This article was co-authored by Carla Toebe. Carla Toebe is a licensed Real Estate Broker in Richland, Washington. She has been an active real estate broker since 2005, and founded the real estate agency CT Realty LLC in 2013. She graduated from Washington State University with a BA in Business Administration and Management Information Systems.

This article has been viewed 74,242 times.

Have you made an offer on a home only to have it rejected with the return of a counteroffer? This is a very common occurrence in the real estate market. The seller might counter with a higher price, might reject or modify some of your conditions, or both. If you feel the counteroffer is fair, you can accept it and proceed with the purchase of the property. If you do not agree with the terms of the counteroffer, you can reject the offer outright or reject the terms of the counteroffer with a new counteroffer of your own.

Steps

Rejecting a Counteroffer With a New Counteroffer

-

1Carefully consider the terms of the counteroffer. Decide if there are any terms that are deal breakers and if there are any terms you are willing to accept. Negotiating may be easier if you are able to agree to at least some of the terms proposed by the buyer.

- If you want to negotiate a lower purchase price, think about specific reasons you can offer to support your proposed price. If there are repairs or upgrades that need to be made to the house, mention these, along with an estimated cost, to help support your offer. If there are similar homes in the area that have sold for less recently, mention them.

-

2Think about the other terms of your offer. Keep in mind that price is not the only factor for many sellers. Try to find out as much as you can about the sellers so you will know what factors might motivate them to close the deal with you.[1]

- If the seller has rejected any of the terms of your offer, such as your proposed closing date, your request that certain items of personal property be included with the sale, or your request that the seller pay a portion of your closing costs, decide how important these conditions are to you and if there is any way to reach a middle ground with the seller.

- If the sellers are trying to purchase another house, offering to close quickly might be enticing. In some cases, you may even offer to close on the house quickly, and then give the sellers the opportunity to rent the property from you so they have more time to move.[2]

- If you can afford to pay cash, this will definitely be enticing to many sellers because they will not have to worry about your financing falling through.

- Some sellers might be motivated to sell to you if you make them feel like you will take great care of their house and will truly enjoy living there. Remember to be friendly throughout negotiations. Depending on who the sellers are, you might even want to tell them how much you love their house. [3]

Advertisement -

3Stick to your strategy. Ideally, you will have decided on your strategy upon first deciding to enter into negotiations for a specific house. Once you decide how much the house is worth to you and how much you can afford to pay for it, be firm.

- There are many different strategies for negotiating the purchase price of a house, including offering a lowball offer in the hopes of getting the lowest possible price, or offering a full-price offer to show the seller that you are serious about buying their home. Your strategy will depend on the market conditions and how badly you want a particular house.

- Try to make the sellers as comfortable as possible with your offer by having your financing lined up in advance, offering a reasonable amount of earnest money, and not asking for too many concessions.

- While there is no absolute rule for how much you should offer in your counteroffer, try to avoid insulting the sellers by offering too little. Try to show the sellers that you are interested in working with them by meeting them somewhere in the middle. Keep in mind that a fair price will always depend on market conditions.

- Buying a home can be very emotional. Try your best not make decisions based on emotions, as you may end up spending more than you are really comfortable with.[4]

-

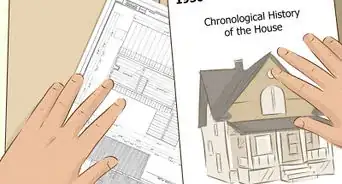

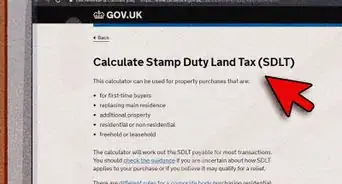

4Do your research. If you are not working with a Realtor, you can craft a counteroffer on your own, but you will need to be familiar with the laws in your state and understand exactly what information needs to be included in a counteroffer. You will also want to be very familiar with the real estate market in your area.

- This is a contract, so it is important to be thorough. Requirements vary by state, but in general, you will want to provide the amount you are offering, a list of contingencies, a list of items that will remain in the home, the amount of earnest money you will provide, and the method of payment. You should also include a deadline for the seller to respond to your offer.[5]

- Do your own Comparative Market Analysis (CMA) to help you decide how much you should offer for the house. This means analyzing homes that have recently sold in the immediate area and comparing them to the home you are interested in buying. A Realtor will have more access to up-to-date information on recent sales, but if you are buying a house on your own, you can do your own research. A home that is similar to yours will be a similar size, will have a similar number of rooms, will be in a similar kind of location, will be in a similar condition, and will be no more than one mile away from the property you are considering. The closing date of the comparables should be within 6 months but no later than 1 year from the time of your research.

