to cover the payment.

-

8Evaluate your options if you can't afford your payments. If you find you aren't able to make your student loan payments, contact your loan servicer as soon as possible to find out if you qualify for deferment or forbearance. You may have to prove financial hardship for a forbearance. Deferments are more typically granted to individuals who are unemployed, serving in the military, or attending graduate or professional school.[17]

- You have to be proactive about this. If you simply stop making your payments, it will negatively affect your credit score. Too many missing payments will cause your loans to go into default, which can be disastrous for your ability to borrow in the future.

- If you qualify for deferment or forbearance, your loan servicer may apply the deferment or forbearance back to your oldest missed payment. However, this will decrease the number of payments you don't have to make in the future.

- Depending on the type of loan you have, your loan may still continue to accrue interest while payments are in deferment or forbearance.

Refinancing Your Loans

-

1Consolidate your federal loans through a Direct Consolidation Loan. If all of your loans are federal Direct loans, you can consolidate them and make a single monthly payment. When you consolidate through the federal government, you won't necessarily get a lower interest rate than what you're currently paying. However, consolidation can make repayment more convenient.[18]

- Even though you won't get a lower interest rate, consolidations loans can be especially helpful if you have several years worth of loans that are with different servicers and have different due dates.

- Generally, if you have loans with different servicers, they would all be moved to a single servicer when you consolidate.

- If you have different types of loans, you may end up with two consolidation loans rather than just one. However, this can still make your payments easier to manage.

-

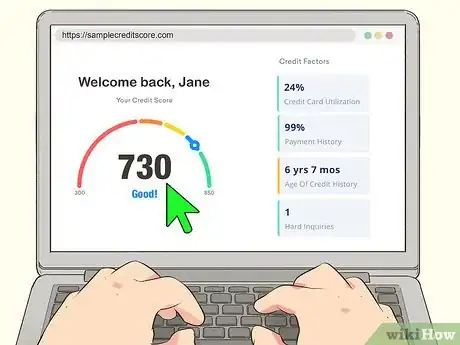

2Check your credit scores. The main reason to refinance your loans is to get a lower interest rate.[19] If you don't have a credit score over 680, it's unlikely you'll qualify for a lower interest rate than what you're currently paying. Some refinance companies only consider applicants with credit scores above 700.[20]

- While you can get a credit report for free each year from each of the 3 credit bureaus (TransUnion, Equifax, and Experian), these reports don't include your scores. You can use free websites or apps, such as Credit Karma, Credit Sesame, or Wallet Hub, to check your credit score. You can also pay for access to your official credit score from one of the 3 credit bureaus.

-

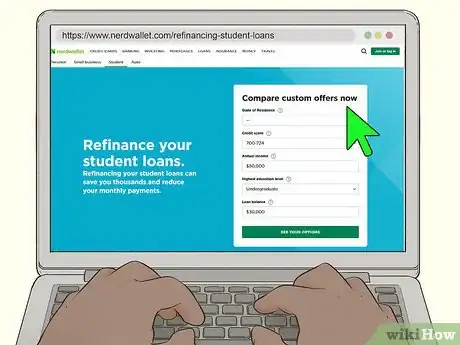

3Compare loan consolidation and refinance companies. Refinancing your loans into a single loan can make repayment easier and may lower your monthly payment. Generally, you want to look for the company that will give you the lowest possible interest rate. That way, you'll pay less money overall for the life of your loan.[21]

- If you can't get your loans refinanced at a lower rate than what you're currently paying, there's no point in refinancing. Even if you're offered a lower monthly payment, you'll still be paying off your student loans for a longer period of time and will end up paying more overall.

- Nerd Wallet has an online tool you can use to compare companies and find the best fit for your needs. Go to https://www.nerdwallet.com/refinancing-student-loans and enter your information to get started.

Tip: If you refinance your loans, you may lose your rights to deferment or forbearance. Even if you don't anticipate ever needing those options, they are valuable to keep in case of an emergency. Make sure any refinance company you choose allows you to retain those rights.

-

4Get quotes from companies you're interested in. Typically, consolidation and refinance companies provide you an estimate based on your answers to a few questions about your income and the total amount of your student loans. They'll likely also do a "soft pull" of your credit, which doesn't give them the details of your credit history and doesn't have a negative impact on your score.[22]

- You can use these quotes to compare different lending companies. However, keep in mind that the terms of the loan you're ultimately offered may not be the same as the one in the quote.

-

5Complete an application with the lender of your choice. Once you've decided which lending company you want to use, you'll fill out a complete application with more details than the information you provided to get the initial quote. Typically, you can fill out this application online in 10 to 15 minutes.[23]

- After your application is complete, you'll get a refinancing offer. You may have a limited period of time to either accept or reject that offer. If you accept the offer, the lender will pay off your student loans for you and you will then make your monthly payments to that lender rather than your previous loan servicer.

- Try to only submit a full application to one lender. Each lender will do a hard pull on your credit, and too many hard pulls can have a significant negative impact on your credit score.

-

6Arrange for automatic payments if possible. Lenders often offer incentives if you agree to automatic payments. You may qualify for a lower interest rate, for example, or a slightly lower monthly payment.[24]

- Remember only to sign up for automatic payments if you're confident the money will be in your account to cover the payment on the due date each month. If a payment is returned, you'll be on the hook for additional fees from the lender as well as bank fees. In addition, your payment will be recorded as late, which can hurt your credit.

Expert Q&A

Did you know you can get expert answers for this article?

Unlock expert answers by supporting wikiHow

-

QuestionHow can I pay off my debt if I don't have a lot of money?

Benjamin PackardBenjamin Packard is a Financial Advisor and Founder of Lula Financial based in Oakland, California. Benjamin does financial planning for people who hate financial planning. He helps his clients plan for retirement, pay down their debt and buy a house. He earned a BA in Legal Studies from the University of California, Santa Cruz in 2005 and a Master of Business Administration (MBA) from the California State University Northridge College of Business in 2010.

Benjamin PackardBenjamin Packard is a Financial Advisor and Founder of Lula Financial based in Oakland, California. Benjamin does financial planning for people who hate financial planning. He helps his clients plan for retirement, pay down their debt and buy a house. He earned a BA in Legal Studies from the University of California, Santa Cruz in 2005 and a Master of Business Administration (MBA) from the California State University Northridge College of Business in 2010.

Financial Advisor I say it's about slow, incremental change. Taking baby steps toward cutting your spending has a big impact. For example, continue ordering out, but maybe get the burger without fries. Another option is called refinancing. What that means is, when you owe someone money, they usually charge you interest. There's a lot of ways to refinance student debt. If you can lower your loan's interest rate by even a single percentage point, it can make a big impact.

I say it's about slow, incremental change. Taking baby steps toward cutting your spending has a big impact. For example, continue ordering out, but maybe get the burger without fries. Another option is called refinancing. What that means is, when you owe someone money, they usually charge you interest. There's a lot of ways to refinance student debt. If you can lower your loan's interest rate by even a single percentage point, it can make a big impact.

Warnings

- This article addresses paying off student loans in the US. If you've accrued student loan debt in another country, your options may be different. Consult your loan servicer or an independent financial advisor for more information.⧼thumbs_response⧽

- Avoid amassing other debt, particularly credit card debt, until you've taken a chunk out of your student loans. If you do use credit cards, don't charge more than you can pay back in full each month.⧼thumbs_response⧽

- No company is going to pay off your student loans for you. If you get offers over the phone or through email that sound too good to be true, they probably are.⧼thumbs_response⧽

- Whenever possible, limit your borrowing to federal loans and avoid private loans, which typically have higher interest rates and fewer options for paying them back if you run into difficulty.⧼thumbs_response⧽

References

- ↑ https://www.debt.org/students/how-to-pay-back-loans/

- ↑ https://studentloans.gov/myDirectLoan/counselingInstructions.action?counselingType=exit

- ↑ https://studentaid.ed.gov/sa/repay-loans/understand/exit-counseling

- ↑ https://studentaid.ed.gov/sa/repay-loans

- ↑ https://www.moneyunder30.com/student-loans

- ↑ https://www.debt.org/students/how-to-pay-back-loans/

- ↑ Benjamin Packard. Financial Advisor. Expert Interview. 11 March 2020.

- ↑ Trent Larsen, CFP®. Certified Financial Planner. Expert Interview. 22 July 2020.

- ↑ https://www.debt.org/advice/budget/

- ↑ Trent Larsen, CFP®. Certified Financial Planner. Expert Interview. 22 July 2020.

- ↑ https://studentaid.ed.gov/sa/repay-loans/understand/plans

- ↑ https://www.debt.org/students/how-to-pay-back-loans/

- ↑ https://studentaid.ed.gov/sa/repay-loans/understand/plans

- ↑ https://studentaid.ed.gov/sa/repay-loans/understand/plans

- ↑ https://studentaid.ed.gov/sa/repay-loans/understand/plans

- ↑ https://studentaid.ed.gov/sa/repay-loans

- ↑ https://studentaid.ed.gov/sa/repay-loans

- ↑ https://studentaid.ed.gov/sa/repay-loans

- ↑ Benjamin Packard. Financial Advisor. Expert Interview. 11 March 2020.

- ↑ https://www.nerdwallet.com/article/loans/student-loans/pay-off-student-loans-fast

- ↑ https://www.nerdwallet.com/article/loans/student-loans/pay-off-student-loans-fast

- ↑ https://www.nerdwallet.com/article/loans/student-loans/pay-off-student-loans-fast

- ↑ https://www.nerdwallet.com/refinancing-student-loans

- ↑ https://studentaid.ed.gov/sa/repay-loans

- ↑ https://www.nerdwallet.com/article/loans/student-loans/pay-off-student-loans-fast

- ↑ https://studentaid.ed.gov/sa/repay-loans

About This Article

To pay off your student loans, you’ll need to start by learning about your repayment options. If you can afford a standard repayment plan, choose that in order to reduce the overall amount you’ll have to pay. You can also opt for a graduated repayment plan if you think your salary will increase over time. Alternatively, look into an income-based repayment plan or apply for forbearance if you can’t afford to make large payments. To find out what kinds of repayment options are available to you, talk to your loan servicer. For more tips, including how to understand your debt and how to pay off loans as soon as possible, keep reading!