-

5Craft your new counteroffer. This is a new offer that will void any previous offers. If you are working with a Realtor, he or she will take care of the paperwork. Make sure to provide input into the counteroffer and approve it before you sign the counteroffer.

- The terms of your counteroffer will generally depend on the terms the seller has already presented. If purchase price is the only issue, carefully consider how much you would be willing to spend on the home and how much you think the seller would be willing to accept.

- If you can't budge on price, try to be flexible with the other terms of your offer.

- Be prepared for more negotiating. Once you have submitted your offer, the sellers can choose to accept it, decline it, or submit yet another counteroffer. If you feel like you are running out of room to negotiate, you may want to submit a best and final offer, which tells the sellers that this is the last offer they will receive from you.

Declining the Counteroffer Outright

-

1Think about the counteroffer first. Ask yourself if the seller seems willing to negotiate and what it is that bothers you about the counteroffer. Common reactions can include simply being annoyed by the prolonged negotiations, being confused about the intentions of the seller, being surprised by the seller's high asking price, or being worried that you don't have the finances to pay the price the seller wants. Carefully weigh your concerns and decide if you would like to accept the offer, continue negotiating, or simply move on. If you reach the conclusion that the home is not worth pursuing, then it is time to decline the counteroffer.

- Think carefully about the terms of the counteroffer, especially if the seller has rejected a contingency such as a home inspection, as this might be a red flag that there is a problem with the property that the seller does not want you to know about.

- Consider the market, the availability and price of similar homes, and whether or not this particular home has unique characteristics that make it particularly valuable to you.[6] You should only decline the counteroffer outright if you are 100% prepared to leave this home behind.

- If there are multiple offers on the home, do some research or talk to your Realtor to find out if this is common in your market. If it is, then you may have no choice but to prepare yourself for drawn out negotiations if you decide to go through with buying a house.[7]

-

2Decide if you want to walk away or leave negotiations open. The counteroffer renders your prior offer void, so you are usually under no further obligations to proceed, but if you still want to negotiate, you can do so. Your response needs to make it clear whether your declining is final, or if you are still willing to proceed with negotiations based on the terms of your previous offer.

- Be polite. When crafting your response, tell the seller that you appreciate their time and consideration of your offer. Explain that you appreciated the opportunity to view the property and learn about it. Even if you think it is unlikely that the seller will want to resume negotiations with you after you decline the counteroffer, it is important to be polite just in case. You often do not have to respond to a counteroffer if you want to reject it, so check with your Realtor about your state's laws.

-

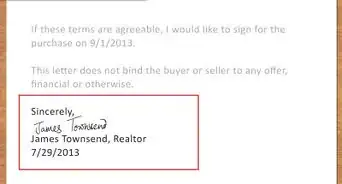

3Respond in writing. If you are working with a Realtor, he or she can take care of this for you. If you are not working with a Realtor, you can write your decision to decline the counteroffer by way of a letter, including your address, name and signature. Be sure to check state laws to understand exactly what information must be included in this letter.[8]

- You don't need to add a specific reason for declining the counteroffer unless you want to. If you wish to explain your reasoning, you can explain that the counteroffer is beyond your budget, that you have another property in mind which is more attractively priced, etc. Providing the exact reasons may make you seem more vulnerable, but it can be handy if you suspect that adding reasons might prompt a change of mind for the seller.

- End the letter with another expression of gratitude for their time and consideration. Wish them the best of luck in selling the property soon if you're closing down negotiations, or simply express a hope that you can keep things moving if you wish to keep negotiating.

-

4Keep searching. Looking for the house of your dreams can be frustrating, but try not to dwell on negotiations that didn't work out. Sooner or later you will find a home that is perfect for you, so don't give up!

References

- ↑ http://www.hgtv.com/design/real-estate/how-to-make-an-offer-for-a-house

- ↑ http://www.hgtv.com/design/real-estate/how-to-make-an-offer-for-a-house

- ↑ http://www.realtor.com/advice/top-10-tips-how-to-write-a-home-buyers-offer-letter-to-a-seller/

- ↑ http://www.credit.com/loans/mortgage-questions/how-to-negotiate-best-price-when-buying-home-purchase-offers/

- ↑ http://www.credit.com/loans/mortgage-questions/how-to-negotiate-best-price-when-buying-home-purchase-offers/

- ↑ http://realestate.findlaw.com/buying-a-home/making-an-offer-on-a-house.html

- ↑ http://www.realtor.org/policy/professional-standards-and-code-of-ethics/a-buyers-and-sellers-guide-to-multiple-offer-negotiations

- ↑ https://www.realtor.com/advice/buy/the-basics-of-making-an-offer-on-a-house/